While small and microcap companies are more vulnerable to volatility and economic conditions, this also creates opportunities. Here, a manager discusses how and where they find value.

Since August 2021, when central banks started a rate rising cycle in response to higher inflation, the share prices of small and micro caps have been disproportionately punished compared to their larger peers.

The reason is that they are more intrinsically linked to the economic cycle, due to lower pricing power and more difficulty accessing debt.

However, James Nguyen, portfolio manager at Tyndall AM, says this is exactly what creates opportunity.

“You can buy quality businesses that get sold off because of market perception,” he explains.

“And while I would agree that in aggregate, small caps are riskier than their larger cap counterparts, you can find great businesses that are growing very quickly, generate strong free cash flow and are self-funding.”

Or, to look at it another way, the large caps of tomorrow are the small caps of today.

Where is the value?

Nguyen says what’s catching his interest at the moment in particular is in micro caps (ASX 300 and beyond).

“That’s where I see the biggest mispricing – quality companies that have been punished due to perceived risks around not just pricing power and access to debt, but also because they are often linked to a single product or service and are therefore less diversified,” he says.

However, they can still be well-run businesses offering structural growth opportunities.

One example is Smart Pay (ASX SMP), a payments provider that has 18,000 terminals across Australia and which charges fees to the customer rather than the merchant. They also have plenty of potential for expansion of this business model, by converting the 30,000 terminals they have in New Zealand to the higher revenue Australian model. They have double-digit bottom- and top-line growth, are highly cashflow positive, self-funding and have no debt.

“The opportunity for them is absolutely huge. And the CEO is one of the most impressive individuals, who we’re confident will be able to convert the majority of those terminals,” Nguyen says.

“The share price is down 30 per cent this year because the market just sees them as being highly correlated to the economy, rather than focusing on their structural growth potential. Despite a weak consumer, they’ve been able to take share off the banks.”

As for sectors, he says they are overweight financials and industrials and underweight consumer discretionary and resources.

“We’re underweight consumer discretionary because we think a lot of the consumer names are still over-earning from the pandemic, and they’re still trading on multiples above historic averages,” he says.

“Where we are getting our exposure to the consumer is through financials, like Smart Pay and Zip. We believe that there is medium and longer-term structural growth to these businesses, so that’s why we prefer them as a consumer discretionary exposure.”

The reason Tyndall is underweight resources is that they are fundamental investors, and many smaller companies in that sector are not yet producing, so have negative free cash flow. An area where they do see value however is copper, due to the role it will play in electrification and decarbonisation. This means there is a supply and demand dynamic that will support higher long-term prices.

“We’re underweight resources, but overweight the commodity we like,” Nguyen says.

One stock pick here is Capstone Copper (ASX: CSC), which is a large producer with operations in the US and Chile.

Understanding the risks

Of course, small caps are often perceived as risky due to the factors mentioned earlier: access to debt, pricing power and less diversification. However, Nguyen says that reducing risk is about finding a skilled manager who can dig deeper and use a ‘quality overlay’.

He explains there are many ways to measure quality, and the way they do it is quality of management, quality of the business model, and the ability of the business to generate free cash flow.

“It’s putting those three together and ensuring you pay a reasonable valuation. You need to make sure you’re not overpaying for those three qualities, but having a portfolio with those qualities will generate better returns and reduce risk,” he says.

