AMP signals advice is no longer a numbers game

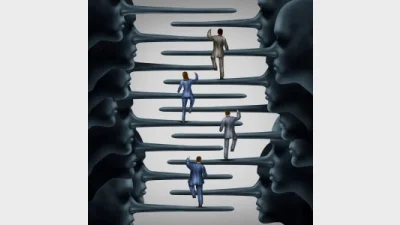

AMP Limited has signalled key elements of the strategy for its financial advice network, revealing to investors that it is no longer a numbers game where advisers are concerned.

According to the briefing provided to investors, AMP intends shifting the emphasis away from adviser numbers to “productivity, professionalism and compliance”.

In doing so, the company noted that the number of advisers in core licensees had declined by 4.6 per cent last year, largely due to exists from the industry including retirements.

To a large extent the picture painted by AMP for the future of its advice network appears to reflect the realities being driven home by the Financial Adviser Standards and Ethics Authority (FASEA) regime and the more recent announcement by the Government of an end to grandfathered commissions in 2012.

In a chart depicting the current shape of its advice network in Australia, AMP revealed that the total number of so-called “core licensees” had declined to 2,567 as at December, last year, compared to 2,692 with the greatest decline being amongst AMP Financial Planning advisers – down to 1,334 in 2018 from 1,437 a year before.

The AMP explanation to investors has come at the same time as some AMP advisers press their representatives for greater clarity around Buyer of Last Resort (BOLR) arrangements, with some demanding pre-Royal Commission valuations.

Recommended for you

Despite the year almost at an end, advisers have been considerably active in licensee switching this week while the profession has reported a slight uptick in numbers.

AMP has agreed in principle to settle an advice and insurance class action that commenced in 2020 related to historic commission payment activity.

BT has kicked off its second annual Career Pathways Program in partnership with Striver, almost doubling its intake from the inaugural program last year.

Kaplan has launched a six-week intensive program to start in January, targeting advisers who are unlikely to meet the education deadline but intend to return to the profession once they do.