A New Chapter in Defence – Focus on Protection, Not Aggression

Modern defence planning has shifted towards safeguarding nations through a combination of technology-driven innovations and essential defence infrastructure.

As the global landscape evolves, defence strategies today focus on precision, surveillance, and reducing human risk, making it a forward-looking sector for investment.

Key Takeaways:

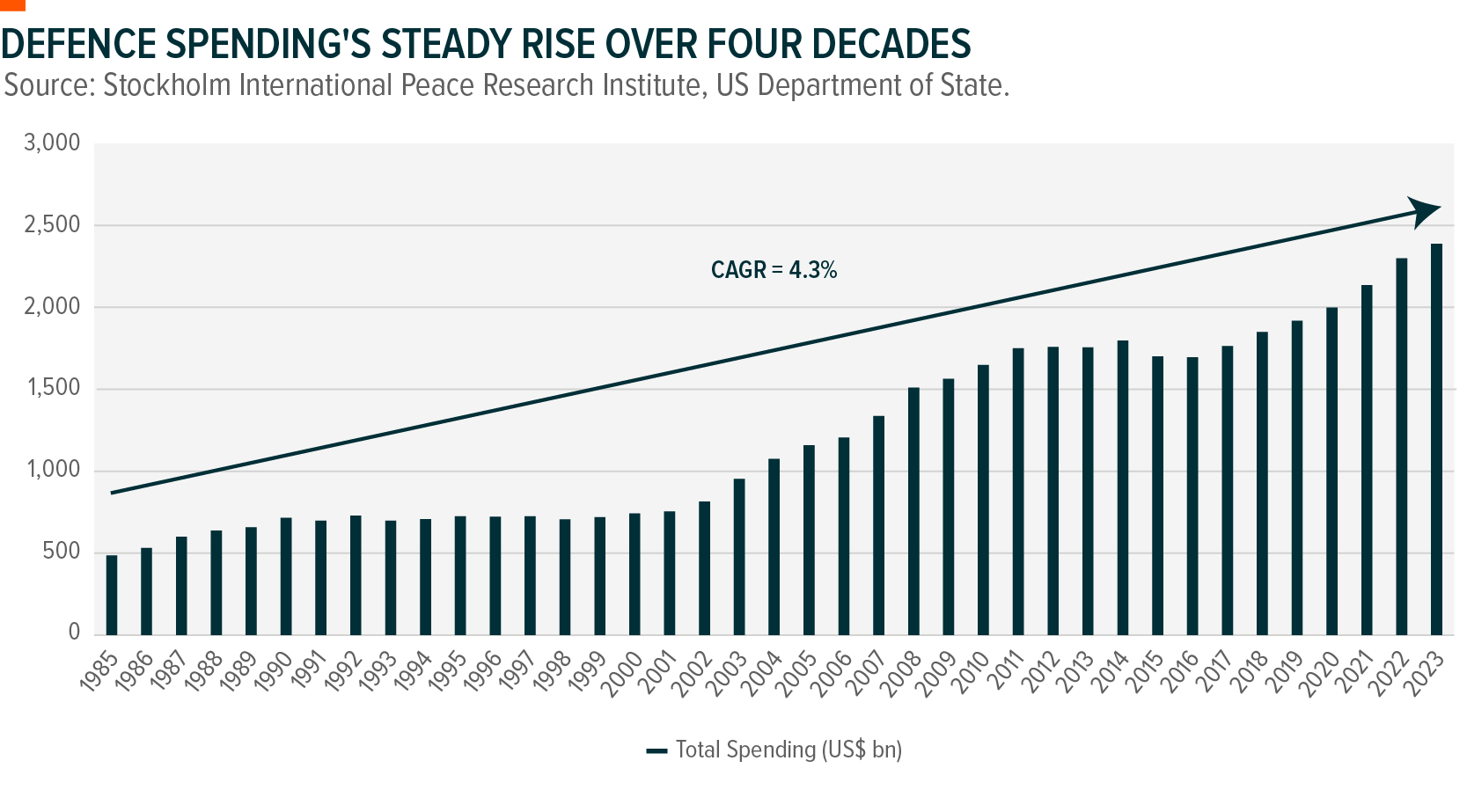

- Historically Consistent Growth: Global defence spending has grown at an annualised rate of 4.3% over the past 40 years, underscoring the essential need for national security and growing role of defence in economies worldwide.

