As artificial intelligence (AI) continues to advance, it’s increasingly clear that reliable and resilient power sources and infrastructure are critical to its growth.

Highlighting this urgency is the International Energy Agency’s (IEA) estimate that by 2026 electricity demand from dedicated AI data centers could grow by more than 10x from 2023 levels.1 In line to benefit from this new demand source over the long term are companies throughout the power sector, in particular companies across the renewable energy value chain and those that provide the required power infrastructure and equipment.

Rapid Growth of AI and Data Centers Has Increased Power Demand Forecasts

Generative AI systems such as ChatGPT are rapidly evolving, and companies are working to significantly expand data centre capacity to keep pace with the AI revolution. Jensen Huang, CEO of AI chipmaker Nvidia, expects that companies could spend a hefty $1 trillion over the next four years to upgrade and expand data centre infrastructure to meet the growing demand from AI applications.3

Not only is the number of data centers rising, but they’re also getting bigger and requiring more power. On its Q1 2024 earnings call, Virginia-based utility Dominion Energy reported that requests for energy demand from proposed data centre campuses range from 300 megawatts (MW) up to several gigawatts (GW).4 The current generation of data centers typically require only about 30MW of electricity demand, while individual data centers under development request as much as 90MW.5 Also, the AI data centre racks that are used in training models can use 5–7x more energy than traditional data centre racks.6

