Asia knocking for financial and super sector

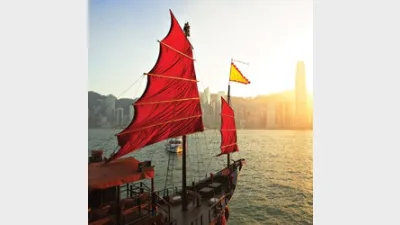

The time is ripe for Australian superannuation funds and the financial services sector to start looking towards Asia and playing in this region according to a business strategist.

Growthcurv managing director Pamela Young told the 2014 Association of Superannuation Funds of Australia conference in Melbourne many countries in Asia like China, Singapore and Malaysia are hungry for imported financial services from Australia.

But despite a growing Asian population, Australia's response to this demographic has been incredibly slow because it does not have multicultural skills due to its isolated location and its mentality that the English language is all it needs.

"You've got a really big challenge because you're looking after the super funds, you're looking after this ageing population, you're looking after the young people now who are preparing for the future," Young said.

"They're looking to for the answer. But when we live in a multicultural society we have to have an answer that suits all cultures."

This includes developing insights and differentiating between the needs of people from different Asian countries like China, Japan, Indonesia and Malaysia.

Super funds and the financial services industry must overcome the physical and cultural gap between themselves and Asia, and they must customise their services to meet this demographic's needs, Young said.

They must also build cross cultural and Asian capabilities in their staff make-up to keep up with the growing Asian population in Australia.

"Super funds have to have answers for all cultures and both genders," she said.

Recommended for you

Despite the year almost at an end, advisers have been considerably active in licensee switching this week while the profession has reported a slight uptick in numbers.

AMP has agreed in principle to settle an advice and insurance class action that commenced in 2020 related to historic commission payment activity.

BT has kicked off its second annual Career Pathways Program in partnership with Striver, almost doubling its intake from the inaugural program last year.

Kaplan has launched a six-week intensive program to start in January, targeting advisers who are unlikely to meet the education deadline but intend to return to the profession once they do.