Perennial sees strong demand for unlisted space

Strong demand from wholesale investors interested in the unlisted space has seen Perennial Value’s pre-IPO Opportunities Fund attract $50 million only weeks after it announced plans for a new Private to Public Opportunities Fund, the firm said.

The new fund, which would close on 16 August, would be an extension of the firm’s Microcap Opportunities Trust which invested primarily in private companies that became public.

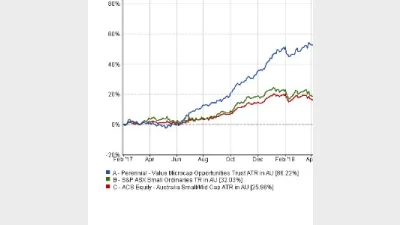

The microcap fund reached the targeted capacity of $200 million and closed, returning 30.4 per cent per annum net of fees since inception.

Perennial’s managing director, John Murray, said: “We’ve been very pleased by the strong demand from wholesale investors for this new fund, in particular high net wealth and family office investors”.

“They recognise there’s a gap in the market for opportunities to invest in early-stage companies requiring growth capital,” he said.

Performance of the Perennial Value Microcap Oppoeruntites Trust since 2017

Recommended for you

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.