Which fixed interest sectors delivered in 2019?

The inflation linked bonds sector was the best performing of the fixed interest sectors for 2019, as all bond sectors saw a strong year despite equities also having strong success.

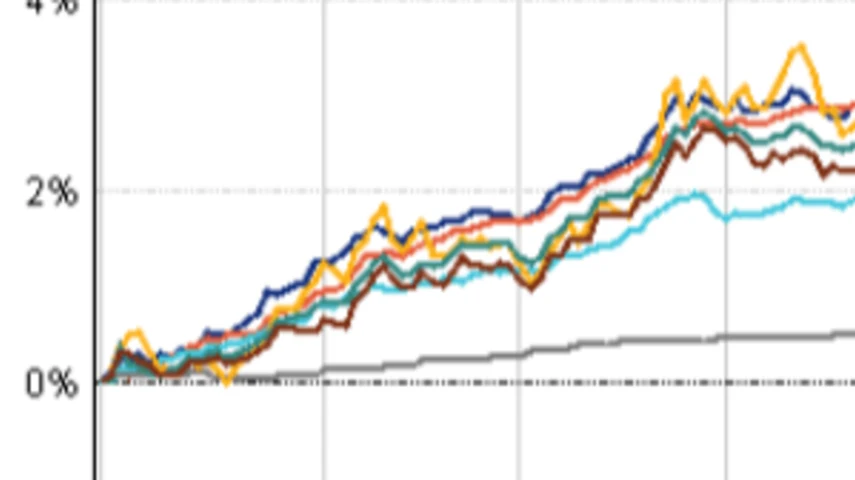

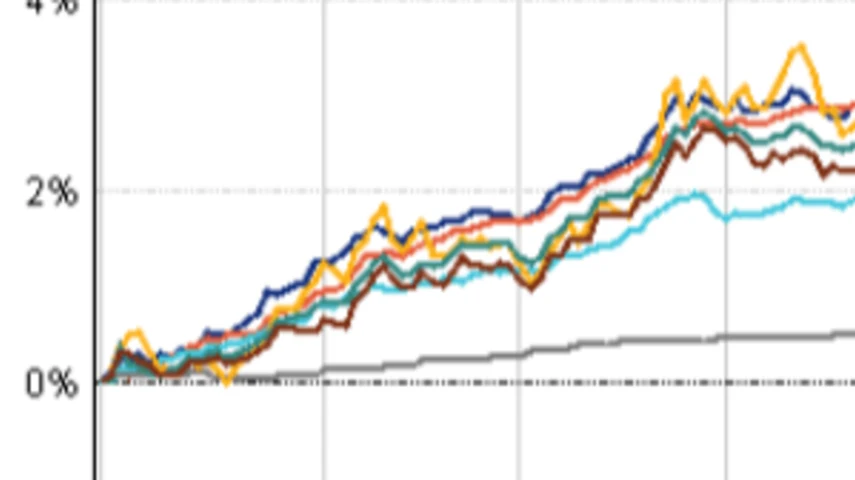

According to FE Analytics, within its Australian Core Strategies universe, inflation linked bonds returned 7.52%, followed by global bonds (7.26%), Australia/global bonds (6.31%), diversified credit (6.18%), Australia bonds (5.79%), global strategic bonds (4.25%) and mortgages (1.72%), over the year to 31 December 2019.

The best performing funds in the inflation linked bonds sector were Ardea Australian Inflation Bond (9.81%), iShares Australian Government Linked Bond (8.41%), Ardea Real Outcome (8.38%), Macquarie Inflation Linked Bond (8.36%) and Vanguard Australian Inflation Linked Bond (8.23%).

The best performing in the mortgages sector were DomaCom DFS Mortgage (8.11%), Trilogy Monthly Income Trust (7.88%), La Trobe 12 Month Term Account (5.26%), Macquarie Debt Market Opportunity no.2 (3.96%) and EQT Wholesale Mortgage Income (3.72%).

In its market commentary, Ardea said the record highs equities finished the year with was in stark contrast to the pessimistic view held for most of the year.

“That same pessimism drove strong returns for bonds as central banks cut interest rates, bond yields collapsed to new record lows in many markets and bonds as an asset class attracted enormous ‘safe haven’ inflows,” it said.

“However, by the beginning of the December quarter bonds lost momentum as economic pessimism turned to optimism, equities rallied strongly, and bond yields began to rise from their lows. While bonds ended the December quarter mixed, they still had a strong year.

“An unusual feature of 2019 was that traditional safe havens and riskier assets both performed well. It is rare and counterintuitive to see both groups perform well at the same time.

Fixed interest sectors performance average over the year to 31 December 2019

Recommended for you

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.

Schroders has appointed a fund manager to its $6.9 billion fixed income team who joins from Macquarie Asset Management.