Four Top Innovator Stocks in US Infrastructure

The transformation of US infrastructure presents significant opportunities for investors.

Recent investments in the sector are set to transform the nation’s landscape, enhancing transportation, energy, and communication systems. This focus on infrastructure is expected to unlock new markets and spur economic growth worth trillions of dollars.1 The modernisation of infrastructure often depends on the convergence of advanced technologies, robust energy solutions, and efficient management systems. In this piece, we highlight four companies held within the Global X US Infrastructure Development ETF (PAVE) that excel in these and other areas critical to the successful infrastructure transformation. In our view, these companies help illustrate the broader array of investment opportunities that are available across the entire infrastructure value chain.

Key Takeways

- Trane Technologies: Leader in climate control and sustainability, driving energy efficiency with advanced HVAC solutions.

- Eaton: Global power management leader, advancing smart grid technologies, energy storage, and electric vehicle infrastructure.

- Howmet Aerospace: Innovator in aerospace components, supporting the modernisation of the aerospace infrastructure.

- Emerson Electric: Specialist in industrial automation and control systems, leading the digital transformation of industrial processes.

Trane Technologies: Pioneering Sustainable Climate Solutions

Trane Technologies is a leader in climate control and sustainability, focusing on heating, ventilation, and air conditioning (HVAC) systems. The company is known for its eco-friendly HVAC solutions, using advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) to improve energy efficiency and climate control. These innovations are designed to meet the growing demand for sustainable building solutions, supporting global efforts to reduce carbon footprints and enhance energy efficiency.2

Trane’s strategy includes integrating the latest technology into their products, helping them stay competitive in a rapidly changing market. Their AI-powered HVAC systems not only optimise energy use but also provide predictive maintenance capabilities, which reduce downtime and operational costs for users. This has made Trane a preferred choice for commercial, residential, and industrial applications looking to improve their sustainability.3

