Which Aussie equity fund was best for the 2010s?

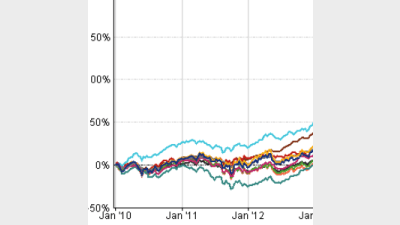

Boutique fund manager Bennelong’s Concentrated Australian Equities was the best performing fund of the decade, returning 265.32%, according to FE Analytics.

This was followed by Cooper Investors (CI) Brunswick (256.68%), DDH Selector Australian Equities (191.46%), Bennelong Australian Equities (181.11%), Macquarie Australian Shares (174.84%), Perpetual Pure Value Share (172.26%), Third Link Growth (165.9%), Macquarie Active Plus Equities (161.1%), Yarra Australian Real Assets Securities (160.98%) and Australian Ethical Australian Shares (160.77%), and the sector average within the Australian Core Strategies universe was 97.49%.

It was a solid decade for the sector as the markets saw strong growth overall after rebounding from the global financial crisis.

When it came to risk-adjusted returns in the sector, CI Brunswick had the best Sharpe ratio (1.22), followed by Bennelong Concentrated Australian Equities (0.75), Perpetual Pure Value Share (0.72), Third Link Growth (0.71) and Australian Ethical Australian Shares (0.68), while the sector average was 0.34.

Bennelong’s Concentrated Australian Equities inception date was 11 months before the decade started – 31 January, 2009 – and it’s total return since inception was 335.81%.

They invested purely in Australian equities, with its current allocation at 99.37%, as of 31 December, 2019.

In their final fact sheet for the decade, Bennelong said the many social, political and economic uncertainties that have overshadowed markets nevertheless remain.

“All up, it’s likely the ASX [Australian Securities Exchange] produces reasonable returns over the medium-term, albeit with ups and downs along the way,” it said.

“As always, there are pockets of risk and opportunity within the market, and that recommends towards a selective approach.”

Best performing Australian Equity funds over the 10 years to 31 December, 2019

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.