Which funds are affected by Saudi Arabia attacks?

An attack on a large Saudi Aramco oil field in Saudi Arabia has caused concerns around global oil supply and a rise in geopolitical tensions with the firm saying the attacks could cut output by more than five million barrels a day.

Saudi Arabia produces 10% of the world’s oil and there is debate over who is responsible for the attack. Saudi Aramco has said the attacks would cut output by 5.7m barrels a day, more than 5% of global crude oil supply.

The price of crude oil fell from US$62.9 last week to $58.3 this week while the price of brent crude fell from $69 to $64.3.

But are any Australian funds affected by the crash?

According to FE Analytics, there are only four funds in Australia which have an allocation to Saudi Arabia. These were the BlackRock iShares Core Global Corporate Bond ETF, BlackRock iShares JP Morgan USD Emerging Market Bond ETF, BlackRock iShares MSCI Emerging Markets ETF and the Robeco Emerging Conservative Equity fund.

Saudi Arabia was only a recent entrant to indices with its addition to the MSCI Emerging Markets index earlier this year. It had previously only been a standalone market due to its restrictions over foreign ownership.

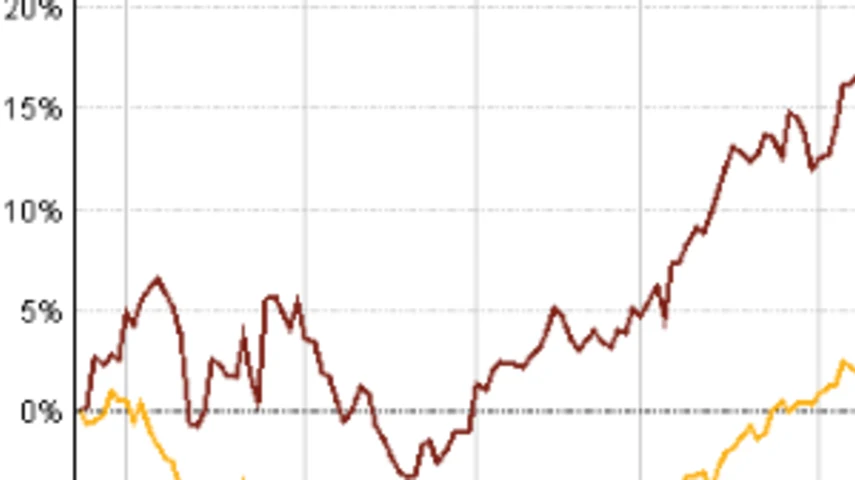

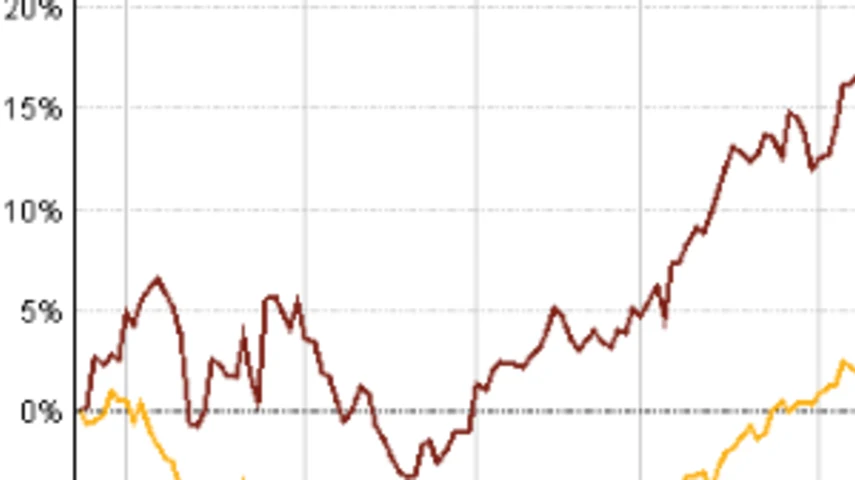

Over one year to 23 September, MSCI Saudi Arabia has returned 13% according to FE Analytics, compared to returns of 7% by the wider MSCI Emerging Markets index.

The largest weighting to Saudi Arabia was found in the BlackRock iShares JP Morgan USD Emerging Market Bond ETF which held 4.2%, its third-largest weighting behind Mexico and Indonesia. The Robeco fund, the only fund which was actively managed by a six-strong management team, held 2.1%.

Robeco portfolio manager Jan Sytze Mosselaar said: “We invest in several stocks in Saudi Arabia, on the back of our factor-based stock selection model that selects low-risk stocks with favourable value and momentum characteristics.

“The stocks we invest in in Saudi Arabia are non-oil related and are in banking, telecom, cement and retail consumption industries. The stocks have a low stock price volatility, a low correlation with the rest of EM and a decent dividend yield. Due to the nature of the business they are in, these stocks were not, or hardly, impacted by the attack on the country’s oil activities.”

Over the past year to 23 September, the best-performing of these four was the BlackRock iShares Core Global Corporate Bond ETF which returned 10.7% according to FE Analytics. This was in contrast to returns of 5.3% by the wider ACS Fixed Interest- Diversified Credit sector.

However, the crash is unlikely to affect Australia, according to AMP’s Shane Oliver, who said oil prices would need to double to present a problem.

Oliver, chief economist at AMP, said: “To be a major problem for global and Australian economic growth, past experience suggests oil prices need to at least double. Right now, we are nowhere near that point with oil prices down from year ago levels.

“Key to watch now will be whether there are more attacks and whether Saudi/US retaliation further escalates the conflict.”

Recommended for you

Nuveen has made its private real estate strategy available to Australian wholesale investors, democratising access to a typically institutional asset class.

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.