- Rising National Security Focus: Increasing global tensions are driving nations to boost defence spending, reflecting heightened national security concerns and a competitive push to maintain strategic advantage.

- Focus on Tech-Driven Defence: The Global X Defence Tech ETF (ASX: DTEC) includes companies with a revenue filter ensuring exposure to AI, drones, and cybersecurity, capturing the future of innovation in defence.

Evolving Defence: A Shift to Protection and Innovation

The narrative of global defence has changed. Gone are the days when defence was solely about large-scale conflicts and aggression. In the 21st century, defence has become synonymous with protection, intelligence, and innovation. Over the past 40 years, global defence spending has grown at a steady annualised rate of 4.3%, showing resilience even during times of economic uncertainty. As the focus shifts from traditional military hardware to advanced technologies, defence is increasingly seen as an essential and stable investment opportunity.

Stockholm International Peace Research Institute, US Department of State

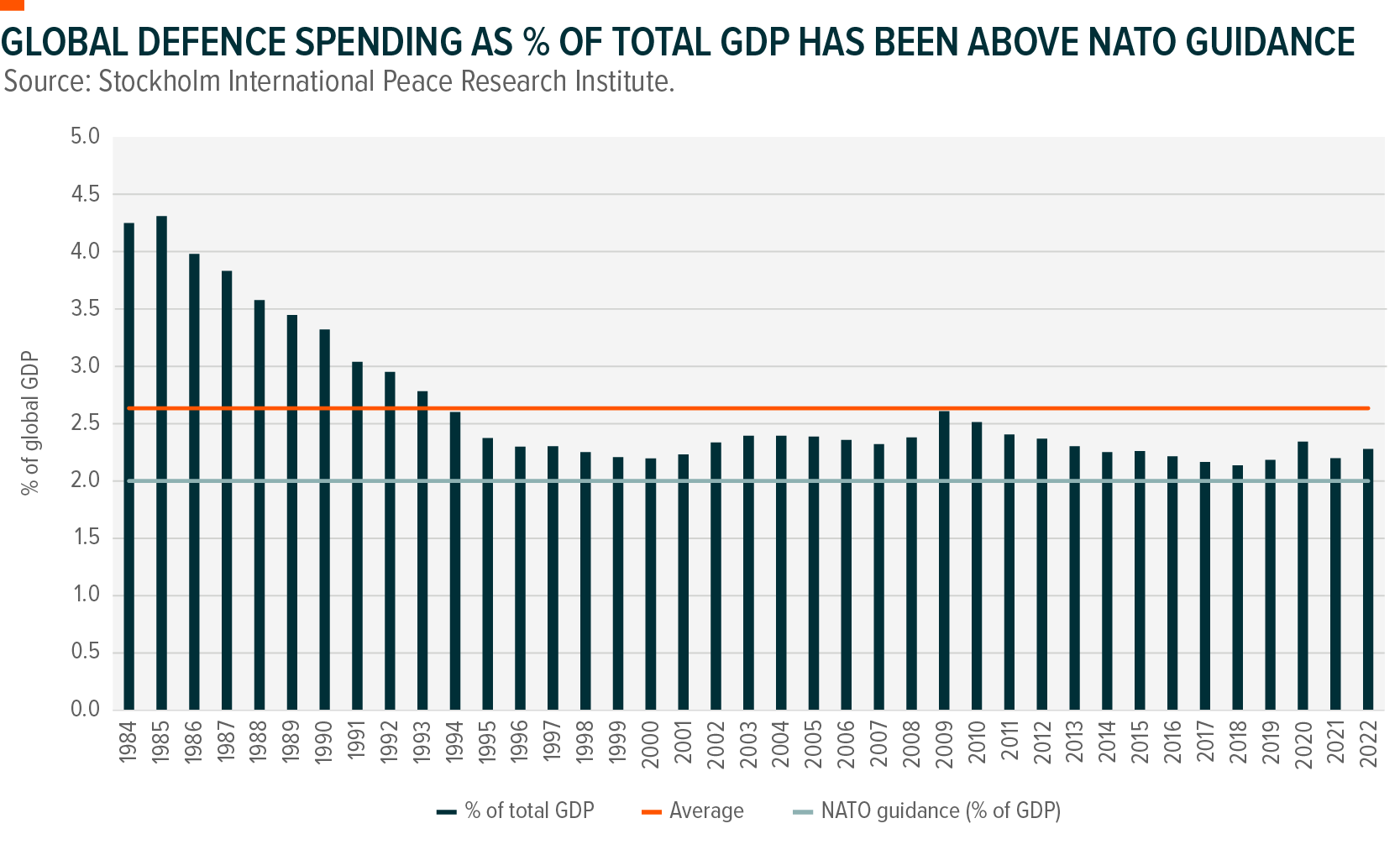

Global defence spending as a percentage of GDP has consistently exceeded NATO’s guideline of 2%. This is not solely due to military ambitions, but also because nations recognise the critical need to invest in protecting and securing their infrastructure in a rapidly evolving technological landscape. In today’s world, threats are not just physical; they are cyber, informational, and infrastructural. This growing focus on security, resilience, and innovation drives countries to commit resources beyond traditional military spending, ensuring their systems remain robust against evolving threats.

