Online advice to solve affordability issue

A new online advice platform has been launched into the market offering financial plans for as little as $199, targeting the four out of five Australians who are priced out of the advice market.

The platform, MOVO, was launched by financial services firm Financial Index Wealth Accountants and is targetting lower-to-middle socio-economic class consumers.

The basic $199 service would include an individually tailored financial advice report and email access to the financial adviser for the life of the advice report. There are two other upgraded services, with the most expensive plan costing $349.

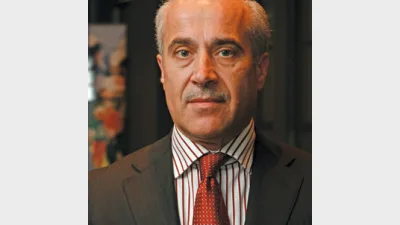

Company chief executive officer Spiro Paule said the platform is able to offer a low-cost service due to reduced overheads and other efficiencies of the online world.

He said it achieved one of the key objectives of the Future of Financial Advice (FOFA) reforms — increasing access to financial planning services by offering lower cost advice.

"We're targeting the segment of the market that has been totally overlooked until now — young families struggling to build up their savings and accumulate wealth, would-be entrepreneurs trying to get their businesses off the ground and people trying to make their way in an increasingly complex financial world but doing it in an ad hoc and often haphazard way," Paule said.

A report published by the Australian Securities and Investments Commission in 2010 found an average financial plan costs between $2500 and $3500, with the regulator expressing concern that many consumers would not be able to access advice services.

Paule said the online service would not ‘devalue' financial planning in the long term, as the one fifth of Australians currently using financial advisers are unlikely to change their habits.

Furthermore, the new service would not compete with traditional financial planning services, including that of Financial Index itself, which targets high-net-worth investors, Paule said.

"We're not targeting Australians currently using advisers and who, from our understanding of this market segment, are unlikely to change their habits and go online," Paule said.

"We're targeting the Australians who never get to see a financial planner — the four fifths of Australians who are currently priced out of the market."

Financial Index is also offering its MOVO service with a ‘white label' capability to adjacent financial service providers and other companies, and has announced the rollout of online accounting, lending and self-managed super fund solutions.

Recommended for you

Equity offerings should be “seriously considered” by advice firms if they want to attract experienced advisers with the option viewed as a major differentiator for candidates seeking their next role.

DASH Technology Group has enacted two internal promotions, appointing a chief risk officer and chief commercial officer to strengthen the firm’s governance and operational capabilities.

The Stockbrokers and Investment Advisers Association has announced the appointment of its new chief executive following the exit of Judith Fox after six years.

Insignia Financial has appointed an experienced financial advice leader as head of education and advice on its Master Trust business, who joins from Ignition Advice,