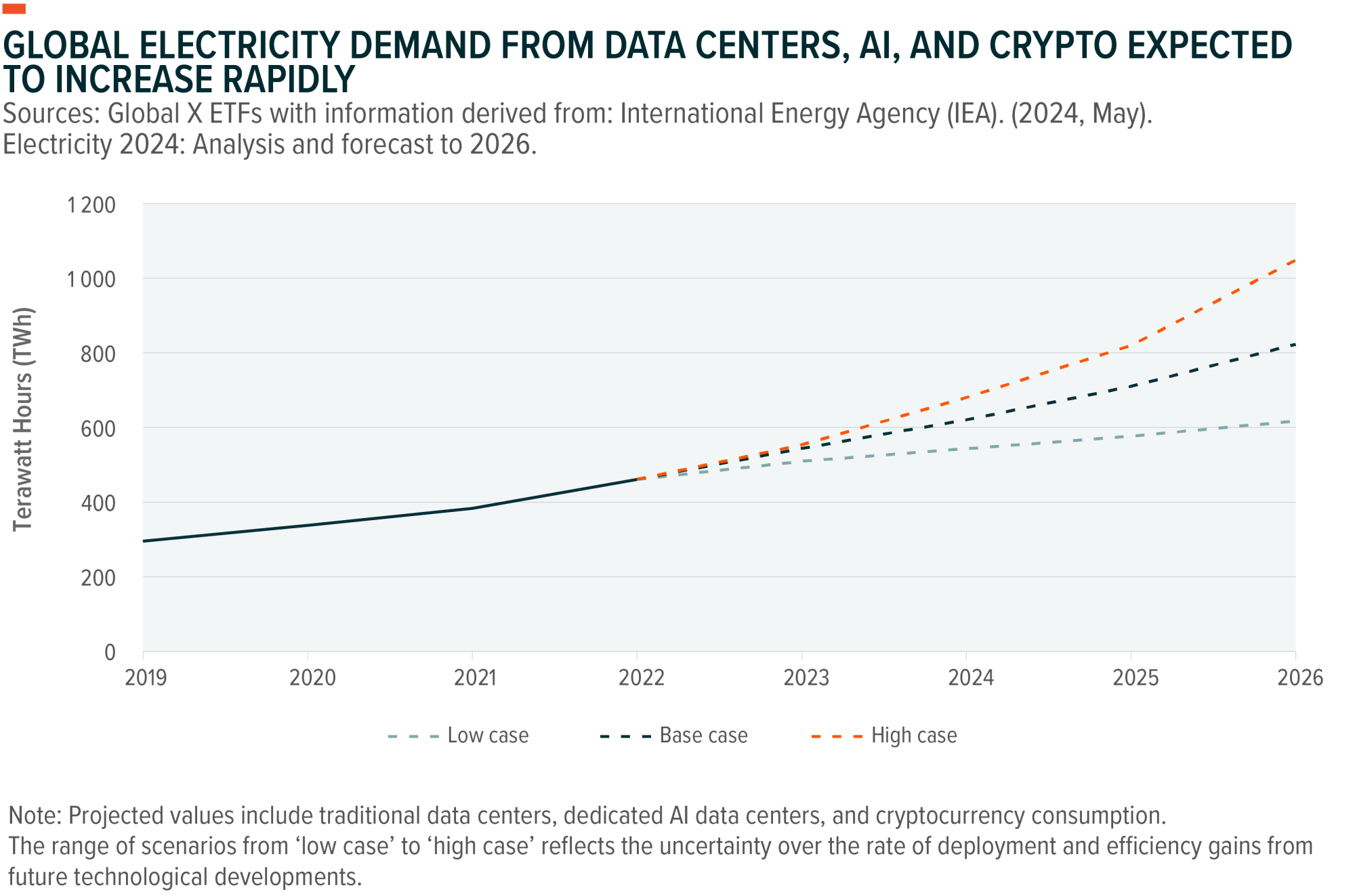

The subsequent increase in power demand is likely to create significant new growth opportunities for power producers around the world. In particular, the IEA forecasts that electricity consumed by data centers and cryptocurrencies around the world could increase from 460 terawatt-hours (TWh) in 2022 to as high as 1,050 TWh in 2026.7 For context, this type of demand would be roughly equal to Germany’s current electricity needs.8 At the country level, Ireland’s rapidly expanding data centre landscape could account for one third of the country’s electricity demand by 2026. China’s data centre electricity demand could grow 1.5x from 2020 levels to reach 300 TWh by 2026.9

