Uncovering the Broader Landscape of Innovation

Innovation isn’t just a buzzword; it’s the lifeblood of growth, competitiveness, and sustainability across industries.

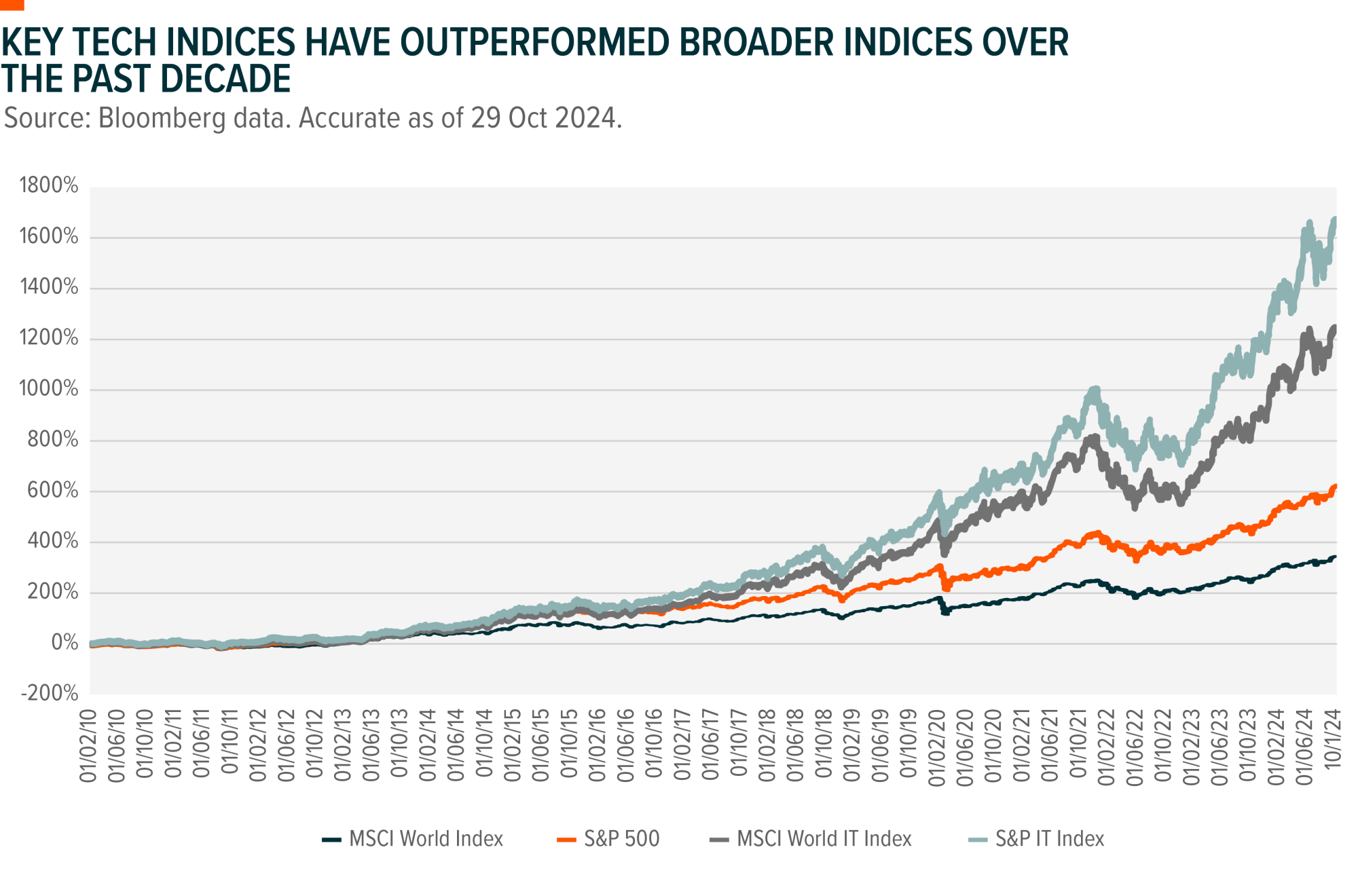

Companies that consistently push boundaries - those that innovate rather than merely adapt are the ones most likely to thrive, transforming technological advances into real-world progress. This drive has been central to the sustained outperformance of technology (“tech”) indices, such as the MSCI World Information Technology Index and S&P 500 Information Technology Sector Index, which have exceeded broader market benchmarks over the past decade1. In an era where disruption is constant, companies at the forefront of innovation often find themselves leading the charge, no matter their sector or exchange.

