How did the best boutiques perform in 2019?

The best performing Australian equities fund in 2019 was a boutique, but it was not alone at the top as several others performed well.

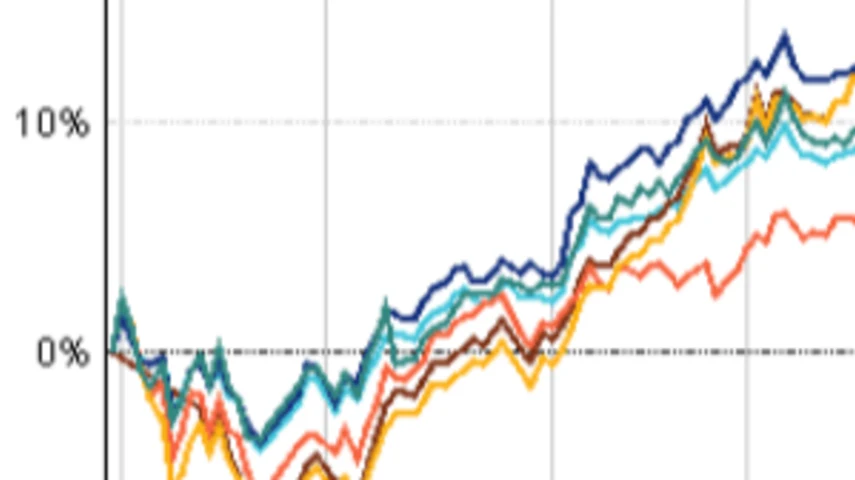

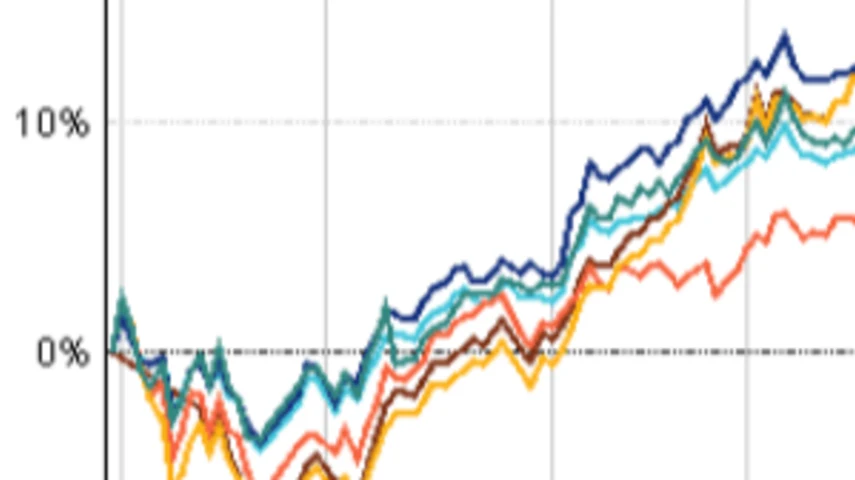

According to FE Analytics, the best performing Australian equity boutique funds within the Australian Core Strategies universe were DDH Selector Australian Equities (35.68%), DDH Selector High Conviction Equity A (33.57%), Bennelong Australian Equities (29.69%), Alphinity Sustainable Share (29.25%) and Hyperion Australian Growth Companies (28.86%), over the year to 30 November 2019.

The Australian equities sector returned 22.96% over the same period.

DDH Selector Australian Equities sector weightings were consumer products (27.29%); telecom, media and technology (20.4%); health care (17.74%); financials (9.94%); basic materials (9.91%); industrials (9.27%); and money market (5.44%), as of December 31, 2019.

Their top holdings were Aristocrat Leisure (5.5%), Altium (5.16%), James Hardie Industries (5.06%), Nanosonics (4.76%) and IOOF Holdings (4.45%).

Bennelong’s sector weightings were consumer products (31.65%), health care (21.63%), basic materials (19.55%), financials (13.18%) and industrials (6.91%).

Their top holdings were CSL (13.29%), BHP (8.09%), Aristocrat Leisure (5.31%), James Hardie Industries (4.99%) and Fisher & Paykel Healthcare (4.82%).

Hyperion’s top holdings were Cochlear Limited (10.66%), REA Group (10.34%), CSL (9.71%), Dominos (8.79%) and Macquarie (7.12%).

In their December quarterly review, Alphinity credited the first phase of the US/China trade deal and improved certainty around Brexit after the Tory election victory as driving the market’s performance at the end of the year.

“This contrasts with the noticeable economic slowdown that took place during 2019, when global manufacturing was effectively in recession,” it said.

Best performing Australian equity boutique funds over the year to 30 November 2019

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.