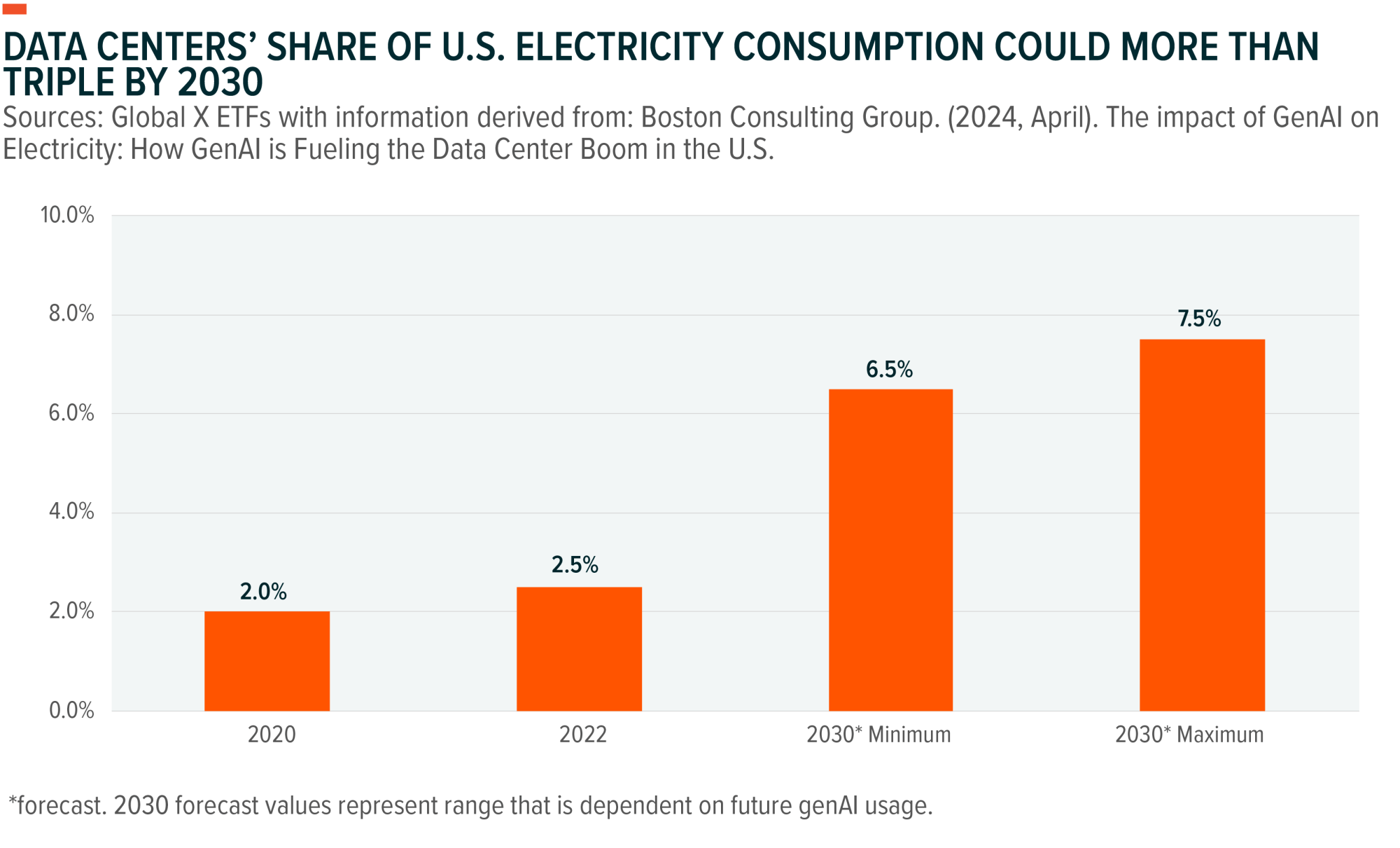

In the United States, the largest data centre market in the world, data centre electricity consumption could more than triple from 126TWh in 2022 to 390TWh by the end of the decade.10 As a result, by 2030, data centers could account for 7.5% of U.S. electricity consumption, up from an estimated 2.5% share in 2022.11 Combined with rising adoption of electric vehicles (EVs) and the ongoing electrification of industrial activities, total U.S. electricity demand is forecast to increase by as much as 20% by the end of the decade.12 This growth would be quite the U-turn from the near-flat U.S. power demand growth over the last decade.13,14

Recently, U.S. utilities began discussing plans to account for additional growth. For example, Georgia Power has increased its projected load growth from around 400MW in their plan from January 2022 to more than 6,600MW in their plan from October 2023.15 That’s a 16.5x increase in forecasted demand growth in under 2 years. Dominion Energy forecasted demand from data centers in Virginia to more than double from 3.3GW in 2023 to more than 7GW in 2030.16 That said, the company’s recent requests for “several gigawatts” from data centre developers suggest the potential for even more demand growth.

Renewables Can Help Meet Added Demand Without Compromising Companies’ Sustainability Targets

Data centers are likely to create growth opportunities for a range of power sources, including natural gas, nuclear power, wind power, solar power, hydrogen, and energy storage systems. In particular, renewable energy systems may help meet the AI-induced power demand while also keeping companies on track towards their clean energy targets. Microsoft aims to match 100% of its electricity consumption to zero carbon energy sources, 100% of the time, by 2030.17 Google pledged to power its operations with carbon-free energy 24/7 by 2030, and Meta also committed to reaching net zero emissions across its value chain by the end of the decade.18,19