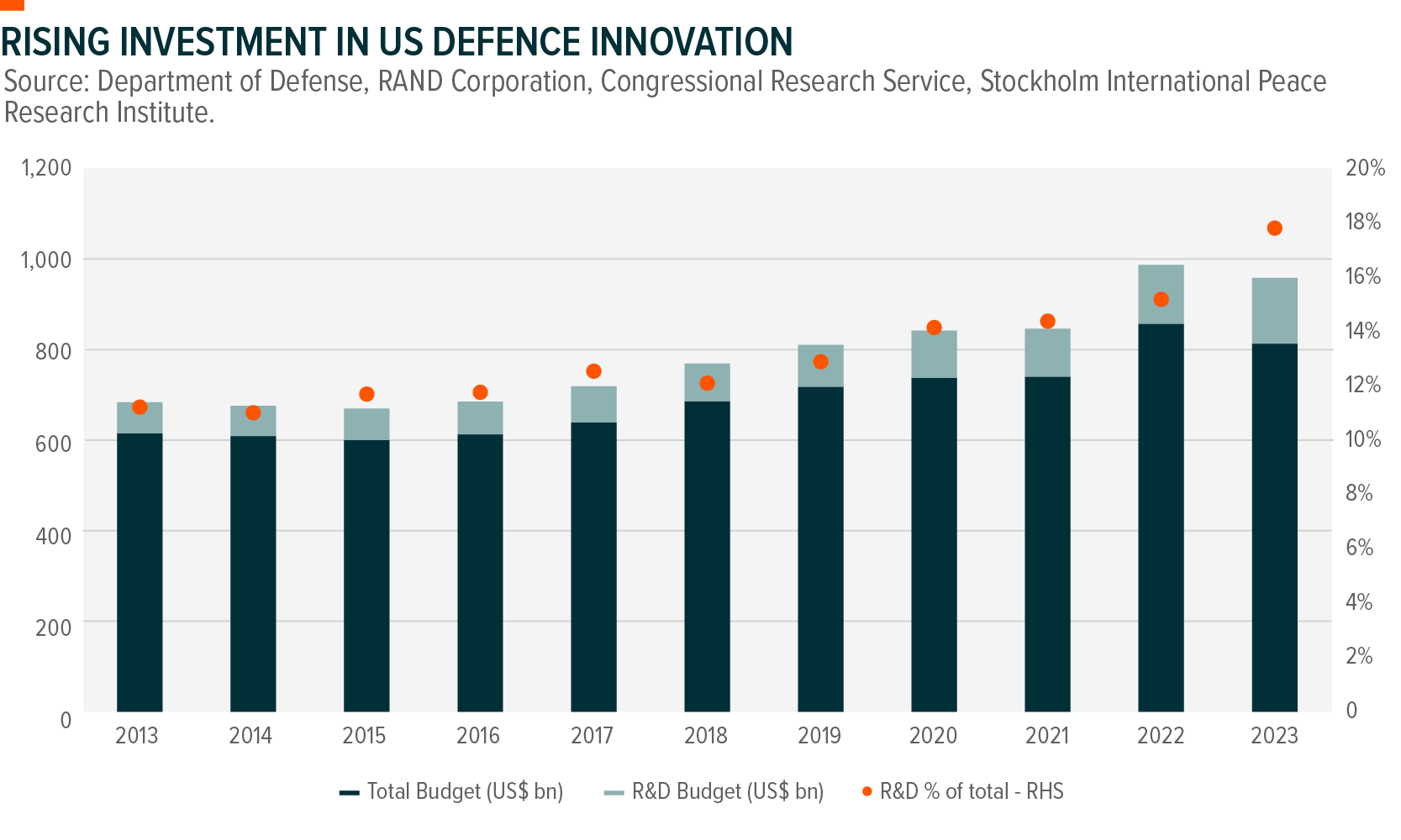

Technological advancements are now at the heart of defence strategies, with investments in AI, drones, and cybersecurity leading the way. Defence budgets are increasingly allocated towards these innovations, allowing countries to safeguard critical infrastructure, enhance surveillance capabilities, and respond to modern threats with greater precision. The demand for these technologies reflects a growing realisation that future conflicts will likely be defined by intelligence and automation rather than sheer military force.

