Infrastructure going green

The upcoming US election is expected to provide an additional boost to ‘green’ infrastructure programs at the time when the sector has already begun incorporating the environmental, social and governance (ESG) principles, according to RARE Infrastructure.

In addition, the sector’s shift towards green was underpinned by a number of global initiatives to reduce carbon emissions which resulted in more local actions supporting the further development of renewable energy and the drive toward greater electrification.

At the same time, the movement towards increased efficiency of infrastructure put a spotlight on the development of electricity storage as well as technology that reduced waste.

The trend towards green infrastructure was further strengthened by the US investors who only recently started to appreciate the role the ESG played and this brought more attention to discussion around the Green New Deal (GND). The deal was proposed package of US legislation that looked to address climate change.

“We are going to start to see quite many conversations around this,” RARE’s senior portfolio manager, Nick Langley, said.

“Meanwhile, significant capital is being spent to mitigate the effects of climate change and adapt networks and infrastructure to cope with more volatile climatic events, such as ice storms and wildfires,” RARE’s senior portfolio manager, Charles Hamieh, said.

“Governments are setting targets for electricity sourced from renewable energy – EU 32% by 2030, California 60% by 2030, Virginia 0% carbon by 2050 – and the Bloomberg New Energy Finance researchers expect 80% of new capacity growth through 2050 will come from renewables.”

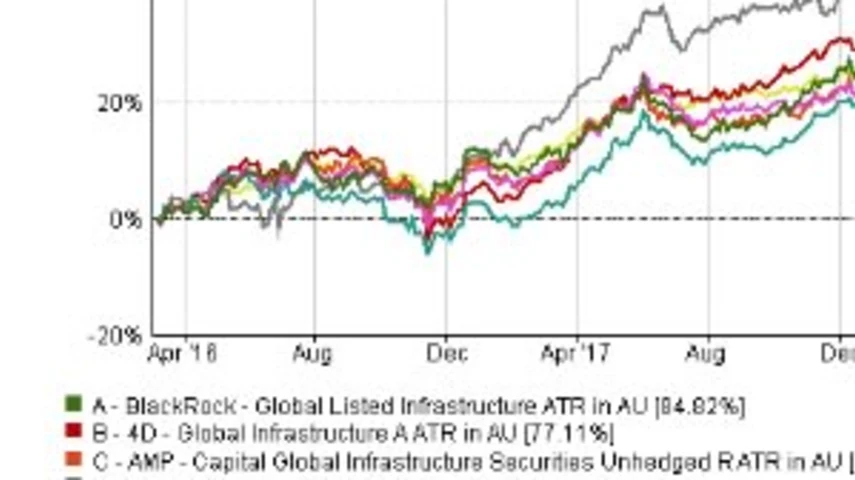

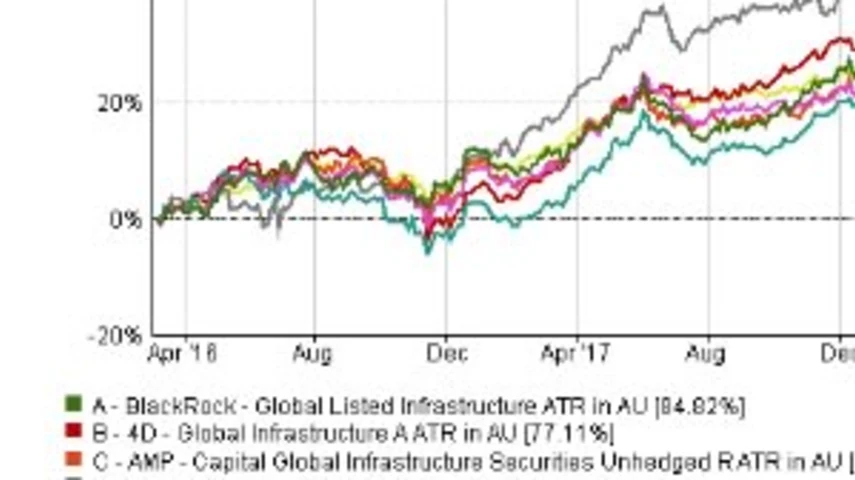

In Australia, according to FE Analytics, the five top performing funds, within the Australian Core Strategies Equity Infrastructure sector, based on the three-year performance to December 2019, were: the 4D Global Infrastructure (16.65%), the BlackRock Global Listed Infrastructure (15.11%), the AMP Capital Global Infrastructure Securities Unhedged (14.60%), Magellan Infrastructure Unhedged (14.49%) and the Lazard Global Listed Infrastructure (13.78%).

The RARE Infrastructure Value Unhedged, sat in the second quartile and over the same time period returned 12.07%. By sector breakdown, the fund was invested in electricity supply (38%), telecom, media and technology and in oil and gas (18%).

Top 5 performing infrastructure funds and RARE infrastructure fund performance v sector over the three years to 31 December 2019

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.