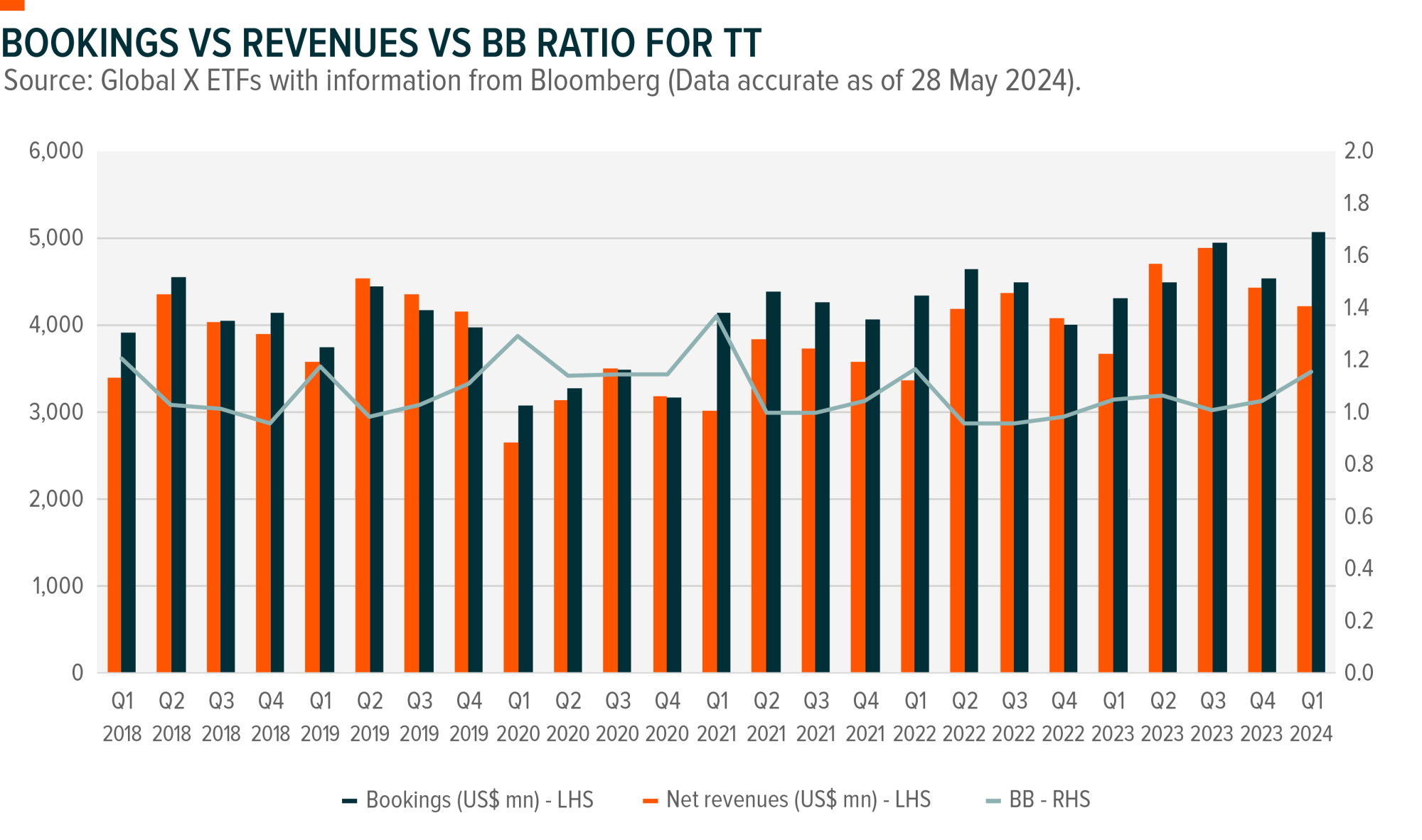

A key indicator of Trane's strong market position is its consistently high book-to-bill (BB) ratio, which has been close to or above 1.0 for the past six years.4 The BB ratio compares the number of new orders received to the number of goods shipped and billed, showing that the company's bookings have consistently outpaced its billings, indicating strong demand and future revenue growth.

Eaton: Advancing Power Management and Smart Grids

Eaton is a global leader in power management, offering solutions that enhance the efficiency, reliability, and safety of electrical, hydraulic, and mechanical power systems. Their innovations in smart grid technologies and electrical infrastructure are crucial for modernising the US power grid, making it more adaptable to evolving energy needs.

Eaton’s product portfolio includes a wide range of electrical components and systems designed to improve power distribution and management. Their smart grid technologies use artificial intelligence (AI) and the Internet of Things (IoT) to optimise energy flow, reduce outages, and seamlessly integrate renewable energy sources into the grid. This positions Eaton as a key player in the shift towards a more sustainable and efficient energy infrastructure.

A distinguishing factor for Eaton is its strategic focus on large-scale projects and its ability to benefit from the ongoing surge in US manufacturing investment. As of Q3 2023, Eaton has identified approximately US$859 billion in announced mega projects, with about 20% of these projects having started. The company estimates a $5-$8.5 billion opportunity from the electrical content of these projects and has secured around $850 million to date. Their strong market position is further highlighted by their ability to capture a significant market share in recent mega project bids.5

In addition to these efforts, Eaton is at the forefront of energy storage and electric vehicle (EV) infrastructure development. They are pioneering advanced battery storage systems that not only support grid stability, but also enhance the integration of renewable energy sources. Their innovations in EV charging technology are poised to revolutionise the EV market by providing faster, more efficient charging solutions that can help accelerate the adoption of EVs across the US.6

Eaton’s advancements in smart grid technologies and energy-efficient solutions are essential for the modernisation and reliability of the US electrical infrastructure. Their efforts support the national push towards a more sustainable and resilient power grid, which is vital for economic growth and environmental sustainability.

Howmet Aerospace: Shaping the Future of Aerospace Infrastructure

Howmet Aerospace is a leading provider of advanced engineered solutions for aerospace components, including jet engine parts, airframe components, and industrial gas turbines. The company’s expertise in advanced materials and precision manufacturing has made it a key supplier to both commercial and defense aerospace sectors.

