Reducing the cost of insurance

Recently, the focus has been on saving rather than spending. Clients have realised that the good times don’t last forever, and they now want to ensure they have emergency funds in place if they suffer a major financial event, such as losing their job.

Quite often, insurance is low on a client’s priority list. However, good insurance planning is an essential component of any robust financial plan. This is the case at any stage in an economic cycle, however, it is even more crucial when the job market is tight.

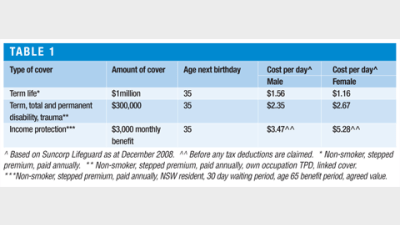

It’s a common misconception that life insurance is expensive. However, most clients are surprised to learn that life insurance is cheaper than they think.

Table 1 shows examples of how affordable life insurance can be:

The reality is that disposable income available to fund premiums may be harder to find these days. Outlined below are a few options to consider when looking to reduce the effective cost of insurance.

Group risk

If the client has access to group rates through their employer or their corporate superannuation plan, this should be one of the first things that planners consider. Not only are the premiums lower than compared to individual cover, the client can insure up to the automatic acceptance limit without an underwriting assessment. Where insurance is held within super, however, there are associated issues that should be considered as part of the decision-making process (see “Insurance within superannuation” below).

Reduce discretionary spending

Another thing most planners will do to address the affordability issue is assess their clients’ cash flow. Quite often clients will be surprised at the amount of money spent on small items such as coffees or bought lunches that could be directed to insurance premiums. Most clients will agree that providing a stable financial future for their family far outweighs the small luxuries bought every day.

Revise level of cover

The sum insured may cover a range of things such as debt, children’s education, superannuation, income to retirement, aged care costs, conversion of the home, medical bills, funeral costs, estate costs and amounts to be distributed via the estate.

The sum insured figure may also take into account the total outgoings of the family based on the number of dependants and length of time that financial support is required. When dependants become financially independent, the sum insured may be reduced. In addition, other amounts included in the total sum insured calculation that may not be critical (such as amounts distributed to the estate) can be reduced or eliminated.

However, the reduced premium should be weighed up against any increased financial exposure if an insurable event occurs.

Revise terms of cover

It is preferable to have some cover with less than ideal terms, rather than none. This could come in the form of a longer waiting period or benefit period for income protection insurance, or a reduced sum insured for term life, total or permanent disablement (TPD) or trauma cover.

Packaging of products

Products such as trauma insurance are comparatively expensive compared to term life, TPD and income protection insurance. In the case of trauma insurance, planners could look at packaging alternative products with or without levels of trauma cover to achieve a similar result.

For example, instead of full trauma cover, the following options could be considered:

- restricted trauma cover such as ‘cancer cover’;

- reduced trauma cover packaged with an income protection policy (with a longer waiting period than usual); or

- income protection with private health insurance.

The end result at the time of claim will be different under each option. Therefore, the reduced premium should be weighed up against the potential increase in exposure compared to having full trauma cover.

Insurance within superannuation

When insurance premiums are funded by either the super balance or contributions, they are effectively paid tax free. This is because most people will either salary sacrifice or make personal deductible contributions into super (if an eligible person, which include self-employed, substantially self-employed, retired or unemployed individuals).

Any contributions tax payable on these contributions is usually offset by the deduction passed on by the super fund (the super fund can claim a deduction on payment of the premiums to the insurance provider). Compare this with paying up to 46.5 per cent on salary to fund insurance outside of super.

Other superannuation strategies can also be utilised, such as the higher income earning spouse salary sacrificing and contribution splitting to a low income earning spouse to fund premiums. Alternatively, the higher income earning spouse can make spouse contributions. Either way, the higher income spouse will reap more tax benefits than the lower income spouse.

However, holding insurance inside super can create issues that will generally occur at the time of claim. These include issues with access to proceeds, tax on payments, timing until proceeds are received, and restricted beneficiary, trustee discretion and product feature issues. We do not deal with these in detail here.

Summary

Insurance is a critical part of any financial plan. It is generally affordable and, in addition, the cost can be minimised by utilising the various strategies discussed above. However, the savings incurred now should be weighed up against any potential issues. These are outlined in table 2.

Rachel Leong is a technical services consultant at Suncorp Life.

| Travel Insurance Quotes |

Recommended for you

The Federal Court has dismissed a conflicted remuneration case brought by ASIC against the director of life insurance distributor Freedom Group, where Bali holidays and Vespa purchases were among sales incentives.

Policy and advocacy specialist Benjamin Marshan has left the Council of Australian Life Insurers after less than a year, having joined in March from the Financial Planning Association of Australia.

The declining volume of risk advisers meant KPMG has found a rising lapse rate for insurance policies arranged by independent financial advisers, particularly in the TPD and death cover space.

The Life Insurance Code of Practice has transferred from the Financial Services Council to the Council of Australian Life Insurers.