Riding the Wave of National Security Priorities

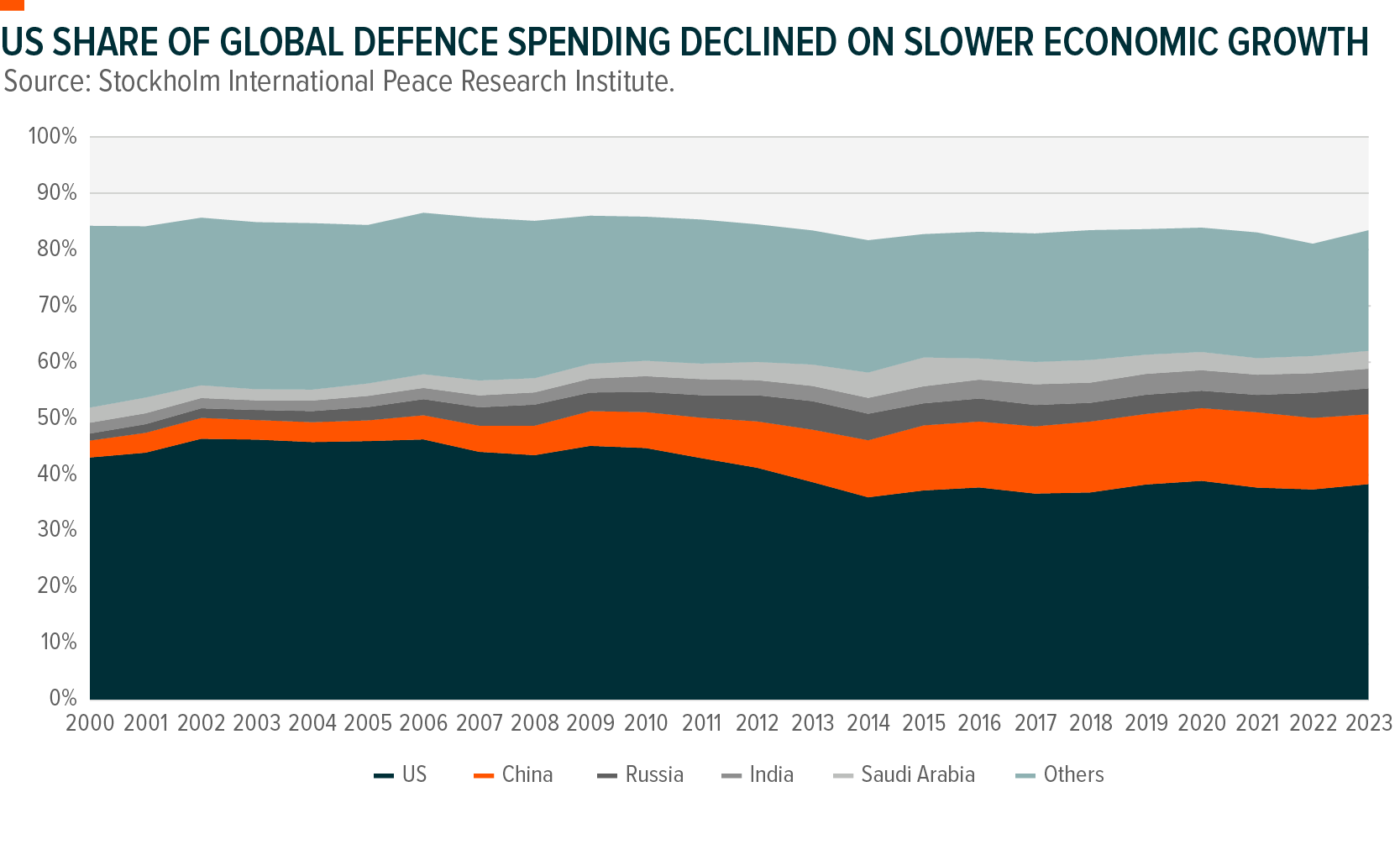

As global security priorities shift, countries like China and India have seen steady growth in their defence budgets over the past decade. However, attention is now turning back to the US, where we have seen accelerating growth in defence spending driven by increasing spend as % of GDP. Despite a relative decline in its share of global military expenditure in recent years, driven by slower economic growth, the US remains the world’s largest defence spender.

With rising geopolitical tensions and renewed focus on national security, the US is positioning itself for a spending catch-up. The need to modernise military capabilities and maintain its strategic advantage is pushing the US government to allocate larger portions of the budget toward defence, including traditional military spending and new initiatives. This could mark the beginning of a new era of elevated defence expenditure, ensuring that the US stays ahead in the global arms race.

As military spending becomes a priority once again, the US is expected to reclaim a larger share of global defence budgets. This shift will be critical in maintaining global security leadership and addressing the changing balance of power. With stronger economic footing, the US is now ready to reassert its dominance in the defence landscape.

