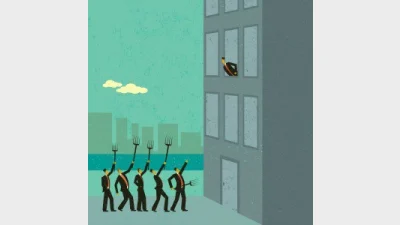

Some scandals would have been caught by the BEAR

A number of recent scandals within the major banks might have been picked up and dealt with under the Bank Executive Accountability Regime (BEAR) but the Australian Prudential Regulation Authority (APRA) is not prepared to say which ones.

APRA executive general manager, policy and advice, Pat Brennan has countered suggestions that the BEAR may not have picked up some of the recent banking scandals by telling a Parliamentary committee that he believed there were instances where the new legislation would have been triggered.

“Again, I'd rather not name an individual ADI [bank],” he said. “But there were circumstances which I have thought through which would definitely have triggered a BEAR investigation.”

“I can't say what the outcome of that investigation would have been. But there were certainly instances which are relevant to consider under BEAR which we would have seen,” Brennan said.

Under questioning by ACT Labor Senator, Katy Gallagher, Brennan acknowledged the limitations of the BEAR regime and the fact that with CommInsure having been sold to AIA it was unlikely to be covered by the new system.

“To the extent that they're not an ADI, they won't be covered. I'm not completely familiar with the terms of the agreement. It is possible that even when an ADI off-loads a subsidiary they have some involvement. It might be selling or supporting the products, even if they're not taking the insurance risk,” he said.

Brennan said it depended on the cases, but some insurance companies would be covered and some would not.

Recommended for you

The Reserve Bank of Australia (RBA) has lowered rates to a level not seen since mid-2023.

Financial Services Minister Stephen Jones has shared further details on the second tranche of the Delivering Better Financial Outcomes reforms including modernising best interests duty and reforming Statements of Advice.

The Federal Court has found a company director guilty of operating unregistered managed investment schemes and carrying on a financial services business without holding an AFSL.

The Governance Institute has said ASIC’s governance arrangements are no longer “fit for purpose” in a time when financial markets are quickly innovating and cyber crime becomes a threat.