The aerospace industry is undergoing a significant recovery, driven by increased demand for commercial aircraft and renewed defense spending. Howmet’s advanced materials and engineering capabilities position it well to benefit from these trends. The company’s products are critical for improving the performance, efficiency, and safety of modern aircraft, making them a key player in the aerospace supply chain.

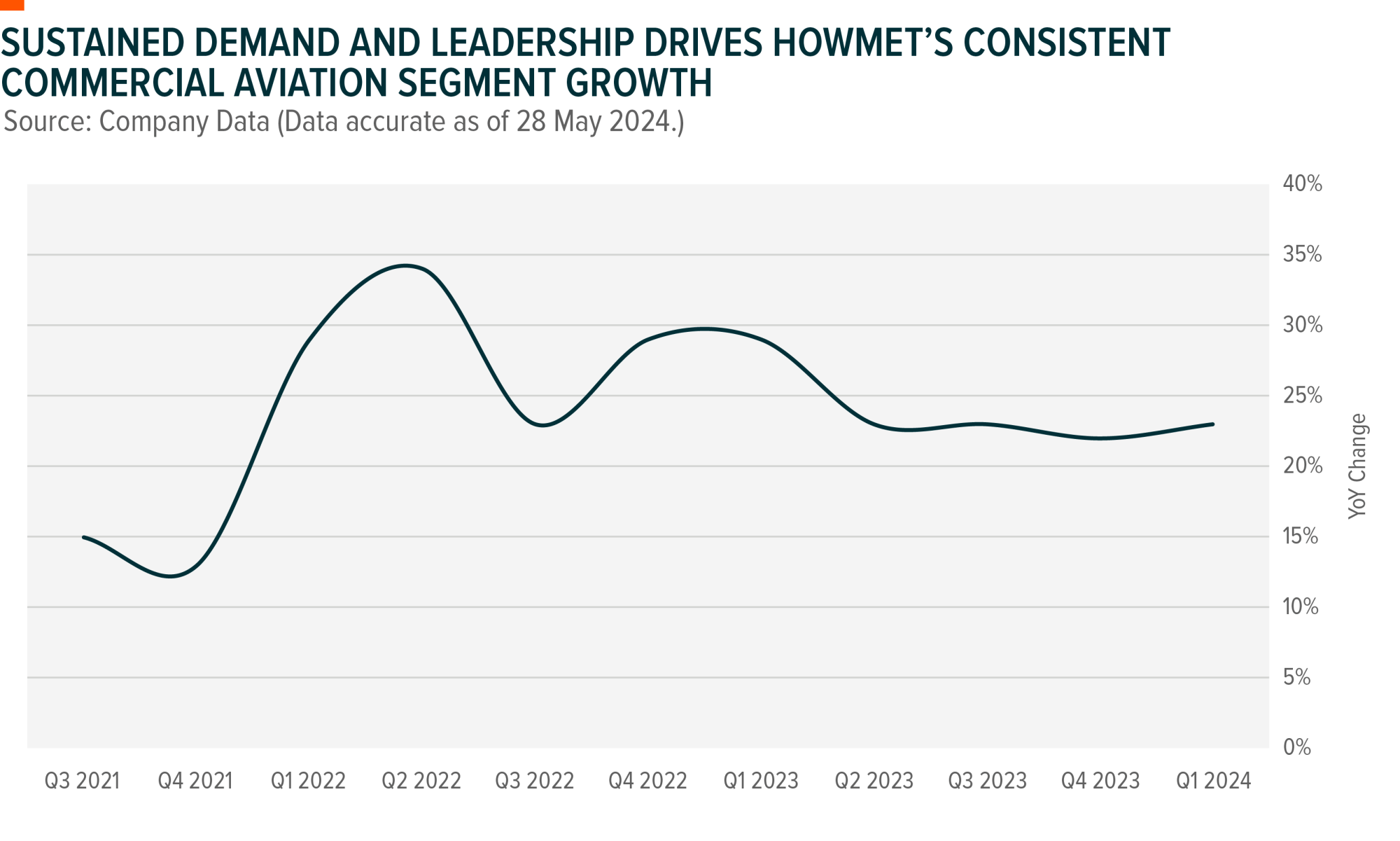

One of Emerson's standout areas is their innovation in smart manufacturing and the Industrial Internet of Things (IIoT). Their IIoT solutions connect machinery and equipment to a central network, providing real-time data and analytics that help businesses optimise performance and reduce costs. Since Q3 2021, the average growth of commercial aerospace revenue has been 24% year-over-year, showing the steady demand and expansion in this sector. This integration of intelligent systems is paving the way for the factories of the future, driven by interconnected, smart technologies driving efficiency and innovation.

Howmet stands out for its pioneering work in additive manufacturing, also known as 3D printing. This technology allows Howmet to produce complex aerospace components with precision and efficiency. By leveraging 3D printing, Howmet can reduce material waste, lower production costs, and accelerate the development of new aerospace technologies. This positions the company at the cutting edge of aerospace innovation and highlights its importance in the national infrastructure landscape.

Emerson Electric: Leading Industrial Automation and Control

Emerson Electric is a diversified global manufacturing and technology company, offering a broad range of automation solutions, industrial software, and climate technologies. With a strong focus on industrial automation and digital transformation, Emerson is at the forefront of modernising industrial processes and infrastructure. Their strategic emphasis on advanced automation technologies positions them as a key player in enhancing operational efficiency and productivity across various sectors.

Emerson's automation solutions incorporate cutting-edge technologies such as artificial intelligence (AI), Internet of Things (IoT), and machine learning. These technologies are pivotal in improving operational efficiency, reducing downtime, and boosting productivity. Emerson's industrial software and control systems are extensively utilised in industries ranging from manufacturing to energy production, enabling seamless integration and optimisation of complex industrial operations.

One of Emerson's standout areas is their innovation in smart manufacturing and the Industrial Internet of Things (IIoT). Their IIoT solutions connect machinery and equipment to a central network, providing real-time data and analytics that help businesses optimise performance and reduce costs. This integration of intelligent systems is paving the way for the factories of the future, characterised by interconnected, smart technologies driving efficiency and innovation.7

