The Nuclear Renaissance Is More Than a Uranium Trade

After taking a healthy breather over Q3 2024, the nuclear theme is rising once again as a top performer.

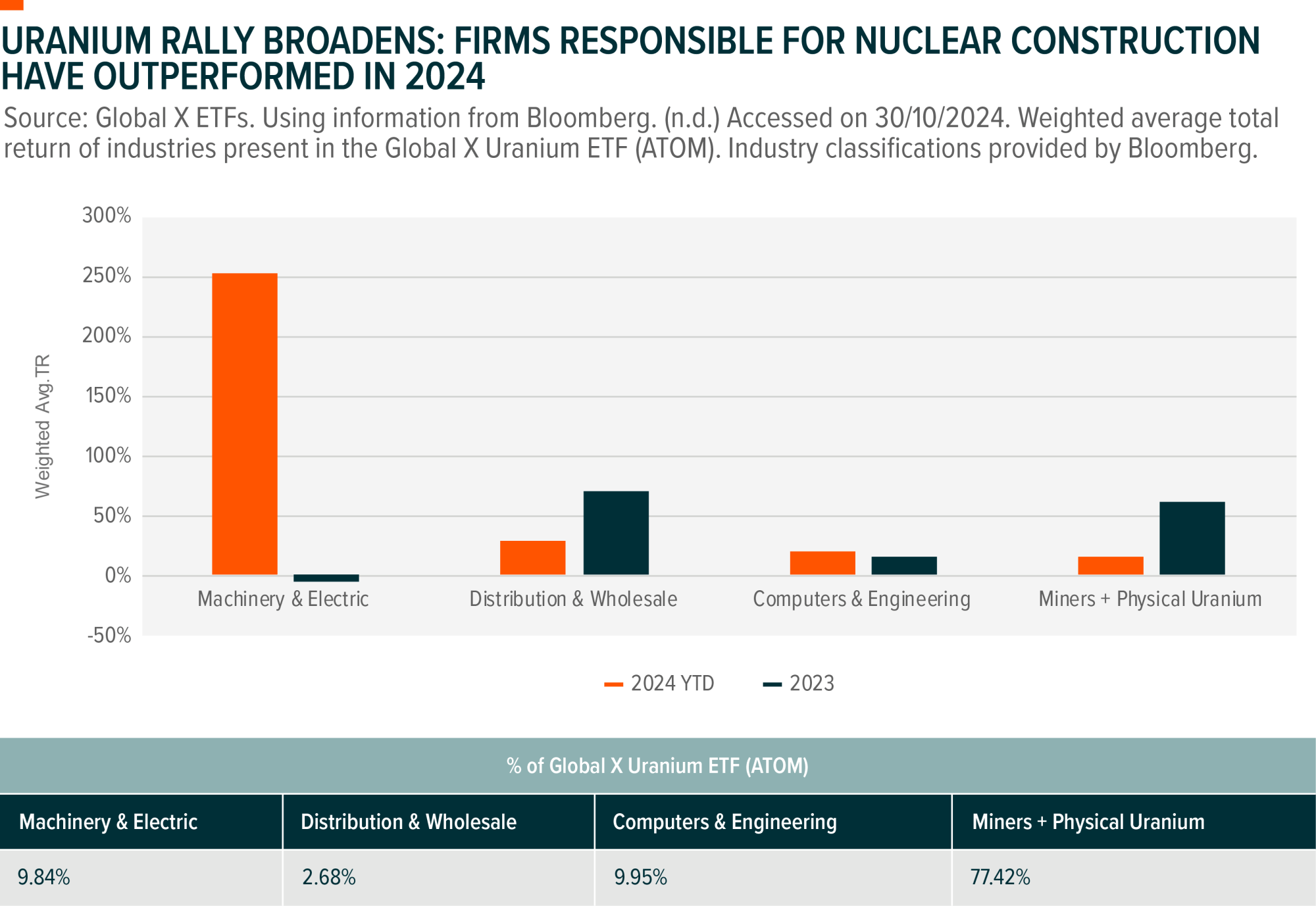

This quarter, we continue to see an influx of news which highlight the progress of nuclear adoption and signal a continued shift in global sentiment. However, with recent developments putting the spotlight on nuclear engineering and machinery firms, a new stage of the uranium thematic has been unlocked. Investor enthusiasm is no longer centred on physical uranium alone, as AI power demands and policy support for new technologies broaden the beneficiaries of our current nuclear renaissance.

