FOFA changes not necessarily riskier - APRA

The Australian Prudential Regulation Authority (APRA) has refused to concede that the Government's changes to the Future of Financial Advice (FOFA) legislation will necessarily give rise to greater consumer risk.

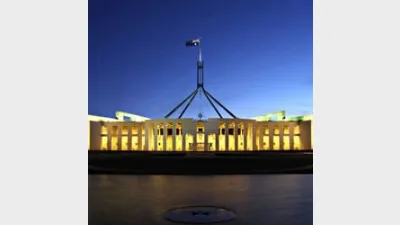

Giving evidence before a Parliamentary Committee in the immediate aftermath of the Government's regulatory changes to FOFA, APRA executive general manager, Charles Littrell suggested the changes might actually encourage the industry to become more cautious.

Asked by Queensland Labor MP, Dr Jim Chalmers whether the winding back of the FOFA protections would give rise to more risk, Littrell said this could not be assumed.

"Not necessarily, for the same reasons that lifting speed limits does not necessarily increase car crashes; it depends on the response of the drivers," he said. "Either they drive more wildly and end up in more crashes or they will get more scared and have fewer crashes."

However while APRA refused to concede that the Government's changes had the potential to generate greater consumer risk, it did acknowledge that the issues around the Commonwealth Bank's handling of the Commonwealth Financial Planning enforceable undertaking had caused it to examine the bank's governance arrangements.

APRA chairman, Wayne Byres told the parliamentary committee that the regulatory had "obviously taken an interest in both the ASIC investigations and the results of the Senate inquiry and what they have said about governance and controls".

"We are reflecting on that; we have spoken to the bank and got its version of events," he said.

Recommended for you

The Reserve Bank of Australia (RBA) has lowered rates to a level not seen since mid-2023.

Financial Services Minister Stephen Jones has shared further details on the second tranche of the Delivering Better Financial Outcomes reforms including modernising best interests duty and reforming Statements of Advice.

The Federal Court has found a company director guilty of operating unregistered managed investment schemes and carrying on a financial services business without holding an AFSL.

The Governance Institute has said ASIC’s governance arrangements are no longer “fit for purpose” in a time when financial markets are quickly innovating and cyber crime becomes a threat.