Bell AM hits three-year milestone

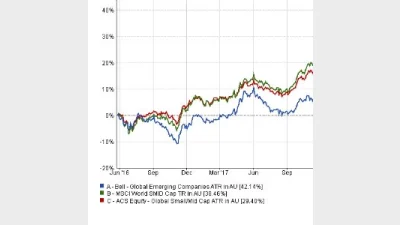

Bell Asset Management has announced it has hit a key milestone with its Global Small and Mid-Cap offering, Bell Global Emerging Companies Fund, reaching a three-year track record.

The fund invested in a diversified portfolio of 35-55 global small and mid-cap companies across different geographies, including North America, Europe and Asia.

Commenting on the milestone, Bell’s chief investment officer, Ned Bell, said: “Bell Asset Management has been researching and investing in global small and mid-cap (SMID) stocks since 2003 and over this time, we have developed a comprehensive and in-depth understanding of the SMID Cap landscape.

“Since launching the Bell Global Emerging Companies Fund in June 2016, we have outperformed the MSCI World SMID Cap benchmark, highlighting our depth of knowledge in this area and our robustness and ability to perform well in periods of heightened volatility.”

According to Bell, global SMID stocks also had less valuation risk than large cap growth stocks, less absolute risk than emerging markets and less liquidity risk than small caps.

Recommended for you

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.