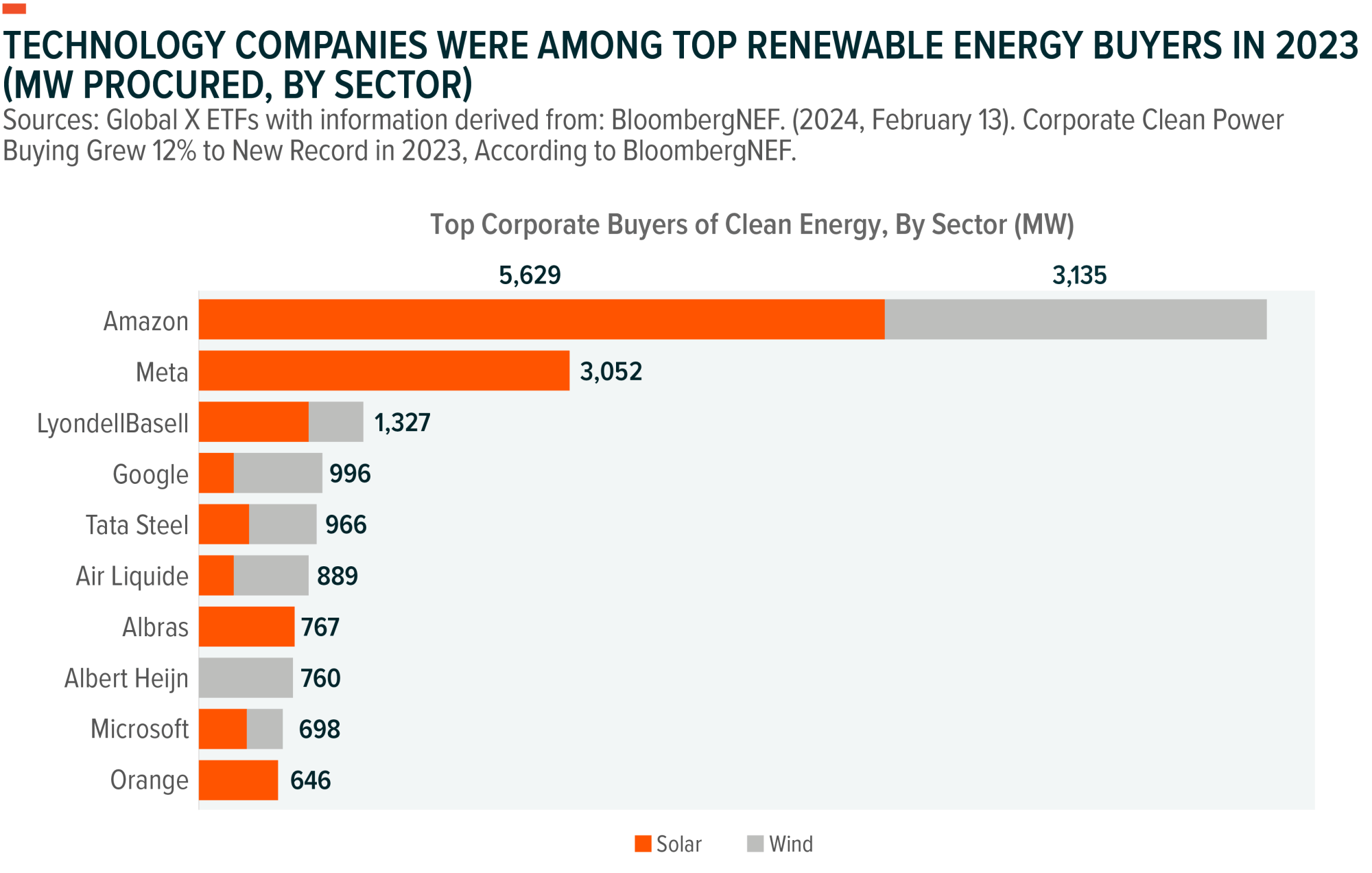

Tech giants and AI leaders like Microsoft, Google, and Meta are already top clean energy buyers, and in our view, they’re likely to remain top customers as they look to secure even more clean power for AI operations.20 For example, in May 2024, Microsoft and Brookfield Renewable Partners announced a corporate power purchase agreement (PPA) for the development of 10.5GW of wind and solar power capacity in the United States and Europe between 2026 and 2030. The agreement is about 8x larger than the previous largest corporate PPA, and it is estimated that the total wind and solar project costs could exceed $10 billion.21,22 The two companies have also discussed expanding the deal to include more projects and other countries.23 In December 2023, Meta announced a PPA with renewables developer Ørsted for a 300MW solar farm and a 300MW, 4-hour battery energy storage system to power its data centre operations in Mesa, Arizona.24 In addition to renewables, companies like OpenAI and Amazon are exploring potential opportunities to use nuclear power for more sustainable data centre operations.25

The Clean Energy Buyers Association (CEBA), which counts Google, Meta, Amazon, and Microsoft as members, is also working with utilities to ensure that renewables remain a part of the conversation as they come up with resource plans to meet forecasted demand growth. For example, in April 2024, CEBA and Georgia Power announced plans to work together to develop a new customer clean energy program that will be included in the utility’s 2025 Integrated Resource Plan (IRP) filing.26 IRPs are planning documents that outline how utilities expect to meet forecasted future power demand. Prior to this announcement, Georgia Power had been planning to expand fossil fuel-fired power plant capacity to meet expected demand growth from tech and industrial customers.27 The collaborative efforts with CEBA open up the opportunity for renewables to potentially be a bigger part of the solution.

Management Commentary Highlights AI-Induced Growth Opportunities for the Power Sector

On recent earnings calls, management teams from companies across the renewable energy value chain highlighted the potential growth opportunities from the adoption of AI. Connor Teskey, CEO of Brookfield Renewable Partners, stated that the market is only just starting to understand the amount of power needed for the adoption of AI, and that “sourcing sustainable renewable power at scale is now on the critical path to delivering the rollout of AI globally.”28 Kirk Crews, Executive VP and CFO of NextEra Energy, reported that strong demand for the company’s power is partly due to industrial customers looking to decarbonise operations and meet AI and data centre demand.29 Mark Widmar, CEO of solar panel equipment provider First Solar, noted that data centre load growth is partly responsible for increased demand expectations.30