Key Takeaways

- Alphabet Inc.’s (Google’s parent company) recent investment in Small Modular Reactors (SMR) completes the pattern of nuclear adoption among the cloud hyperscaler “holy trinity” and puts the spotlight on new-gen nuclear technology.

- Government policy support is driving adoption across both the West and the East, with each side prioritising the buildout of domestic supply chains – highlighting companies related to nuclear construction and the nuclear fuel cycle.

- We believe having exposure to the full uranium value chain, including nuclear engineering, machinery, and construction firms, is critical to fully capturing the uranium thematic opportunity.

Big Tech Dreams of Small Reactors

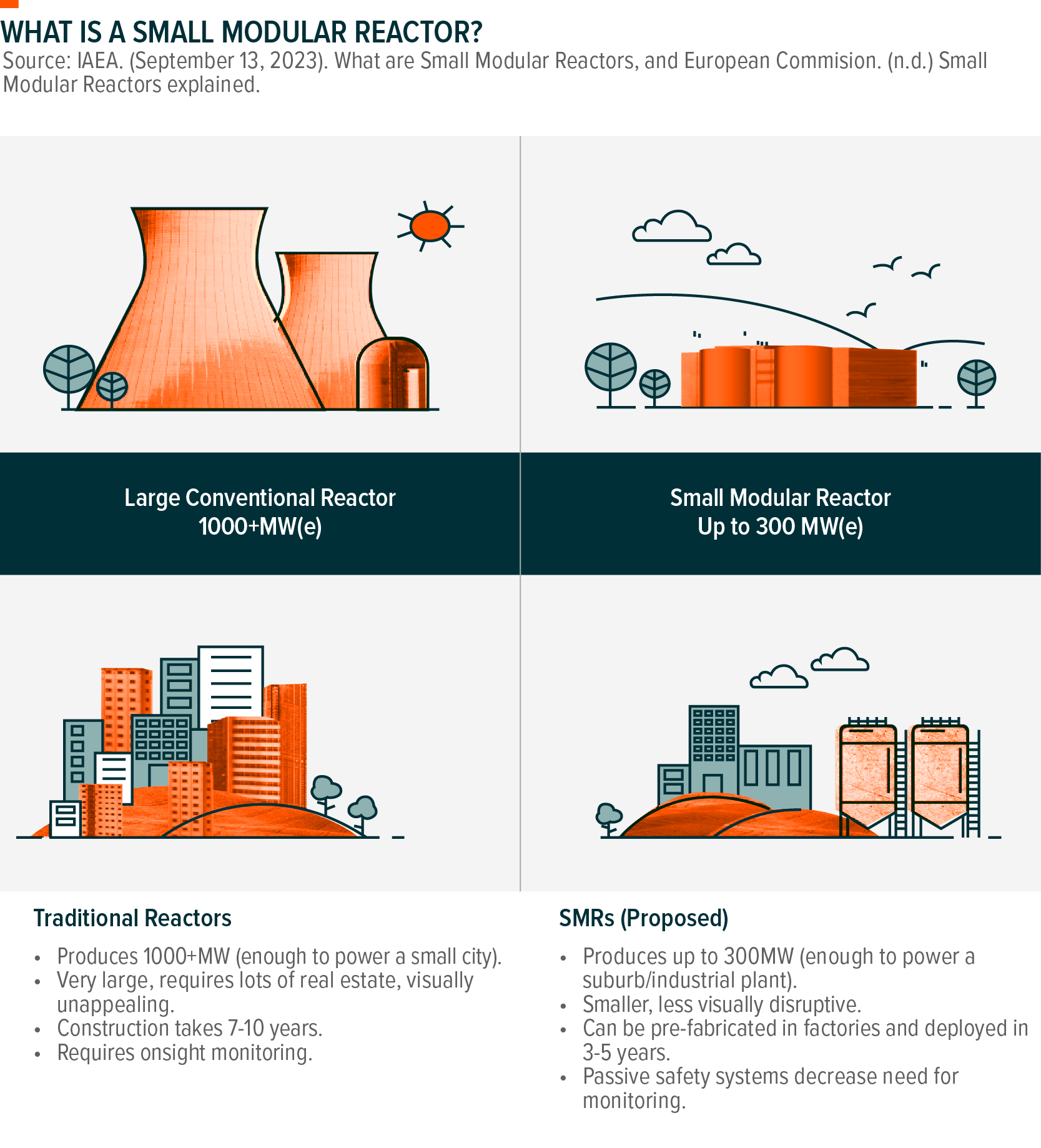

On the 14th of October 2024, Google parent company Alphabet Inc. announced the world's first corporate agreement to buy power from a SMR provider.1 SMRs are a developing technology that promise to be smaller versions of traditional nuclear power. While SMRs are not yet a reality in the West (Russia and China claim to have already constructed functioning SMRs), engineering firms expect them to be safer, quicker to build, and take up much less real estate compared to their predecessors. Kairos Energy, the company contracted to build Google’s SMRs, intends to bring its first functional reactor online by 2030, followed by additional reactor deployments through 2035.2

Why invest in SMRs? With their safety, ease of construction and clean energy, SMRs make perfect partners for datacentres which have massive power demands and require near permanent up-time. Indeed, Google intends to use Kairos’ new SMRs to fuel the build out of a fleet of AI datacentres over the next decade.

Google’s new agreement with Kairos is just the most recent in a series of deals that big tech firms have inked with nuclear power providers in 2024. Earlier this year, Amazon purchased a nuclear-powered datacentre from clean energy provider Talen Energy for US$650 million.3 Since then, Amazon has only doubled down, investing upwards of US$500 million across three corporate agreements (Energy Northwest, X-Energy, and Dominion Energy) to support the development of SMRs.4 Microsoft, not one to be left behind, also recently signed a power deal with Constellation Energy to resurrect a nuclear unit on Three Mile Island in Pennsylvania, which has particular significance due to it being the site of the worst US nuclear accident in 1979.5

