Active and passive funds that beat their peers

In the crowded space of Australian equities, there is a number of active funds that have managed to outperform those having an index-tracking approach over the 11 month-period ending in May, 2017 according to Money Management’s analysis based on FE Analytics’ data.

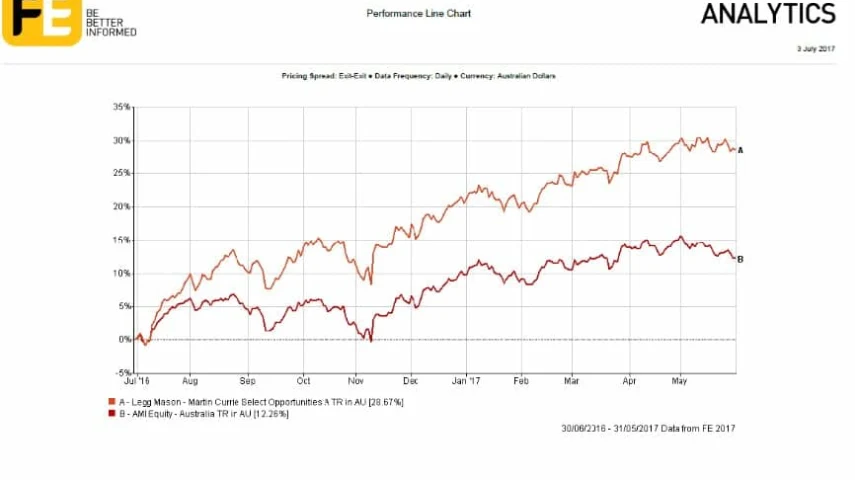

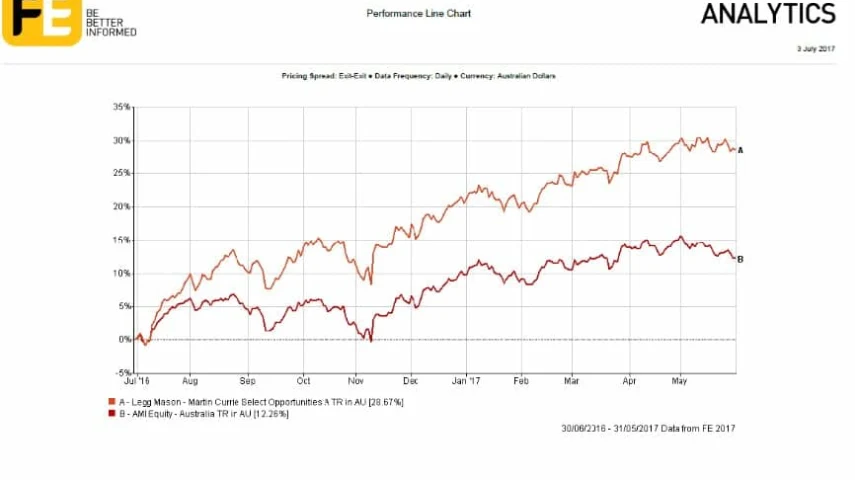

FE Analytics, which analysed the best performing funds investing the majority of their assets in Australian equities and not focused on a specific industry sector, found that between 30 June, 2016 and 31 May, 2017, Legg Mason Martin Currie Select Opportunities Fund topped the AMI Equity Australia sector’s performance table, with its 28.67 per cent total return, net of fees, distributions reinvested.

At the same time, when reviewing some of the top performing index-tracking funds, BetaShares – FTSE Rafi Australia 200 ETF (25.33 per cent) was the only fund sitting in the sector’s top quartile. The remaining four passive funds, out of five best performers, were in the second quartile and still managed to beat the peer group average with lower annual fees than their active rivals.

On the other hand, according to FE Analytics data, all the six top performing active funds found themselves in the top quartile.

Apart from Legg Mason’s Martin Currie Select Opportunities Fund, the remaining top five active Aussie equities funds were:

- PM Australian Companies (27.04 per cent)

- L1 Capital Australian Equities Wholesale (24.83 per cent)

- Dimensional Australian Value Trust (23.84 per cent)

- Lazard Select Australian Equity (22.47 per cent)

- Nikko AM Australian Share Wholesale (22.22 per cent)

The data also showed that the average fund in the AMI Equity Australia sector was making 12.26 per cent over that time period.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.