Don’t base investments on tax warns DNR Capital

Investors were avoiding exposure to stocks with franking in the run-up to the election, with DNR Capital warning they should not base investment decisions solely on tax.

According to DNR Capital’s Australian Equities Income portfolio manager Scott Kelly, a group of investors were reducing exposure to stocks with franking ahead of a potential change in government as Labor candidate Bill Shorten had spoken about removing franking credits.

Additionally, this market uncertainty around the election led to investors keeping cash on the sidelines.

“This cash can be now invested with more confidence. However, we caution that business fundamentals should be the primary focus and investors should not base investment decisions solely on tax which is why we are underweight the banks, and recently exited our positions in Telstra and Woolworths,” he said.

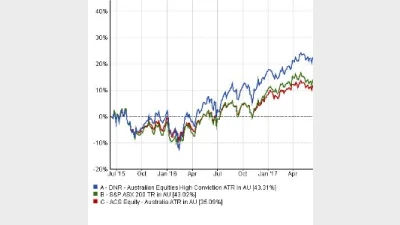

As far as alternative stock exposure was concerned, retirees should more favourably consider Australian equity income strategies with a focus on growing income with after-tax benefits as an attractive alternative, particularly given that alternative investments at a time when the Reserve Bank of Australia (RBA) cut rates to one per cent, Kelly said.

“The DNR Capital Australian Equities Income Portfolio holds a number of stocks that offer a combination of attractive dividend yields, growth, franking benefits and importantly, valuation support. These include: Tabcorp, Suncorp, Flight Centre, IPH and Super Retail,” he said.

Recommended for you

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.