Key Takeaways

- The Nasdaq remains a vital hub for tech innovation, yet many pioneering companies have also emerged on other exchanges. In the US, around 40% of tech stocks by number and 20% by market weight are primarily listed outside of Nasdaq2, reflecting the diverse landscape where innovation flourishes.

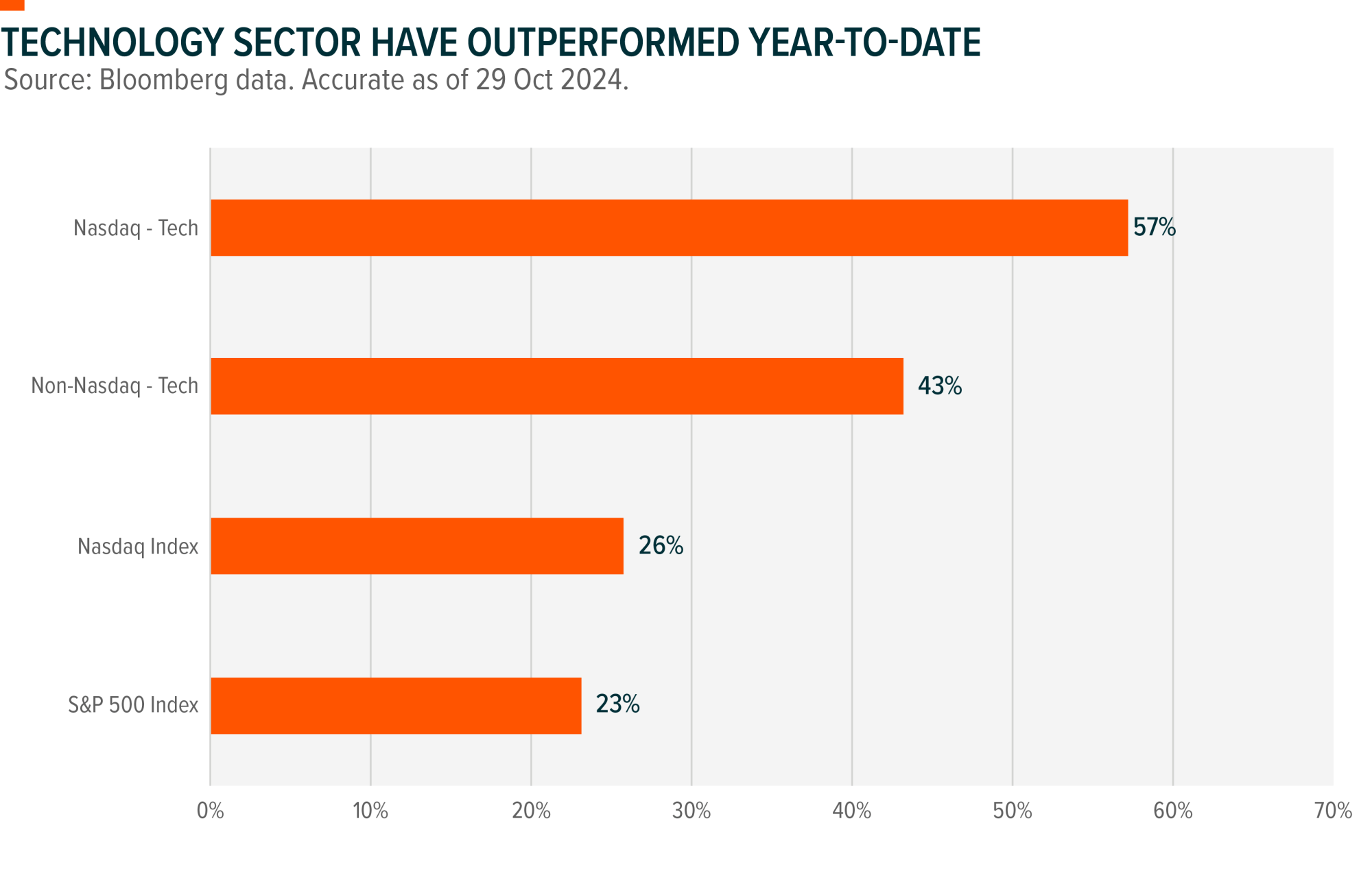

- Year to date, Nasdaq-listed tech stocks posted a 57% total return, while non-Nasdaq tech names followed closely with 43%3, underscoring that significant growth opportunities also exist outside Nasdaq.