The Future of Defence Lies in Technology

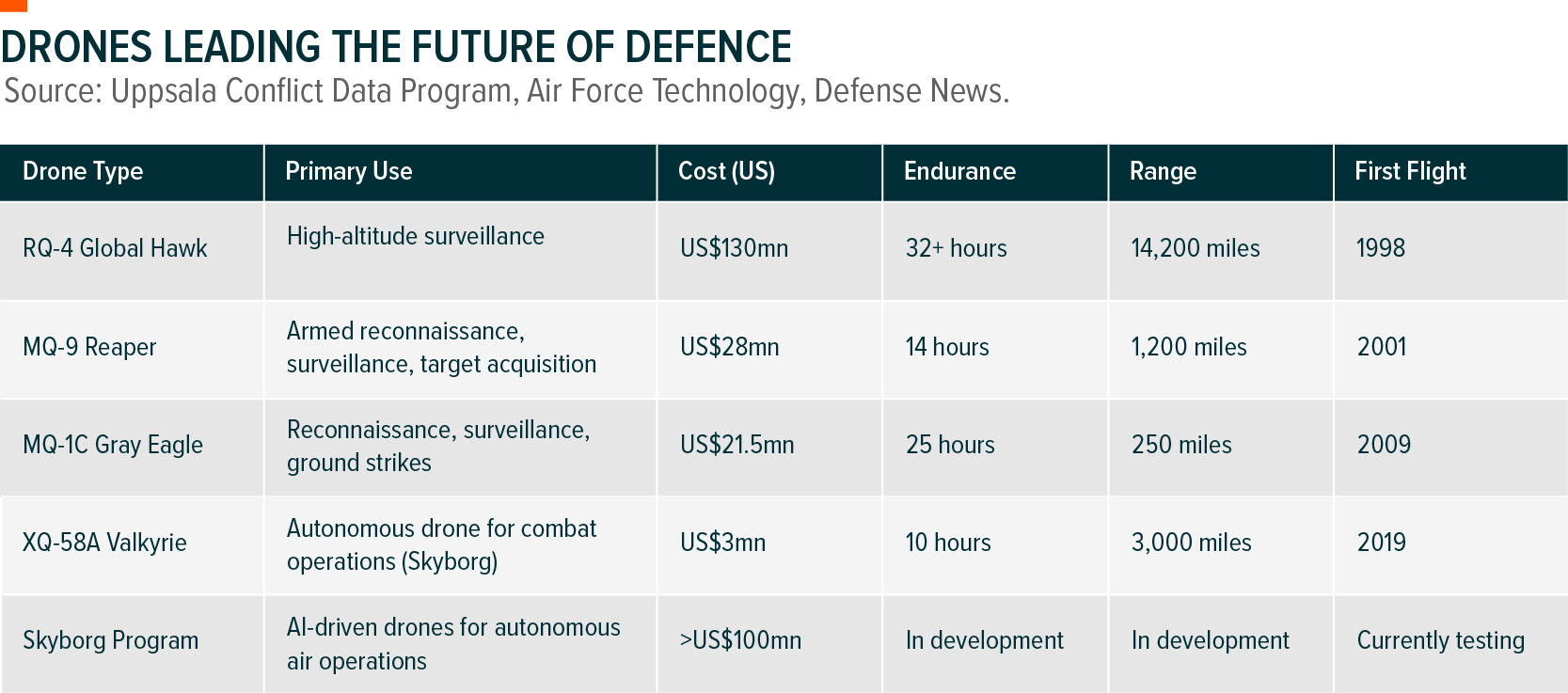

Today’s defence budgets are shifting away from tanks and fighter jets to intelligent systems and automated solutions that enhance a nation's ability to respond to threats quickly and precisely. The demand for advanced technology is surging, with sectors such as AI, quantum computing, and drone technology leading the charge. These innovations are transforming modern defence, allowing for more precise and autonomous decision-making, and are rapidly becoming central to both surveillance and combat operations.

Governments across the globe, particularly in the US, are ramping up investments in defence technologies that focus on automation, intelligence gathering, and cybersecurity. Drones, in particular, have become pivotal in modern warfare and national security strategies. Autonomous drones are increasingly relied upon for reconnaissance and precision strikes, with AI-driven platforms offering enhanced operational efficiency. The future of defence lies in these advancements, as nations prioritise technological superiority to maintain a strategic edge in a rapidly changing global landscape.

Our World in Data, Stockholm International Peace Research Institute

Protection, Not Aggression – The Modern Defence Strategy

The global decline in military casualties, particularly from 2000 to 2021, reflects a broader shift in global defence strategies, where the emphasis is on protection rather than aggression. Countries are now focusing on surveillance, intelligence, and technological superiority, using tools like drones and AI to enhance operational efficiency while minimising human risk. The modern defence strategy is less about traditional warfare and more about precision, protection, and proactive security measures.

As defence spending continues to prioritise advanced technologies and innovation, the future of global security will be driven by the ability to adapt to new threats through automation and intelligence. For investors seeking exposure to this evolving landscape, the Global X Defence Tech ETF (ASX: DTEC) offers targeted access to companies at the forefront of these technological advancements, providing a unique opportunity to capitalise on the future of defence.

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.

Global X is a leading ETF provider, offering a wide range of thematic, commodities, income, core, and digital asset solu...

Recommended for you

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.

The recent US election has had strong reverberations across equity markets internationally and in Australia. Here, Tynda...

The growing use of drones is transforming warfare

Innovation isn’t just a buzzword; it’s the lifeblood of growth, competitiveness, and sustainability across industries.