Investors warned to take caution on equity fundraisings

Investors need to watch out among the recent capital raisings as not all of them are attractive opportunities and some businesses could still struggle when the COVID-19 pandemic is over, according to First Sentier Investors.

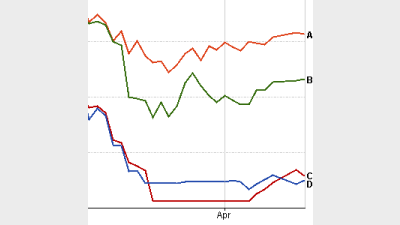

Firms such as Webjet, Flight Centre and Auckland International Airport have sought the tap the market for funds after their businesses were hit by the travel restrictions.

But Dawn Kanelleas, senior portfolio manager for First Sentier’s small and mid-cap strategies, said investors needed to first assess whether the business still had attractive characteristics after it raised the capital.

“These characteristics include not just valuation as a driver, but whether, at the end of this crisis, the business will have sustainable competitive advantages and not be permanently impaired by the COVID-19 crisis. We look to businesses with strong financials once normal business resumes and where we can find them, businesses with predictable and recurring revenue streams.”

She said First Sentier had opted to support Webjet but not Flight Centre as it preferred the online presence of Webjet which it expected would grow in the future, in contrast to the physical store presence of Flight Centre.

Webjet was one of the worst-hit Australian stocks by the crisis with shares down 70% since the start of 2020.

“With Webjet, we saw a medium to long term opportunity to capitalise on the fallout of competitors in the form of traditional travel management companies post-Coronavirus. We believe that the advent of this pandemic will only hasten that shift to online,” Kanelleas said.

“In contrast, the formal announcement by Flight Centre to close more than 50% of leisure shops globally, including more than 40% of Australian leisure outlets, significantly reduces Flight Centre's points of presence as a distributor of tourism inventory. This then enhances the Webjet value proposition for us.”

It also supported Auckland International Airport as it felt there was ‘significant scope’ for the company to generate profitable growth going forward through the deployment of cash.

Share price performance of Flight Centre, Webjet and Auckland International Airport v ASX 200 since start of the year to 15 April, 2020

Recommended for you

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.