Politics doesn’t slow All Ords

While the Federal Budget and the Reserve Bank of Australia’s discussion on interest rates had the potential to impact the Aussie share market, the All Ordinaries Index continued to rise, according to Wealth Within’s chief analyst, Dale Gillham.

Granted the Budget wasn’t exactly controversial, politics tends to cause issues in the market, but according to Gillham, market volatility continued to ease, and was now reaching its lowest levels since October last year.

Gillham said to be wary of changes in the direction of the market though, as this is what tends to happen when volatility starts consolidating sideways for a period of time.

“Given the market did not pull back as far as I expected in the past month, but instead continued to make new highs, this could be a sign of a short-term change in direction,” said Gillham. “If the market continues to rise in the short term, then we will see a larger fall in the second half of the year.”

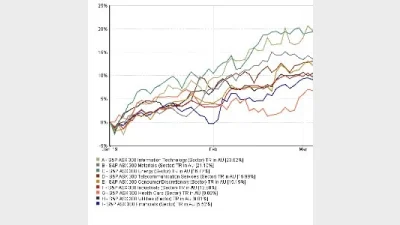

Looking at the sectors, Gillham said the information technology and materials sectors were top performances, while utilities and energy were bottom performers.

Gillham expects the All Ordinaries to either rise up until early May, and then fall in late May or June, or the current rise will stop in the next week and fall in early May.

“Either way, the longer term outlook is bullish for our market,” he said. “The sectors to watch in the second half of this year are Healthcare, Energy and Financials.”

The chart below tracks the performance of the market sectors for the year to date.

Recommended for you

With an ESG product labelling consultation currently ongoing, Zenith’s head of responsible investment agrees the existing system for funds is so unclear that people may be better off ignoring it.

The global investment market is looking to China as a roadmap to success, as the nation pioneers technological development in AI and robotics, Australia-China Relations Institute Professor Marina Yue Zhang has said.

International asset manager Robeco has appointed a new chief investment officer as incumbent Mark van der Kroft departs the firm after 25 years.

Regal Partners has regained the funds under management lost after the Opthea failure to close out the financial year at $18.9 billion.