The AI industry also recognises that significant power growth is central to support future advancements. Ami Badani, CMO of chip designer Arm Holdings, stated that AI’s “insatiable demand” for electricity means that advancements in AI can’t continue without addressing the growing power needs.31 Badani also noted that a single ChatGPT query requires 15x more energy than a typical web search.32

Conclusion: AI’s Impact on the Renewables and Power Sectors Could Be Substantial

OpenAI CEO Sam Altman recently admitted that “we still don’t appreciate the energy needs of this technology.”33 What can be said with more certainty at this point is that for the AI revolution to take hold, more power is needed. For investors looking for potential clues about the connection between AI’s proliferation and potential opportunities in energy, we believe that big tech being among the most prolific buyers and supporters of clean energy is meaningful. In our view, this type of demand and its potential impact on the ongoing energy transition creates significant long-term opportunities for renewable energy producers and equipment providers.

Discover opportunities in AI and clean energy with Global X ETFs.

Footnotes

- Ibid.

- Data Center Dynamics. (2024, February 14). Nvidia CEO Jensen Huang predicts data center spend will double to $2 trillion.

- Dominion Energy. (2024, May 2). Q1 2024 Earnings Call [Presentation].

- The Motley Fool. (2024, May 2). Dominion Energy (D) Q1 2024 Earnings Call Transcript.

- S&P Global. (2023, October 17). Power of AI: Surging datacenter load has Dominion bracing for AI’s added demand.

- International Energy Agency (IEA). (2024, May). Electricity 2024: Analysis and forecast to 2026.

- Ibid.

- Ibid.

- CPower. (2024, March 19). Demand Growth Offers Opportunities for Data Centers.

- Ibid.

- CNBC. (2024, May 5). AI could drive a natural gas boom as power companies face surging electricity demand.

- EIA. (n.d.). Electric Power Monthly: Table 5.1. Sales of Electricity to Ultimate customers. Accessed on May 17, 2024.

- Wood Mackenzie. (2024, March 1). Demand growth creates new challenges for the power industry.

- Georgia Power. (2023, October 27). Company seeks approval to invest in and deploy new generation resources, continue transforming its fleet and electric grid.

- CNBC. (2024, May 5). AI could drive a natural gas boom as power companies face surging electricity demand.

- Brookfield Renewable Partners. (2024, May 1). Brookfield and Microsoft Collaborating to Deliver Over 10.5 GW of New Renewable Power Capacity Globally.

- Google Sustainability. (n.d.). Operating on 24/7 Carbon-Free Energy by 2030. Accessed on May 15, 2024.

- Meta Sustainability. (n.d.). Climate. Accessed on May 15, 2024.

- BloombergNEF. (2024, February 13). Corporate Clean Power Buying Grew 12% to New Record in 2023, According to BloombergNEF.

- Brookfield Renewable Partners. (2024, May 1). Brookfield and Microsoft Collaborating to Deliver Over 10.5 GW of New Renewable Power Capacity Globally.

- CNBC. (2024, May 1). Microsoft signs deal to invest more than $10 billion on renewable energy capacity to power data centers.

- Brookfield Renewable Partners. (2024, May 1). Brookfield and Microsoft Collaborating to Deliver Over 10.5 GW of New Renewable Power Capacity Globally.

- Ørsted. (2023, December 11). Meta and SRP customers will benefit from the solar and stored energy from Eleven Mile Solar Center in Pinal County.

- NBC News. (2024, March 4). The AI industry is pushing a nuclear power revival – partly to fuel itself.

- Clean Energy Buyers Association (CEBA). (2024, April 16). CEBA Agreement with Georgia Power Opens Path To Customer-Driven Clean Energy.

- Canary Media. (2024, April 22). Data centers want clean electricity. Can Georgia Power deliver it?

- The Motley Fool. (2024, May 3). Brookfield Renewable Partners (BEP) Q1 2024 Earnings Call Transcript.

- The Motley Fool. (2024, January 25). NextEra Energy (NEE) Q4 2023 Earnings Call Transcript.

- The Motley Fool. (2024, May 1). First Solar (FSLR) Q1 2024 Earnings Call Transcript.

- Fortune. (2024, April 16). AI could gobble up a quarter of all electricity in the U.S. by 2030 if it doesn’t break its energy addiction, says Arm Holdings exec.

- Fortune. (2024, April 22). OpenAI’s Sam Altman is funding a green-energy moonshot as AI’s power demand grow to ‘insatiable’ levels.

- The Verge. (2024, January 19). Sam Altman says the future of AI depends on breakthroughs in clean energy.

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits, and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.