High volatility delivered high results

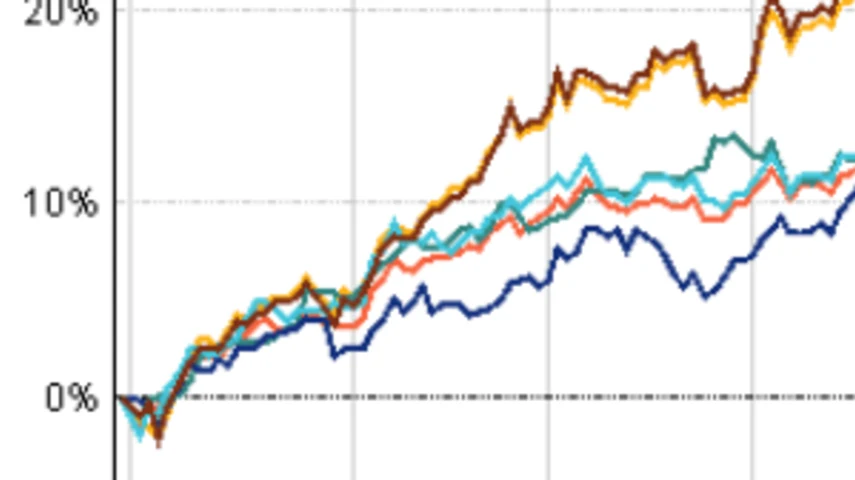

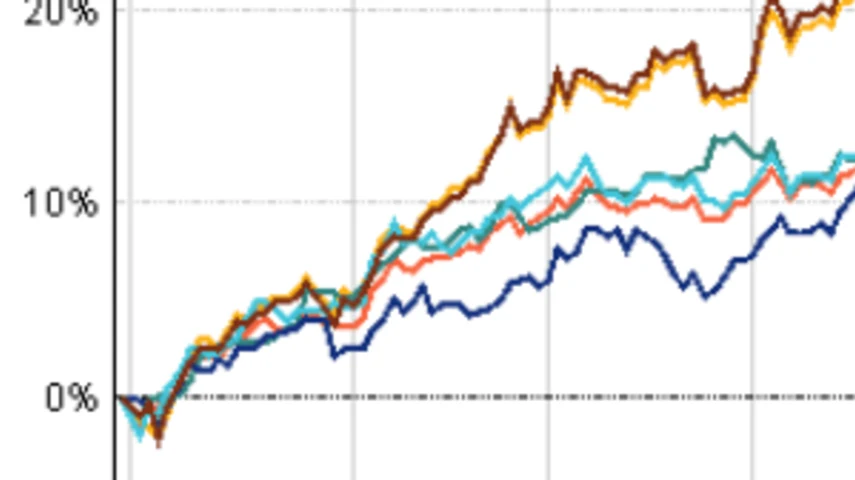

The two best Australian equity funds were the most volatile, while the four most volatile funds delivered returns above the sector average, according to data from FE Analytics.

The top five performing funds within the Australian Core Strategies Universe were DDH Selector High Conviction Equity A, which had a volatility of 13.56, followed by DDH Selector Australian Equities (13.31), Yarra Australian Real Assets Securities (12.8%), Crescent Wealth Australian Equity Retail (12.63) and Lazard Select Australian Equity I (12.41), over the year to 31 December, 2019.

The DDH Australian Equities fund returned 39.21%, followed by the DDH High Conviction fund (35.32%), Crescent (28.55%), Yarra (26.25%) and Lazard (12.43%).

The Australian equities sector returned 22.67% with a volatility of 8.64.

When it came to the least volatile, Pentalpha Income For Life Ordinary had the lowest volatility at 5.25.

This was followed by Australian Ethical Australian Shares Wholesale (6.43), CFS FirstChoice Wholesale Lower Volatility Australian Share (6.74), CFS Milliman Mgd Risk Australian Share A (6.76) and APSEC Atlantic Pacific Australian Equity (6.89).

In terms of returns, Australian Ethical was the best performer of the five least volatile (28.6%), followed by CFS FirstChoice (17.55%), CFS Milliman (14.75%), Pentalpha (4.75%) and APSEC (-1.16%).

Performance of the five most volatile Australian equity funds v sector over the year to 31 December 2019

Recommended for you

Perpetual has appointed a new CEO for affiliate J O Hambro Capital Management, as it tries to stem outflows and refresh the brand.

Outflows of US$1.4 billion from its US equity funds have contributed to GQG Partners reporting its highest monthly outflows for 2025 in August.

Domestic equity managers are lagging the ASX 200 in the first half of the year, according to S&P, with almost three-quarters of Australian equity funds underperforming over the six-month period.

ETFs saw almost $5 billion of inflows during August, with international equities gaining double those of fixed income funds, as total assets close in on $300 billion.