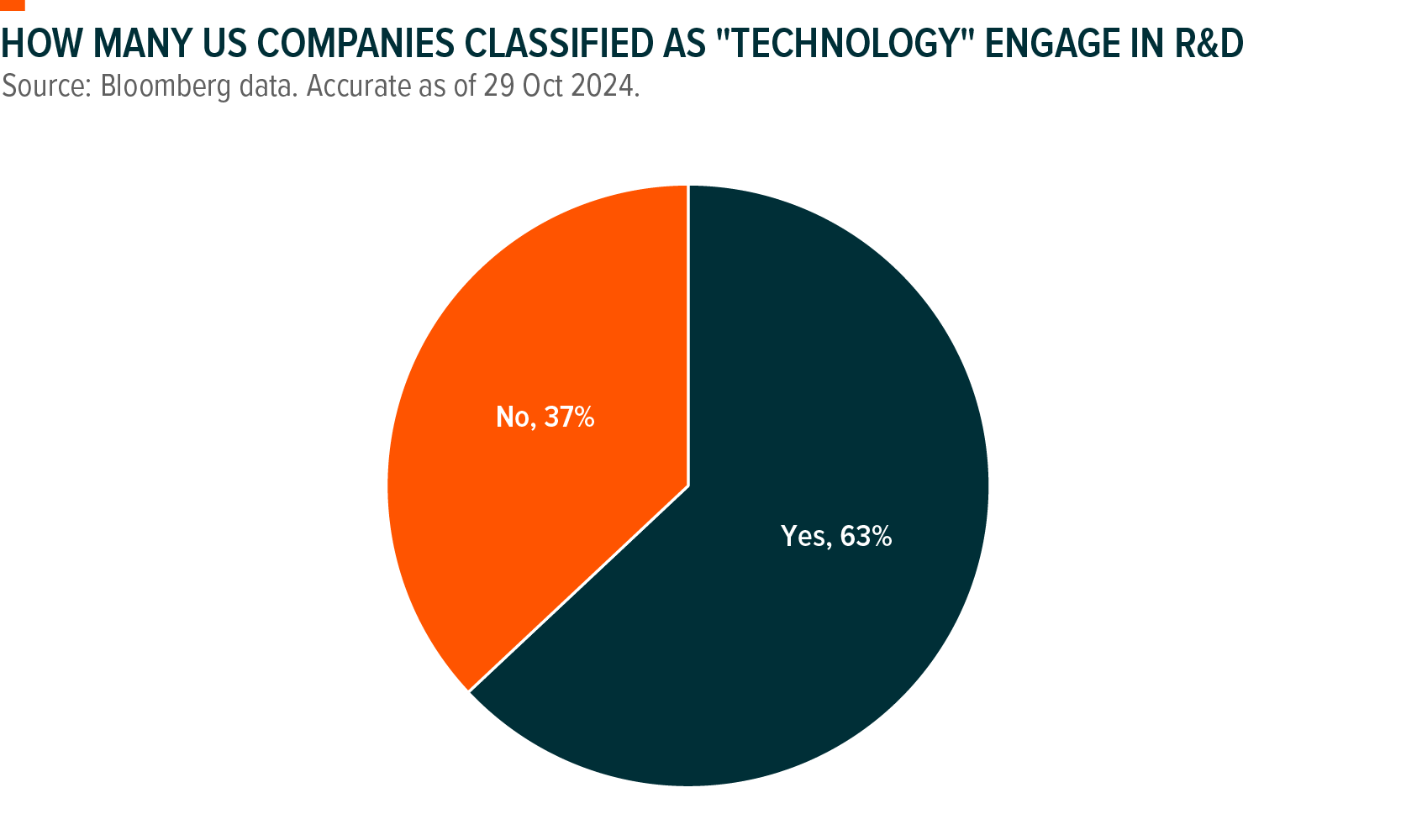

- Companies across multiple sectors are adopting tech solutions, yet only 63% of those classified under traditional technology classifications report dedicated R&D spending.4 This highlights the importance of looking beyond labels to find companies genuinely committed to transformative growth.

