Gold an attractive alternative during uncertainty

Gold exchange-traded funds (ETFs) have given investors a reliable short-term defensive alternative as investors can buy into the value of gold, while taking advantage of the liquidity ETFs offer.

David Bassanese, chief economist for BetaShares, said gold has been a safe haven asset in recent months.

“The change in the US Fed policy bias and the declining of US rates has been supportive of gold,” Bassanese said.

“When interest rates in the US decline, risk in equity markets are high, so it’s been a good environment to move into gold.”

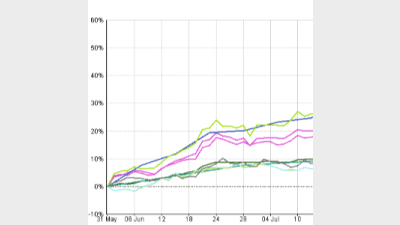

In the last three months to 31 August, 2019, Global Gold Miners ETF and BetaShares Gold Bullion ETF returned 41.14% and 17.38% respectively.

Source: FE Analytics

However, over the longer-term they didn’t provide the same returns, which suggested they were better served in short-term environments as opposed to being a long-term strategy.

“Gold doesn’t offer any yield itself and as a long-term performer it’s going to underperform compared risk assets like equities,” Bassanese said.

“You don’t want a large exposure, you want something around only 5-10%, particularly in an environment where the yield on bonds is pretty low.”

Those same two funds had returned 8.61% and 11.13% respectively over the last three years to the end of August 2019.

This performed significantly lower than their own Australian Resources Sector ETF which delivered 67.71% in the same time period.

Kanish Chugh, ETF Securities co-head of sales, said the advantage of having an ETF for gold was that liquidity made it easier to trade, allowing investors to take advantage of those short-term gains.

“Having a gold ETF means all the storage and insurance aspect of holding gold is taken care of by the ETF provider,” Chugh said.

Chugh said in terms of flows into their Physical Gold ETF, it was the highest inflows across all ETFs for the month of August at $114 million and had hit $1 billion in total assets under management for the first time.

“The next closest in terms of an ETF was an Australian fixed income product with $70.5 million, so you can see investors are sitting there uncertain about what’s going to happen and want insurance in their portfolio,” Chugh said.

“Whether that be China trade tensions, negative yields, or central banks cutting rates, gold is supposed to sit there and protect the portfolio.”

Bassanese said you could buy physical gold bullions and hold it yourself, but through the ASX you could easily buy exposure to a physically backed ETF.

“We have an ETF that invests in gold bullion bars stored in a London bank vault, so we effectively buy the gold bullion on your behalf,” Bassanese said.

Three-years to 31 August 2019 performance of gold funds vs resources sector

Source: FE Analytics

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.