‘Incredible’ gap between small and micro caps stocks

A ‘significant value opportunity’ exists for micro-cap investors as the gap widens between them and small-cap stocks, according to Spheria.

Speaking at the Pinnacle Investment Summit in Sydney, Spheria portfolio manager Marcus Burns said the gap between the two sectors had been getting wider over the last 12 months.

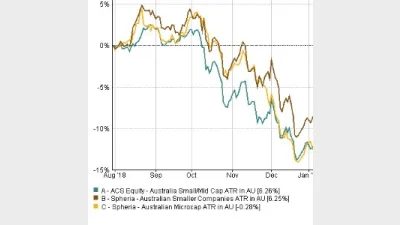

The firm runs both an Australian Smaller Companies fund and an Australian Microcap fund and the smaller companies fund has significantly outperformed its micro-cap equivalent over one year.

The Australian Smaller Companies has returned 6.25 per cent over one year to 31 July, according to FE Analytics, which was in line with the ACS Equity- Australian Small/Mid Cap sector. However, the Australian Microcap fund lost 0.28 per cent.

“There is dramatic underperformance of microcaps, those stocks under $500 million. If you look over 10 years at the performance of micro and small caps then they tend to trend in line with a similar outcome. But over the last 12 months, the gap between them has opened up dramatically and are now trading at a 12-13 per cent discount to small caps,” he said.

In order to take advantage of this opening, Burns said the firm had been rotating away from small caps and into the micro end of the market instead.

“We think this is an incredible opportunity so we have been shifting some of our funds to micro-cap space to take advantage of this underperformance.”

He highlighted stocks such as Libra, Mortgage Choice and City Chic Collective as those which had done well for the firm.

Recommended for you

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.