Why AI and China are Driving Copper Demand

Copper prices have surged recently, driven by a mix of inflationary pressures and disruptions in supply and demand.

While these traditional factors are significant, it's the evolving thematic trends in copper demand that could be setting the stage for long-term growth. Key catalysts include China's dynamic economic policies and the increasing use of copper in AI data centers.

Navigating Recent Market Dynamics

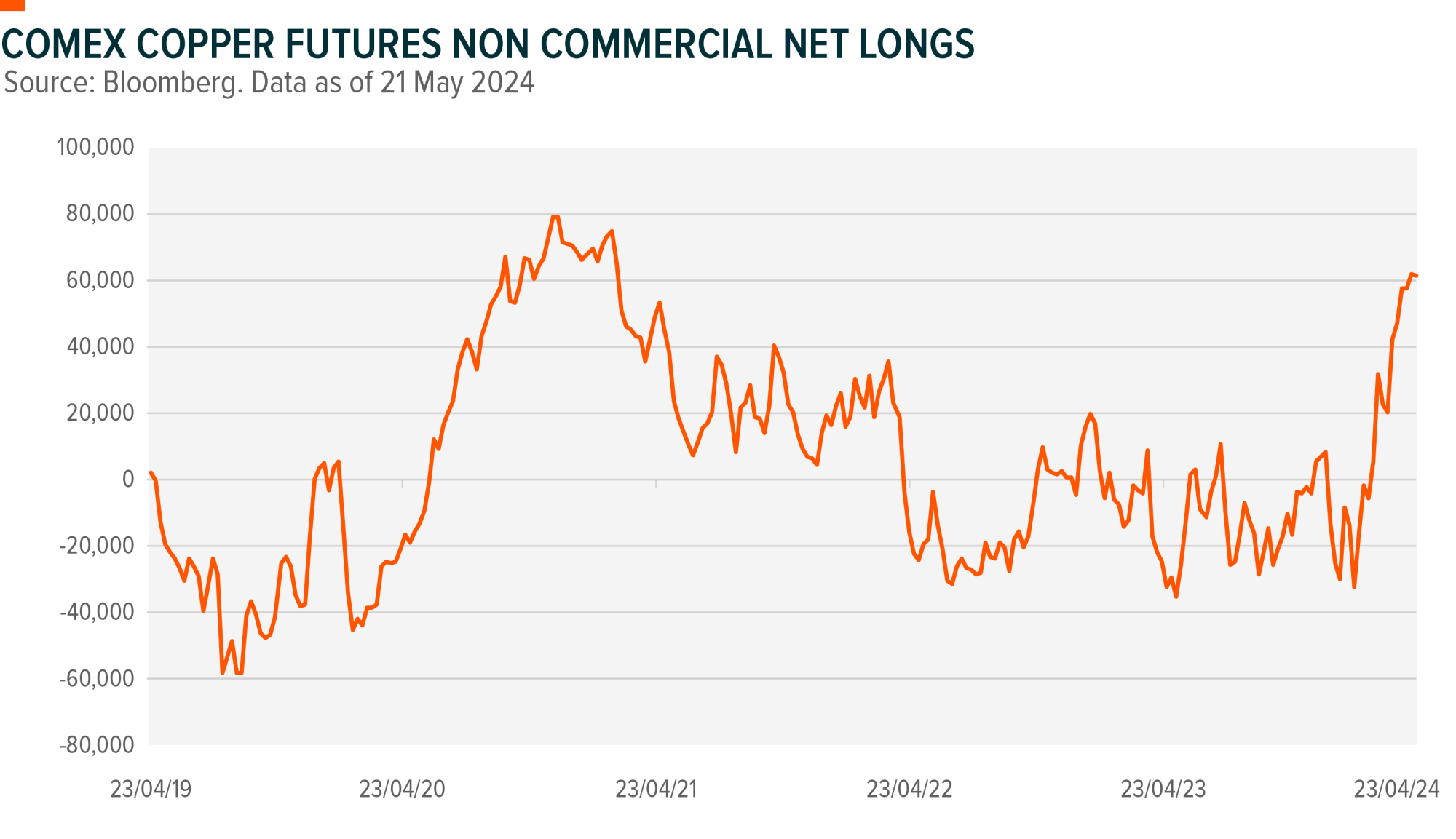

Copper prices have surged by 27% year-to-date, driven by strong demand and significant supply constraints. Institutional investors' bullish stance on copper futures underscores market confidence in sustained price growth. 1 However, major miners like Rio Tinto, First Quantum, and Anglo American are dealing with production downgrades due to underinvestment and declining ore grades. 2 Meanwhile, Chinese smelter closures, caused by collapsing margins, are tightening the supply outlook further, given China's pivotal role in global copper smelting. 3

A New Era for Copper in AI and Technology

Copper’s role in AI data centers is expanding rapidly. As the AI revolution unfolds, copper is becoming both a crucial component and a potential bottleneck. AI data centers need around 65,000 tons of copper for each gigawatt (GW) of applied power. 4 With the U.S. alone forecasted to add 18 GW of capacity by the decade’s end, the demand for copper in these infrastructures is substantial. 5

Advancements in AI and increased global investment in data infrastructure are expected to sustain and accelerate copper demand. As AI technologies evolve to be more efficient and cost-effective, the adoption of copper-intensive infrastructures will only grow, driving higher consumption.