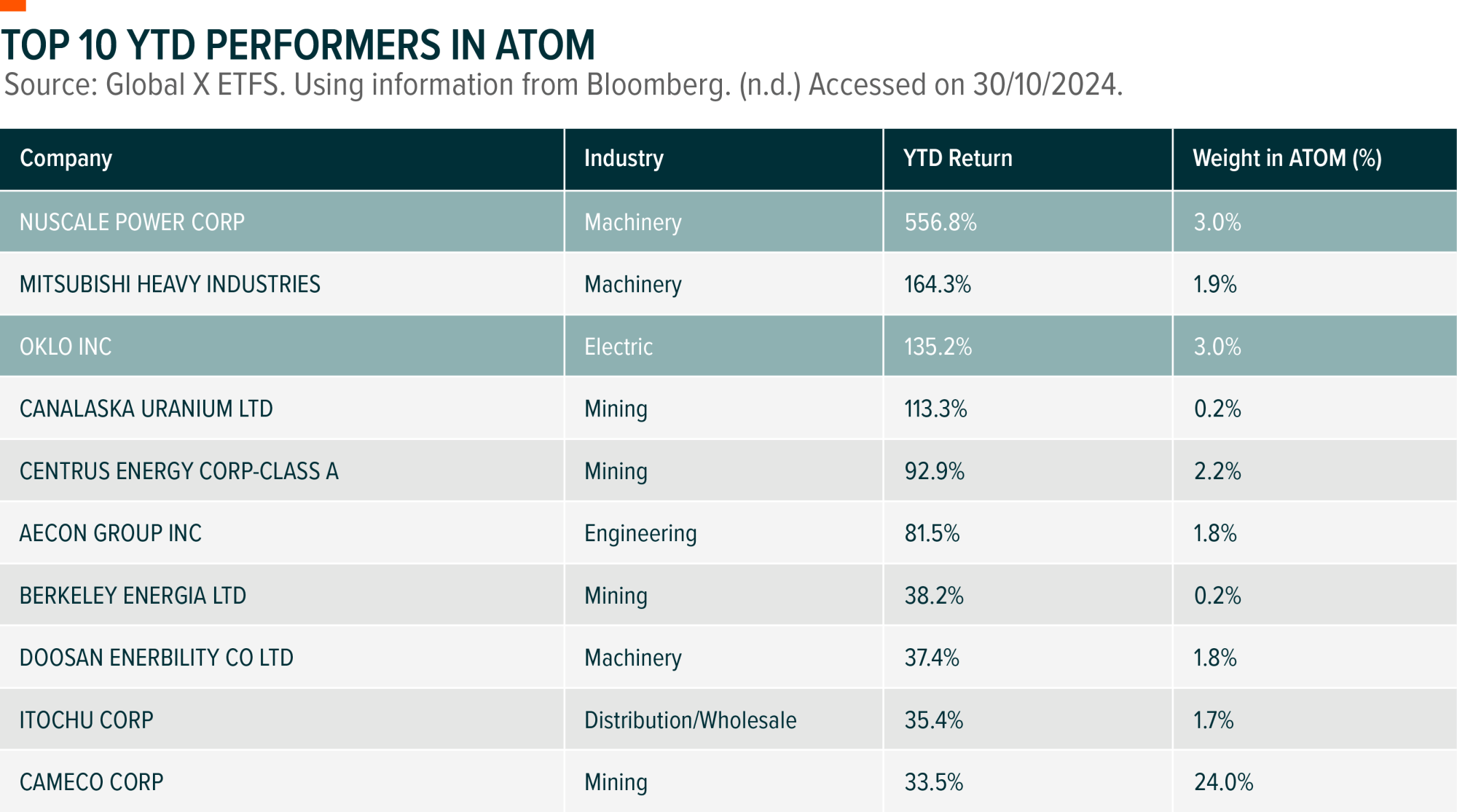

Microsoft, Amazon and Google provide two-thirds of global cloud infrastructure, and with Google’s latest announcement, all three of the hyperscaler holy trinity are now aligned on nuclear power as a source of low-carbon energy.6 Their enthusiasm toward SMRs has also rubbed off on investors, helping listed SMR developers such as Nuscale Power and Oklo Inc dramatically outperform relative to both uranium miners and the rest of the market.

Governments Turn Around on Uranium

Governments across the globe have done an about-face on nuclear energy over the past two years. Many countries now reference nuclear power as an unnegotiable facilitator in the transition toward a truly carbon-zero energy mix. This October, for example, the European Nuclear Alliance, which includes countries such as France, Finland, Netherlands and Sweden, urged the European Commission to recognise the contributions of nuclear power in Europe’s progress toward decarbonisation.

However, given the current geopolitical climate, governments pushing for nuclear power have shied away from global supply chains, and have instead looked inward for the procurement of uranium fuel and build out of nuclear reactors. While this emergent theme is a negative for nuclear’s overall speed of adoption, it provides opportunities for investors as a wider range of participants find themselves benefited by government policy:

- Earlier this year the US Department of Energy requested proposals from US firms in a bid to purchase up to US$2.7 billion of uranium fuel from domestic sources.7 This October, the US DoE awarded its first contracts, to a group of US uranium refiners to produce high-assay low-enriched uranium (HALEU).8 American Centrifuge Operating, a subsidiary of Centrus Energy, was one of six companies selected for the contracts and rallied 56% on the week of announcement.

