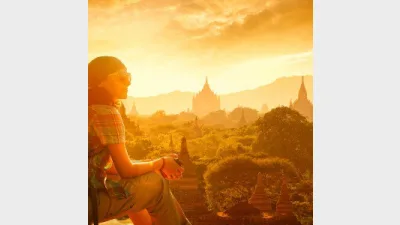

Investors should look to Asia for diversification

Investors can find better growth and diversification opportunities in Asia ex-Japan, than they can in Australia, according to AMP Capital.

Head of Asian equities, Patrick Ho, said some of the 10 countries in the Asia ex-Japan sector were predicting strong gross domestic product (GDP) growth. For example, China expected six per cent GDP growth, while India forecasted seven per cent, while Australia's GDP growth lagged around 3.1 per cent, he said.

"I tend to think earnings will be much higher and that will translate into growth in their [Asian] equity markets," he said.

Investors would have exposure to greater diversification, as in Australia, the top 10 companies accounted for 76 per cent of the index, while in Asia, the top ten firms amounted to 20 per cent of the index.

Also, post-GFC, the Australian index generated 3.2 per cent per annum, while Asia (ex-Japan) yielded 9.1 per cent per annum, he said.

Ho was also excited by China A shares, which allowed Australia investors access to the local Chinese stock market.

The AMP Capital Asian growth fund was buying companies that were benefiting from growing outbound Chinese travel, the growing education market and the growing electric car market, he said.

That growth was not just benefiting China, but the whole Asian region, as more Chinese nationals were also travelling to Korea, for example, to buy make up, have cosmetic surgery and botox.

Recommended for you

Evidentia’s chief investment strategist Nathan Lim has announced his retirement after a 30-year career.

GQG Partners has marked its fifth consecutive month of outflows as its AI concerns lead to fund underperformance but overall funds under management increased to US$166.1 billion.

Apostle Funds Management is actively pursuing further partnerships in Asia and Europe but finding a suitable manager is a “needle in a haystack”.

Managed account provider Trellia Wealth Partners, formed from the merger between Betashares and InvestSense, has appointed its first managing partner.