Size matters in superannuation says APRA

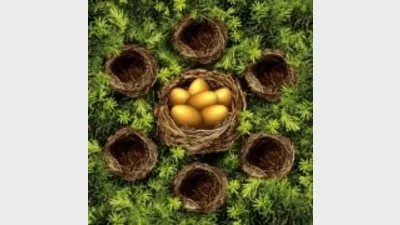

The Australian Prudential Regulation Authority (APRA) has openly declared its view that larger superannuation funds are more sustainable.

Barely a week after distributing superannuation fund heatmaps, the regulator’s latest newsletter contains an article which asserts that “size matters”.

The newsletter referred to scale measures such as:

- Adjusted Total Accounts Growth Rate

- Net Cash Flow Ratio

- Net Rollover Ratio

“These metrics provide an indication of member retention, the amount that the fund is paying out to members for every dollar that is paid in, and the overall growth in assets. In other words, they indicate whether the fund is likely to grow or contract over coming years,” it said.

“Scale is important in superannuation: to put it bluntly, size matters,” the newsletter said.

It said that while size was not a guarantee of good performance, nor an insurmountable barrier to it, “larger funds are typically better able to, for example, negotiate scale discounts with service providers, access investment markets, and spread the cost of operations over their membership base”.

“All of these are ultimately indicators of a fund’s ability to provide good outcomes for its members now and into the future,” the newsletter said.

“APRA expects trustees to consider their heatmap outcomes for the three sustainability metrics, gain an understanding of factors that have driven those outcomes, and develop a plan to promptly address any sustainability concerns.”

Recommended for you

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.