Legislation to remove upper-income concessions nearly ready

Treasury officials have briefed the key financial services organisations on the underpinnings of legislation to remove superannuation tax concessions to upper-income earners (those earning over $300,000).

The legislation, a core element of last year's Budget, was finally released for public consultation by Treasury last week, with industry officials given a deeper briefing on the issues on Friday.

The legislation is the Tax Laws Amendment (Sustaining the Superannuation Contribution Concession) Bill 2013, with the accompanying explanatory memorandum.

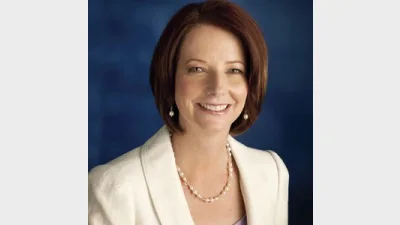

Its release followed on from the Prime Minister, Julia Gillard, saying everything was back on the table in terms of filling the 2013 Budget black hole.

Amid all the debate around the Government's approach to superannuation and discussion of the manner in which existing arrangements unduly favour upper-income earners, the Federal Opposition had pointed out that the Government had failed to introduce the earlier legislation, which effectively reduces access to super tax concessions for those earning over $300,000 a year.

Treasury's synopsis of the purpose of the bill stated that "very high income earners receive a higher superannuation tax concession than average income earners. The changes contained in the Bill will effectively ensure that very high income earners will receive a superannuation concession on their contributions more closely in line with the concession received by average income earners. This will improve the fairness of the taxation of the superannuation system".

The 8 May closing date for public submissions on the legislation suggests that the Government would be hard-pressed to move it through the Parliament during the five sitting weeks before the Federal Election.

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.