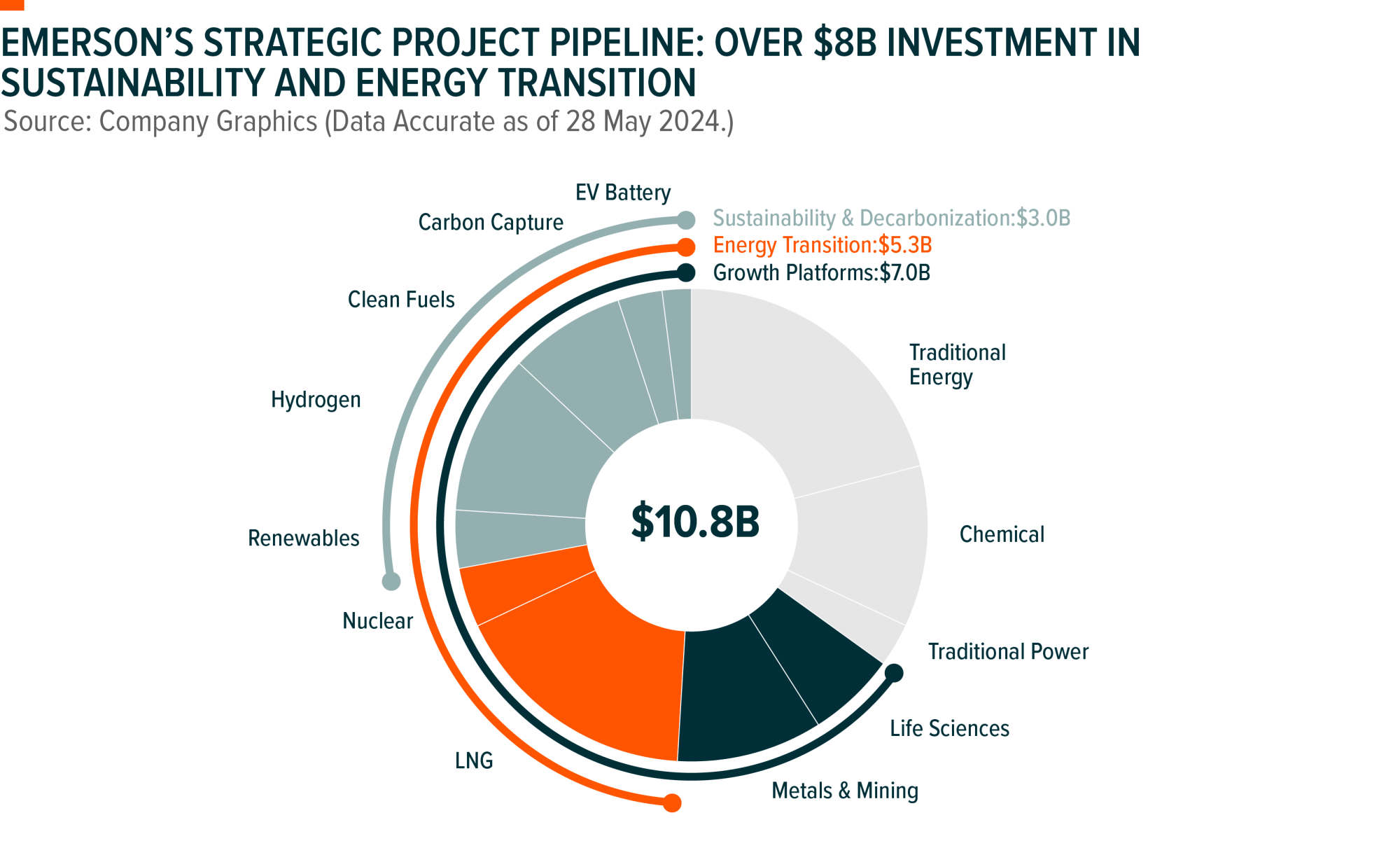

In recent quarters, Emerson has shown consistent performance, particularly in their core process and hybrid businesses. The company has seen robust growth in sectors such as energy, LNG, chemicals, and power, driven by the global push for energy security and sustainability. Emerson's strategic project funnel includes significant investments in sustainability and decarbonisation, with a project funnel totalling $10.8 billion across various sectors including traditional energy, life sciences, and EV battery production.8

Emerson's contributions are critical in the effort to modernise and enhance US industrial infrastructure. Their advanced technologies and solutions are helping to create more efficient, productive, and technologically advanced industrial environments, underscoring Emerson's role as a leader in this transformative field.

These four companies are at the forefront of this evolution, driving innovation and growth across critical areas. As the US focuses on modernising its infrastructure, these companies are well-positioned to benefit from increased investment and development.

Get exposure to a range of companies, including these four, that are transforming the US infrastructure landscape through the Global X US Infrastructure Development ETF (ASX: PAVE).

1 US Department of the Treasury

2 Company website

3 HVAC-B

4 Global X ETFs based on Company Data (Accurate as of 28 May 2024)

5 Company earnings call

6 HVAC-BC

7 Drives & Control

8 Company earnings

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits, and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.

Forecasts are not guaranteed and undue reliance should not be placed on them. This information is based on views held by Global X as at 13/06/2024. Past performance is not a reliable indicator of future performance.

Diversification does not ensure a profit nor guarantee against a loss. Brokerage commissions will reduce returns. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Global X is a leading ETF provider, offering a wide range of thematic, commodities, income, core, and digital asset solu...

Recommended for you

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.

The recent US election has had strong reverberations across equity markets internationally and in Australia. Here, Tynda...

The growing use of drones is transforming warfare

Innovation isn’t just a buzzword; it’s the lifeblood of growth, competitiveness, and sustainability across industries.