Synchron heartened by FSI vertical integration scrutiny

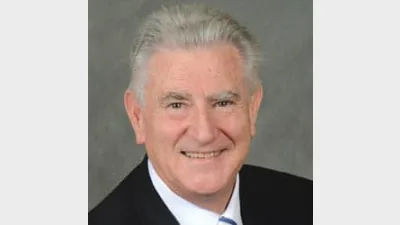

The Financial System Inquiry’s (FSI’s) call for clarity on potential vertical integration conflicts could see moves towards parent-company transparency in the aligned advice space, Synchron director Don Trapnell hopes.

A vocal advocate of vertical integration exposure, Trapnell said the interim report’s acknowledgement of vertical integration and calls for submissions is heartening, given the lack of awareness about the relationship between advisers and the products they endorse from many consumers.

Trapnell believes institutionally-aligned advisers should be declare their links to their parent organisation, so that the consumer can make an informed decision about the product the adviser puts forward.

“As we have always said, it is in the best interests of consumers to ensure that they are fully aware of all the relationships that exist between their advisers and the products their advisers recommend, and how those relationships have the potential to impact on the advice they are given,” he said.

“In fact, we believe it is essential, given the adviser’s obligations under the Best Interests Duty provisions of the Future of Financial Advice legislation.”

Recommended for you

ASIC has released the results of the latest financial adviser exam, held in November 2025.

Winners have been announced for this year's ifa Excellence Awards, hosted by Money Management's sister brand ifa.

Adviser exits have reported their biggest loss since June this week, according to Padua Wealth Data, kicking off what is set to be a difficult December for the industry.

Financial advisers often find themselves taking on the dual role of adviser and business owner but a managing director has suggested this leads only to subpar outcomes.