Super funds heavily reliant on general advice

General advice dominates what superannuation funds are providing to their members, according to the Australian Securities and Investments Commission’s (ASIC’s) review of financial advice provided by superannuation funds.

The methodology utilised by ASIC to survey the superannuation funds has revealed a lot about what the regulator found but also about the intentions of the superannuation funds as they move further into the advice space, with a heavy focus on robo-advice.

The ASIC methodology found that across all funds, general advice made up 75% of advice accessed by members and that the most popular advice topics sought by members were member investment choice, contributions and retirement planning.

It also found that across all funds that offer advice services to members, the most common delivery channels for providing advice to members were in-house call centres (37%) and advice providers employed by a related party (26%).

ASIC also noted that, across all funds, the key identified conflicts of interest were vertical integration, relationships with third-party advice providers, and bonuses paid to advice providers.

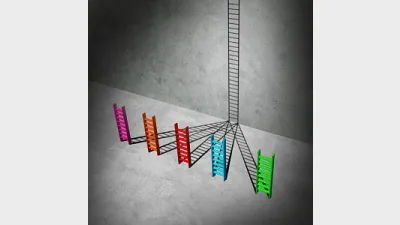

It also found that 61% of funds intended to increase their use of member self-directed digital advice that can generate Statements of Advice (SOAs).

Looking at advice delivery, the ASIC research also revealed that:

- 49% of general advice was provided by in-house call centres;

- 30% of intra-fund advice was provided by member-directed digital advice tools that generate SOAs; and

- 72% of comprehensive advice was provided by advice providers employed by a related party.

Recommended for you

Despite the year almost at an end, advisers have been considerably active in licensee switching this week while the profession has reported a slight uptick in numbers.

AMP has agreed in principle to settle an advice and insurance class action that commenced in 2020 related to historic commission payment activity.

BT has kicked off its second annual Career Pathways Program in partnership with Striver, almost doubling its intake from the inaugural program last year.

Kaplan has launched a six-week intensive program to start in January, targeting advisers who are unlikely to meet the education deadline but intend to return to the profession once they do.