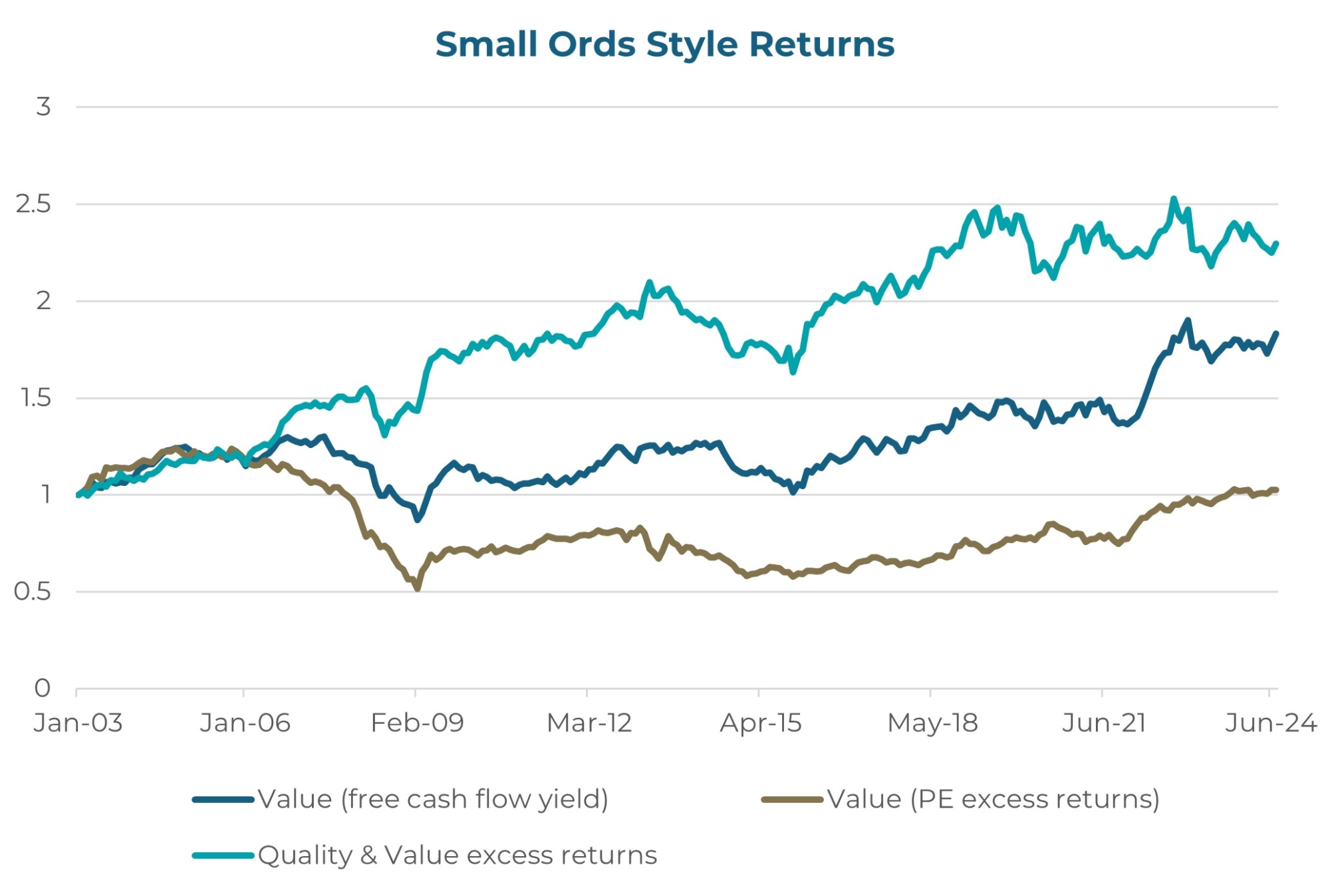

In fact, quantitative analysis showed that a value strategy biased towards free cash flow generation would have significantly exceeded the performance of the Small Ordinaries benchmark over the past 20 years (see figure 1).

In addition, returns could be significantly enhanced by including a quality factor overlay. This combination of value and quality has also delivered superior returns compared to free cash flow in isolation.

Figure 1

Source: UBS/Quantitative Investments 2024

Nguyen concludes that the current market volatility is what creates opportunities for active managers to assess whether a share price hit is warranted from an earnings perspective or not.

“That’s where we’re doing that groundwork to understand a business, to understand the fundamentals, and then to understand the share price reaction,” he says.

“Given how volatile share price reactions are these days, the key to unlocking value and returns in the market is through active management. Especially so within small caps,” he says.