When advice-only trumps vertical integration

Being an “advice-only” business can pay dividends and may be the answer in a post-Royal Commission world, if the experience of Crestone Wealth Management is any measure.

Crestone, a wholesale-focused advice business boasting 75 advisers and $15 billion in assets under advice, celebrates its second anniversary this month after acquiring the UBS Wealth Management business in 2016 but maintaining significant links with the Swiss-based global asset manager.

Discussing the company’s first two years in operation in the context of the current Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, Crestone chief executive Mike Chisholm said he believed the right decisions about structure and intent were made two years ago.

A part of that structure was being “advice only” and encouraging equity ownership on the part of its investment advisers on the basis that that, in turn, would help deepen and lengthen their client relationships.

“How does the Royal Commission impact us? I like to go back two years ago and reflect on how we set up the business,” he said. “We thought long and hard about what were the factors which would set the tone.”

He said the first factor had been scale and that while wealth management businesses needed to have the right scale it was a case of being neither too big nor too small.

“Scale means we can partner up with best of breed service providers such as Avoloq and strategic partnerships with UBS, Credit Suisse and Northern Trust and CommBank for our cash products,” Chisholm said. “Having scale meant that we could attract best of breed service providers.”

“Another benefit [of scale] is ability to identify best of breed products for clients – our business is focused on high net worth and ultra-high net worth clients and identifying opportunities is important,” he said. “You need scale to access those opportunities.”

Chisholm cited being an advice-only business as being the second key factor, and that this had been validated by recent events before the Royal Commission.

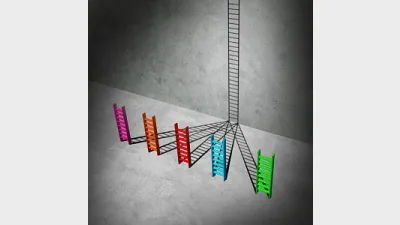

“A lot of discussion in the Royal Commission has centred around vertical integration and we made a very clear decision when setting this business up to ensure we were not vertically-aligned,” he said. “We ensured we could sit on the client’s side of the table and look at all the opportunities – something which would be very challenging in a vertically-integrated business.”

Chisholm said the third factor was focusing on long-term alignment with clients, and in the case of Crestone this had meant its owner/operated model.

“We think it’s very important for advisers to be shareholders in the business so we can have very long-term relationships with our clients. Any interaction with our clients has that front and centre – a long-term relationship business.”

While Crestone has a HNW/wholesale focus, Chisholm said it was nonetheless very strongly supportive of professionalising the advice industry and lifting education standards – something he believed would increase the reputation and level of trust in the industry.

“… we are a wholesale-only business so, strictly speaking, the qualification requirements are not a mandatory prerequisite for us, but we will voluntary meet that and we think we are mostly there already,” he said.

Chisholm said that while structure and the advice-only focus had been important to Crestone’s success, so too had been its technology underpinnings and he paid credit to another Swiss-based firm, Avaloq, for having provided the necessary underpinning.

“It was critical we had an IT platform that could deliver a full range of service and we couldn’t be happier that we landed with Avaloq,” he said. “It is best of breed and allows us to advise on and support a full range of products.”

Recommended for you

The RBA has handed down its much-anticipated rate decision, following widespread expectations of a close call.

Two national advice businesses have merged to form a leading holistic advice business with $2.5 billion in funds under management.

Insignia Financial has completed its transition of a range of administration and technology functions to SS&C Technologies as it seeks to be a leading wealth manager by 2030.

ASIC has permanently banned a financial adviser after he allegedly concealed information from clients and misused client funds, among other breaches.