How does DMKT work?

AMP Capital’s Head of Dynamic Markets, Nader Naeimi says investors and advisers spend a lot of time picking stocks, but what they don’t do enough of is use asset allocation expertise as a source of value add.

By focusing on a long term objective, short term noise and emotions are taken out of the investment process. Value can be added by using data and signals to manage the asset allocation process, according to AMP Capital.

Naeimi shares how Australia's first actively managed, multi-asset fund that’s traded on the ASX can benefit advisers and investors.

Here's everything you need to know about how the Dynamic Markets Fund (Hedge Fund) ASX: DMKT works, in under four minutes.

For more, see part three - how to capitalise on opportunities and part four - how the current global events have created additional opportunities.

Or to learn more about DMKT click here.

Recommended for you

Zagga, a fully licensed Australian boutique investment manager and non-bank lender, is proud to announce that it has retained a 4-star ‘Superior’ investment grade rating from independent research house, SQM Research, for the fifth consecutive year, re-affirming the calibre of its operations, governance, and investment strategy, in the commercial real estate debt (CRED) sector.

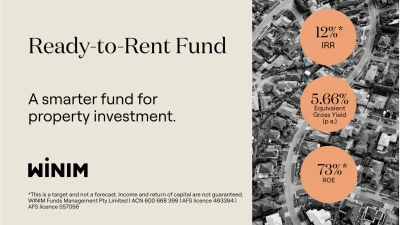

Australia’s $11 trillion residential property market is the country’s largest asset class — and New South Wales leads wi...

Amid growing economic, political, and market uncertainty, credit is proving a hot topic with investors. The smart money ...

One of the most significant surprises of 2024 was the plan announced by the Australian Prudential Regulation Authority’s (APRA) to phase out AT1 hybrids issued by banks. This change raises a number of questions, the most pressing of which is what will happen to AT1 hybrids in 2025 and 2026? Fixed income investors would be wise to start planning how best to navigate the road ahead.