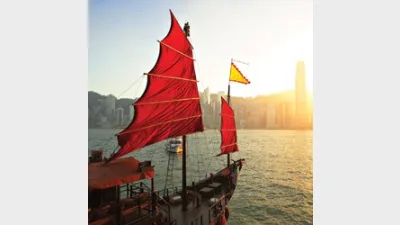

Aussie advice model paying dividends in Hong Kong

Hong Kong-based private wealth management company Harris Fraser Group is using the Australian retail advice model to poach high-net-wealth clients from private bankers.

Harris Fraser Group is a family office business that caters to the needs of mass affluent clients: from managing their equities portfolios to chartering private jets, according to head of private wealth management Marc Geary.

"My smallest 'client' would be $250,000, while the largest client over in Hong Kong is worth $1.7 billion," Geary said.

Hong Kong is lagging behind Australia and the UK when it comes to transparency and regulatory oversight, according to Geary.

"There are no SOAs [statements of advice] in Hong Kong. You don't have to disclose the commission structure of the products that all the private bankers are selling," he said.

"But we do that, and we're winning business left, right and centre purely by taking portfolios from bankers," Geary added.

By incorporating the Australian advice model into Hong Kong, Harris Fraser has become "public enemy number one in the private banking arena", he said.

"We're doing 30, 40 or 50 hours of strategy advice for a $100 million client. A private banker's doing five hours of a marketing pitch on PowerPoint. There's no way we lose that deal," Geary said.

Geary spends half of his time in Hong Kong and the other half in Australia catering for local clients.

The Australian side of the business has four advisers and is growing at the rate of one adviser a year, he added.

Recommended for you

Greater consistency across the ASIC adviser exam has helped boost the number of first-time candidates this year with many opting to sit before undertaking a Professional Year.

Financial advice practice Eureka Whittaker Macnaught is in the process of acquiring three firms to boost its annual revenue to $25 million.

AMP has partnered with Dimensional Fund Advisors and SouthPeak IM to launch a suite of investment solutions aimed at expanding retail access to traditionally institutional funds.

The Financial Advice Association Australia has appealed to licensees to urgently update their FAR records as hundreds of advisers are set to depart by the end of the year.