Objective-based approach better in retirement

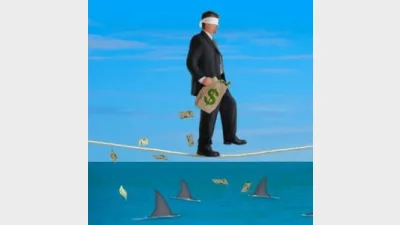

Asset managers need to move away from the benchmark relative approach and into an objective-based approach when thinking about building income products for retirement, according to State Street Global Advisors.

Head of asset allocation, Asia Pacific, Mark Wills believes the discussion has to move away from benchmark and peer relative approaches and into the objectives of the end investor.

"At the institutional level, they're still very vetted to benchmark relative investing. One of the arguments from the planners is they want to move the end investor much more towards objective-based investing," Wills said.

Planners should be assessing the aspirations of clients, compare it to their life expectancy, the amount of money available to them, and calculate longevity risk, and how long clients will need the money for.

Wills also believes member education on complex products is not very useful as clients will not understand it unless they are an expert.

It is more useful for the end investor to focus on how much money they have got and whether it is sufficient to support their desired lifestyle.

But he still believes members will buy products based on what their planners will tell them, adding asset managers should manage the complex process of the investment while planners should focus on managing the relationship with the client.

"For example, when you get in the car and you put your key in the ignition and you turn it on, do you know why it starts? But you trust that it does. You trust the manufacturer has put all the bits into the car, it starts, it goes, and it stops."

Recommended for you

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.