A Broader View on Innovation

The Nasdaq has long been viewed as a foundational home for technology and innovation, with listing requirements from market capitalisation to governance adding a layer of prestige. Yet, not all industry leaders are listed there. Legacy players like IBM and Oracle, as well as newer tech giants like Salesforce and ServiceNow, have established themselves on exchanges outside Nasdaq, reflecting their unique business paths and longstanding exchange commitments. This mix of longstanding and emerging leaders demonstrates that innovation is not bound to one exchange but is inherently diverse and widely distributed.

Recent performance data supports this perspective. While Nasdaq-listed tech companies achieved a 57% return over the past year, non-Nasdaq tech names delivered 43% return, indicating that compelling growth stories are unfolding across different platforms. Approximately 40% of US tech companies, representing 20% of the tech sector’s market weight5, are listed outside the Nasdaq, revealing the breadth of groundbreaking ideas across multiple venues.

Innovation Beyond Traditional Tech Labels

Innovation has also moved beyond traditional tech companies. Sectors such as healthcare, energy, and consumer goods are adopting and developing new technologies, from AI-driven health diagnostics to renewable energy solutions. The line between tech and non-tech continues to blur as companies across various industries embrace transformative change.

Historical data reveals how the sectors that make up the top 20 companies in the S&P 500 have shifted dramatically over the last two decades, illustrating how technology’s influence has permeated previously “non-tech” fields. For investors, recognising these sector shifts is crucial. It’s no longer enough to rely solely on tech labels; it’s essential to seek out companies truly driving change, regardless of classification.

Yet, even as innovation spreads, it’s essential to distinguish those truly committed to technological advancement. Only around 63% of companies classified as tech by traditional metrics report a dedicated R&D budget. The remaining companies may carry the tech label, but their contributions to technological progress remain unclear. For investors, this makes it increasingly important to look beyond labels and focus on firms actively investing in future growth.