China’s Strategic Moves

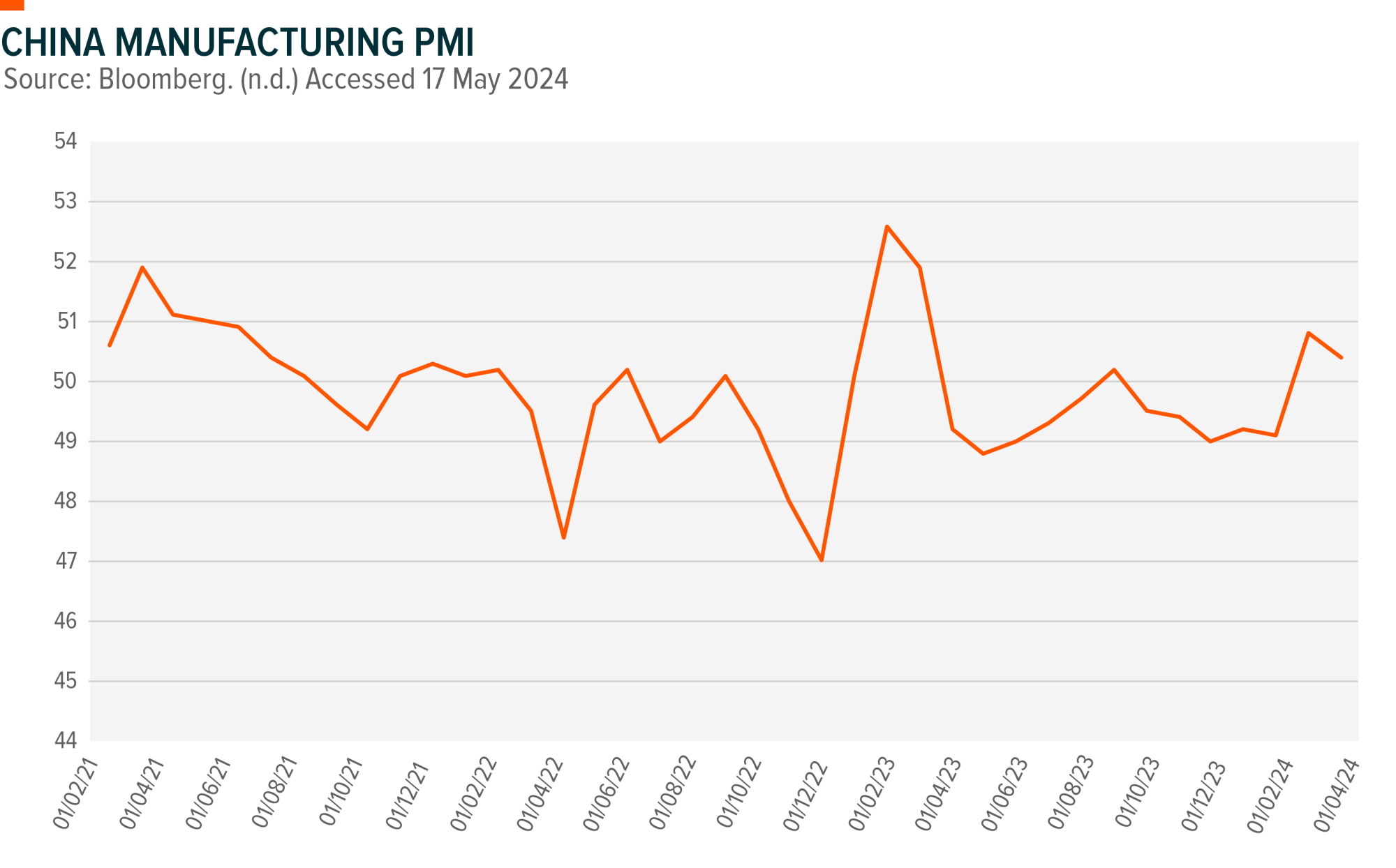

China, the world’s largest consumer of copper, significantly influences global copper demand through its economic activities and policies. China accounts for more than half of the total global demand and its economic development has tripled its copper demand in the last decade. 6 Recent improvements in China’s manufacturing PMIs and infrastructure projects are boosting copper consumption. China’s Belt and Road Initiative continues to drive large-scale infrastructure investments that require substantial copper usage. 7

On May 17, the PBOC announced new property easing measures: RMB300bn for social housing, lower downpayment requirements, removal of the national mortgage floor, and reduced loan rates for housing provident funds. 8 These measures are expected to stimulate the property market, leading to increased construction activities and, consequently, higher copper demand for electrical wiring, plumbing, and other construction-related uses.

