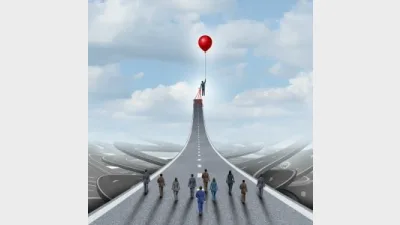

Advisers ‘overwhelmingly positive’ about future

Majority of advisers polled at the Association of Financial Advisers (AFA) National Practitioner Roadshow voted themselves "overwhelmingly happy", while citing their interest in embracing peer-learning to help other advisers succeed.

A total of 93 per cent of the 1,600 advisers said they felt optimistic about their future in the industry, with Roadshow specialist speaker, Paul Kearney, encouraging attendees to adapt to marketplace shifts.

The major shifts in the advice landscape afoot, attending advisers were also quizzed on the future of the industry as a whole, with 59 per cent voting that political and legislative shifts had the greatest direct impact on the delivery of their work, ahead of technological shifts (22 per cent) and societal shifts (six per cent).

A further 84.7 per cent agreed that they would have to let go of certain beliefs, habits, and bias to move forward in the industry, with 31.6 per cent of advisers stating that additional money in their business would be spent on customer-centric technology enhancements.

"What was evident in our live poll, is that advisers need to invest in themselves to adapt," AFA general manager of member services, Nick Hakes, said.

"Advisers need to... collobrate with their peers and to cultivate a culture where they can gain fresh perspectives."

Recommended for you

ASIC has released the results of the latest financial adviser exam, held in November 2025.

Winners have been announced for this year's ifa Excellence Awards, hosted by Money Management's sister brand ifa.

Adviser exits have reported their biggest loss since June this week, according to Padua Wealth Data, kicking off what is set to be a difficult December for the industry.

Financial advisers often find themselves taking on the dual role of adviser and business owner but a managing director has suggested this leads only to subpar outcomes.