- In Japan, where the stance on nuclear has softened significantly, companies such as Mitsubishi Heavy Industries (MHI) have been key beneficiaries. As Japan considers maintaining and building new nuclear power plants, MHI is the likely contractor. MHI is an engineering company with unmatched expertise in the construction of nuclear reactors. As of 2023 the company had a 46% market share on large-scale nuclear turbine generators and its stock has rallied more than 150% this YTD on the Tokyo exchange.9,10

The Uranium Trade Broadens

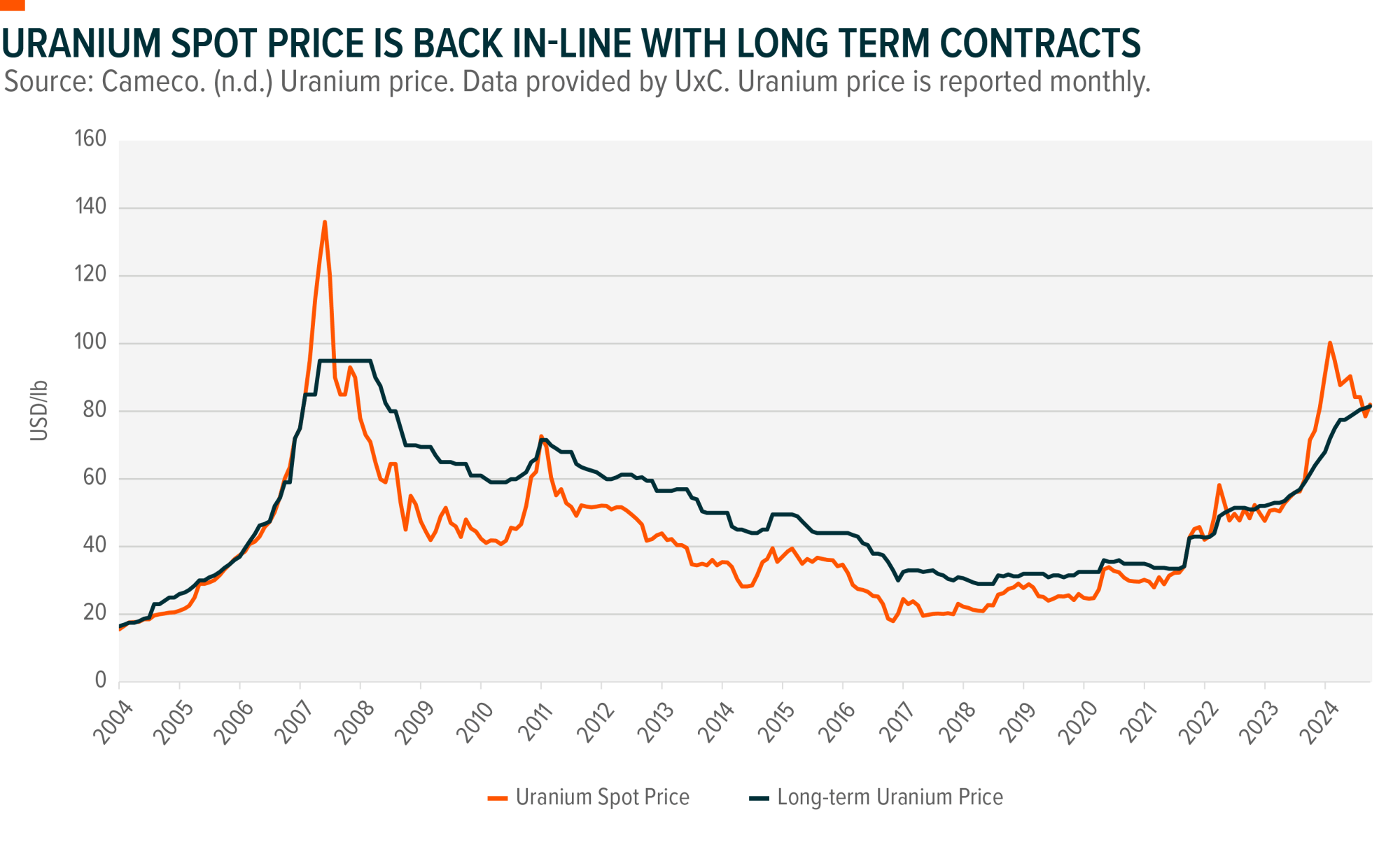

As of the end of September, spot uranium prices have come back in-line with long-term uranium contracts. As such we view the current market pricing as a reasonable and potentially attractive entry-point for investors with conviction in the proliferation nuclear power.

