MDA operator fined for misleading advertising

Synergy Financial Markets had paid a penalty of $10,800 after the Australian Securities and Investments Commission (ASIC) issued it with an infringement notice for false or misleading statements on its website.

The firm trades equities and derivatives on behalf of its clients through the operation of two managed discretionary accounts.

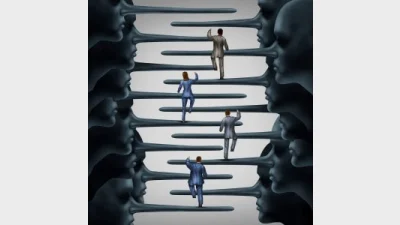

Synergy mentioned several times on its website that investors who invested in its managed discretionary accounts would only pay Synergy “when your account profits”.

ASIC said these statements were misleading because regardless of whether an investment in one of its managed discretionary accounts profits.

Synergy charges investors:

- In one of its managed discretionary accounts an annual management fee of two per cent of an investor’s balance; and

- Brokerage fees and commissions in both of its managed discretionary accounts.

Synergy has removed the statements from its website. The payment of an infringement notice is not an admission of a contravention of the ASIC Act consumer protection provisions. ASIC can issue a notice where it has reasonable grounds to believe the person or firm has contravened certain consumer protection laws.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.