Copper Miners: A Strategic Play

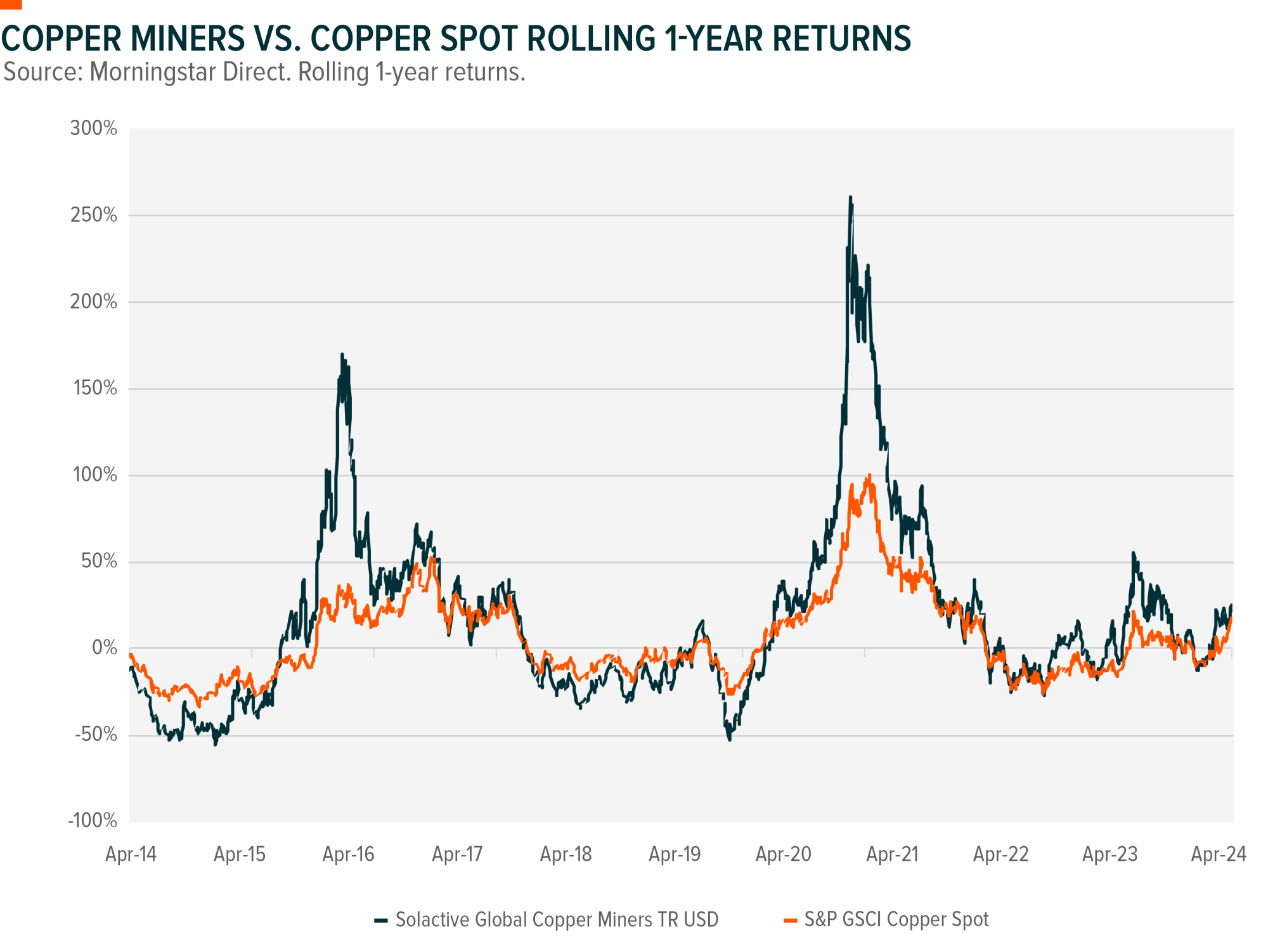

Investing in copper miners has historically been seen as a leveraged play on copper prices. Copper miners often outperform bullion in bullish markets due to their ability to use operating leverage to increase profits. Unlike direct investments in copper, miners can expand production as profit margins grow, providing a potentially higher return on investment during periods of rising copper prices (refer to graph below). 9

Embracing the Future: Thematic Investments in Copper

Copper’s future looks bright, driven by technological advancements and strategic economic policies, particularly in China. As we navigate through this dynamic market, investing in copper and copper miners presents a compelling opportunity to leverage the growing demand for this essential metal.

Explore the Global X Copper Miners ETF (ASX: WIRE)

1 Bloomberg data (n.d.) Data accurate as of 21 May 2024

2 Morgan Stanley Research. Data as of April 2024

3 Mining.com

4 MIT Institute as of 26 March 2024

5 https://www.datacenterdynamics.com/en/news/us-data-center-power-consumption/

6 Global X ETFs with information derived from Bloomberg LP. Data as of January 2024

7 International Copper

8 https://edition.cnn.com/2024/05/17/economy/china-rescue-measures-housing-market-intl-hnk/index.html

9 Source: Global X ETFs with information derived from Morningstar Direct. Data from 4/30/2014 to 4/30/2024. Asset Classes are represented by the following indexes: Copper Miners, Solactive Global Copper Miners Total Return Index; Copper Spot, S&P GSCI Copper Index. Returns and correlations are calculated using 1 year rolling returns with a 1 day moving step.

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits, and are shown without any other adjustment in relation to any tax deduction available to Global X. Forecasts are not guaranteed and undue reliance should not be placed on them. This information is based on views held by Global X as at 17/5/2024.

Diversification does not ensure a profit nor guarantee against a loss. Brokerage commissions will reduce returns. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Global X is a leading ETF provider, offering a wide range of thematic, commodities, income, core, and digital asset solu...

Recommended for you

Amid growing economic, political, and market uncertainty, credit is proving a hot topic with investors. The smart money ...

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.

The recent US election has had strong reverberations across equity markets internationally and in Australia. Here, Tynda...

The growing use of drones is transforming warfare