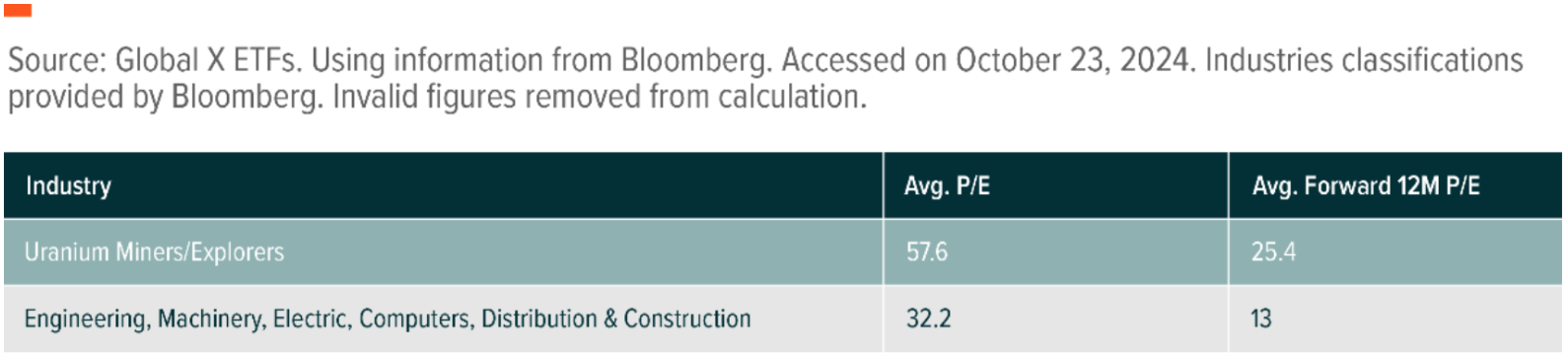

However, physical uranium or uranium miners (which reflect physical prices), are not the only game in town. Evidently, exposure across the value chain – to nuclear engineering, construction, and industrial firms – is critical for investors who wish to capture the full momentum of the uranium thematic. Quantitatively, industrial and engineering firms are currently priced more attractively than uranium miners, despite being more likely to continue benefiting from policy tailwinds.

Explore access to a wide range of firms across the uranium value chain including miners, physical uranium, engineering, construction, and SMR designers with the Global X Uranium ETF (ASX: ATOM).

Footnotes

1. Google. (October 14, 2024). New nuclear clean energy agreement with Kairos Power.

2. Ibid.

3. Datacentre Dynamics. (March 4, 2024). AWS acquires Talen’s nuclear data center campus in Pennsylvania.

4. CNBC. (October 16, 2024). Amazon goes nuclear, to invest more than $500 million to develop small modular reactors.

5. Reuters. (September 25, 2024). Microsoft may pay Constellation premium in Three Mile Island power agreement, Jefferies says (Sept 23).

6. Visual Capitalist. (March 22, 2024). The World’s Biggest Cloud Computing Service Providers.

7. Reuters. (October 18, 2024). US awards contracts for making higher enriched uranium for new reactors.

8. Ibid.

9. Bloomberg. (June 24, 2024). Mitsubishi Heavy Moving Closer to Building New Reactor in Japan.

10. Bloomberg. (n.d.) Accessed on 29/10/2024.

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.

Global X is a leading ETF provider, offering a wide range of thematic, commodities, income, core, and digital asset solu...

Recommended for you

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.

The recent US election has had strong reverberations across equity markets internationally and in Australia. Here, Tynda...

The growing use of drones is transforming warfare

Innovation isn’t just a buzzword; it’s the lifeblood of growth, competitiveness, and sustainability across industries.