Did ASIC quietly raise the adviser levy?

The Australian Securities and Investments Commission (ASIC) has increased the per adviser levy imposed on licensees without formal notice or fanfare, according to the Financial Planning Association (FPA).

The FPA’s head of policy and standards, Ben Marshan has used social media to point out the per adviser levy rise which he said had been lifted from $907 to $1,142.

In doing so, Marshan provided a link to the relevant page on the ASIC website which confirmed licensees that provide personal advice to retail clients on relevant financial products would pay a “minimum levy of $1,500 plus $1,142 per adviser”.

Marshan said he believed financial planners and licensees needed to be aware of the changes for budgeting purposes.

Recommended for you

As the end of the year approaches, two listed advice licensees have seen significant year-on-year improvement in their share price with only one firm reporting a loss since the start of 2025.

Having departed Magellan after more than 18 years, its former head of investment Gerald Stack has been appointed as chief executive of MFF Group.

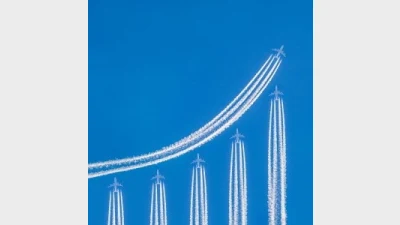

With scalability becoming increasingly important for advice firms, a specialist consultant says organisational structure and strategic planning can be the biggest hurdles for those chasing growth.

Praemium is to acquire an advanced technology firm for $7.5 million, helping to boost its strategy to be a leader in AI-powered wealth management.