Vigilance needed on suspicious super activity

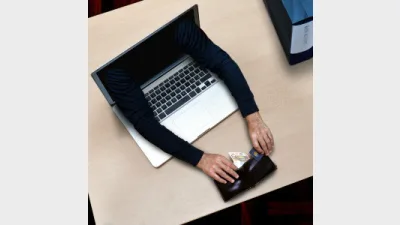

The Association of Superannuation Funds of Australia (ASFA) has urged superannuation fund members to be alert to suspicious activity following the corporate regulator’s confirmation that it has received multiple referrals around scams and fraud relating to the early release of super scheme.

ASFA chief executive, Dr Martin Fahy, said: “It’s critical to protect your superannuation account details and to regularly check your balance, just as you would with an everyday bank account. It’s the best way to be alert to suspicious activity.

“ASIC has outlined the rising threat and identified the growing cases of cybercrime, fraud and identity theft specifically targeting super funds and their members in relation to the COVID-19 early release super scheme.”

ASFA also pointed to the Australian Securities and Investments Commission’s (ASIC’s) indication that there were continued law breaches by real estate agents encouraging tenants to access their super to meet rental payments and credit providers advising borrowers to use it to meet loan repayments.

“We encourage the authorities to prosecute these breaches to the full extent of the law and send a clear message to those preying on vulnerable members of the community,” he said.

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.