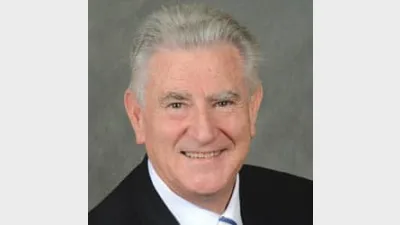

Synchron’s Trapnell clarifies new role

Director of risk-focused dealer group Synchron, Don Trapnell, said he and fellow co-director John Prosser weren’t retiring, nor will the company be up for sale, as the organisation clarifies what their executive re-structuring means for the future of the company.

It was previously announced Trapnell had stepped back the day-to-day running of the business, with former CommInsure head of distribution, Ian Knight, taking over.

“Everyone thinks we’re ready to retire, but the reality is John and I have been at the helm for 20-plus years and we’ve enjoyed our time,” Trapnell said.

“John and I are proud of Synchron and its achievements, and we’ll be handing over the reins in an orderly and timely fashion designed to retain the Synchron culture.

“We believe it’s appropriate to retain our culture and hand over the reins in a timely fashion that we call ‘programmed obsolescence’.”

Synchron currently had 534 advisers in its dealer group and had produced revenue of over $94 million in 2019.

“We needed to take more of a helicopter view of Synchron than we have in the past, we’ve been tied up with the day-to-day and now we have to senior executives able to do that,” Trapnell said.

Michael Jones, previously head of compliance, had also been promoted to general manager, legal and compliance; and Alison Massey, previously practice development manager, had been promoted to head of compliance – advice assurance.

Recommended for you

With an advice M&A deal taking around six months to enact, two experts have shared their tips on how buyers and sellers can avoid “deal fatigue” and prevent potential deals from collapsing.

Several financial advisers have been shortlisted in the ninth annual Women in Finance Awards 2025, to be held on 14 November.

Digital advice tools are on the rise, but licensees will need to ensure they still meet adviser obligations or potentially risk a class action if clients lose money from a rogue algorithm.

Shaw and Partners has merged with Sydney wealth manager Kennedy Partners Wealth, while Ord Minnett has hired a private wealth adviser from Morgan Stanley.