Case Studies: Motorola Solutions and Thomson Reuters

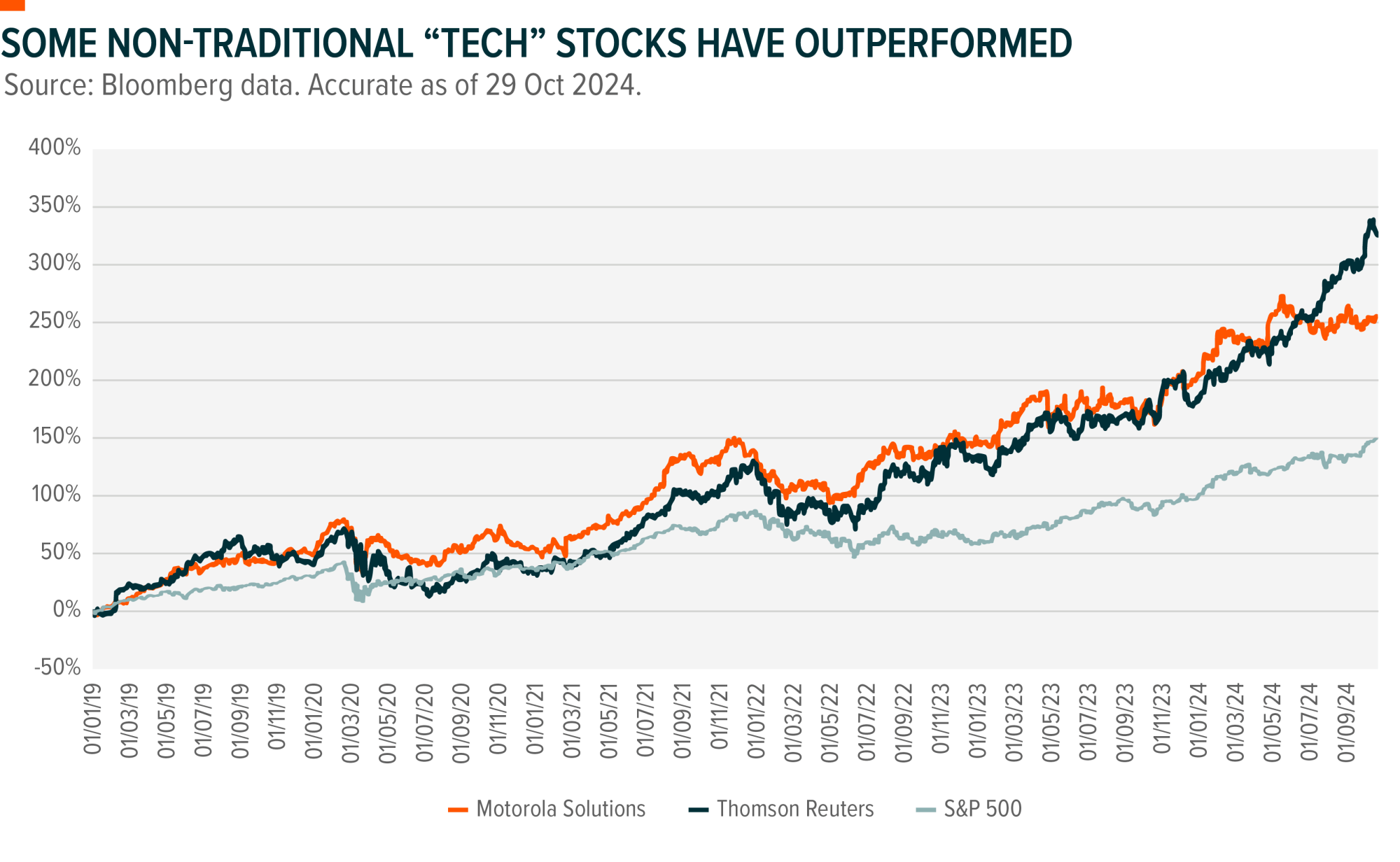

Two key innovators listed outside Nasdaq, Motorola Solutions and Thomson Reuters, demonstrate how transformative technology is driving growth beyond traditional “tech” labels:

Motorola Solutions: Evolving from its telecommunications roots, Motorola Solutions now focuses on advanced public safety technology. It leverages AI for video analytics, cybersecurity, and real-time emergency communication, supporting critical response teams with situational awareness and secure data solutions.

Thomson Reuters: Renowned in legal and financial information services, Thomson Reuters integrates AI and data analytics to enhance workflows for professionals in law, finance, and tax. With tools like CoCounsel Core and Practical Law AI, it streamlines research, document drafting, and compliance, setting a new standard in professional services.

These examples show that innovation flourishes across diverse industries, encouraging investors to look beyond typical tech sectors and Nasdaq listings to identify true pioneers in transformative technology.

Implications for Investors

In today’s globalised market, innovation is everywhere, spanning across regions and industries. While Nasdaq remains a vital hub, compelling opportunities extend well beyond it. By seeking out companies truly committed to innovation regardless of whether they carry the “tech” label investors can position themselves for growth that reflects the dynamic nature of innovation. The Global X US 100 ETF (ASX: U100) aligns with this approach, offering investors a gateway to a broad selection of transformative companies. This accelerating pace of progress proves that impactful ideas can thrive across markets, making it essential to recognise that the next wave of innovation may come from any corner of the market.

Footnotes

1. Bloomberg data. Accurate as of 28 October 2024. Based on MSCI World Information Technology Index vs. MSCI World Index and S&P 500 Information Technology Sector GICS Level 1 Index vs. S&P 500 Index.

2. Bloomberg data. Accurate as of 28 October 2024. Based on Bloomberg sector classification of “technology” industry and the 3 key Nasdaq Exchanges; Nasdaq Global Select Market, Nasdaq Global Market, and Nasdaq Capital Market.

3. Bloomberg data. Accurate as of 28 October 2024. Based on 3 key Nasdaq Exchanges and Bloomberg sector classification. Performance assumes total return in US dollars.

4. Global X ETFs. Based on Bloomberg data accurate as of 28 October 2024. Selection filtered by companies with positive research and development expense in the most recent financial year.

5. Global X ETFs. Based on Bloomberg data accurate as of 28 October 2024.

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.

Global X is a leading ETF provider, offering a wide range of thematic, commodities, income, core, and digital asset solu...

Recommended for you

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.

The recent US election has had strong reverberations across equity markets internationally and in Australia. Here, Tynda...

The growing use of drones is transforming warfare

As bank issuance shrinks, corporate hybrids are in the ascendent, with non-financial corporate hybrids potentially instrumental in powering Australia’s energy transition. So what do they offer the fixed income investor?