In much the same way that medical specialists benefit from referrals from general practitioners, financial planners have much to gain from referral arrangements with other professional advisers, commonly known as Centres-of-Influence (COIs).

But why are some so much better at it than others?

Before we delve into that, it’s worth saying that having a referral system in place is more-or-less a must have, not a nice-to-have. Many financial planners are unable to provide advice across all six traditional areas of financial advice – ie. income, investment, debt, risk, retirement and estate planning.

When a client’s needs exceed the planner’s expertise, the planner must work with or refer the client to other professionals if they are to act, as they are required to act under the Corporations Act, in the client’s best interests.

The complexity of client problems often calls for help from a team of professionals, each specialising in their chosen field, who understands their own limitations and is prepared to work together and refer business to other professionals in order to provide holistic advice.

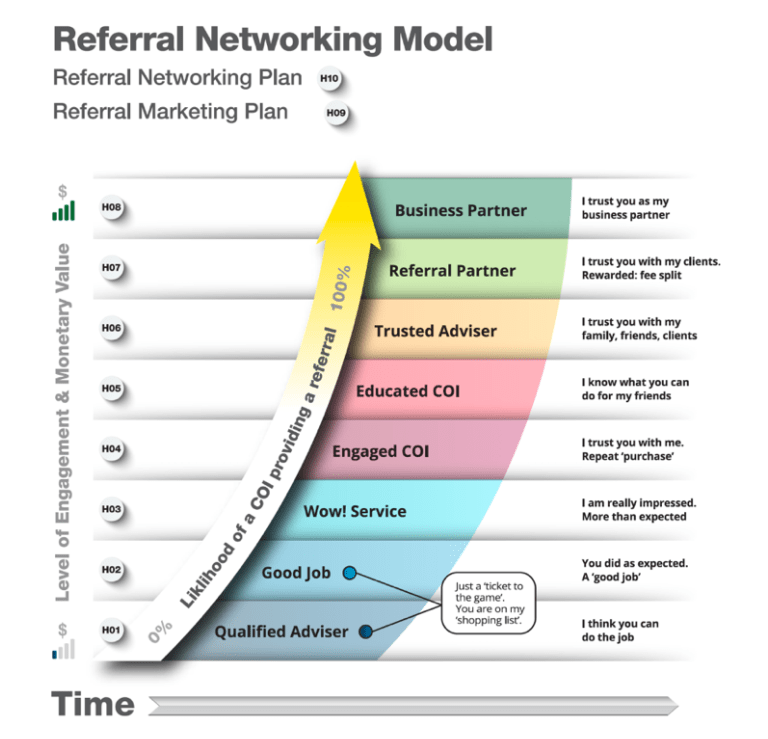

The Referral Networking Model

The Referral Networking Model below illustrates how relationships, engagement, and trust deepen over time as the referral partner progressively advances up various levels of trust.

But here’s the rub – unlike the medical profession, other financial services professionals seem to be less inclined to refer clients to planners. Negative publicity of the findings of the Royal Commission certainly didn’t help. So how do financial planners earn referrals and what are some doing that makes them so much better at it than others?

Attracting referrals

To investigate this question, we asked a number of planners about their experience through a series of interviews and a national survey of 100 financial planners. Our aim was to identify the factors that separate those planners who are successful in attracting referrals, from those who are not.

Not surprisingly, being qualified (Level 1 of the model) on its own does not result in referrals. Similarly, merely doing a good job (Level 2) does not positively impact referrals. These are just tickets to the game. However, when a planner provides exceptional service (the Wow! Service level) to a COI’s clients, this can and often does result in receiving more referrals from that COI.

Our question was – how did the planners we interviewed, who were successful in receiving referrals, overcome the stumbling blocks to gain the opportunity to work with other professionals in the first place?

Education is key

Many of these planners indicated that they developed a close relationship between themselves and referral partners before they began to receive referrals. This may be in part because the referrer had a relationship between themselves and their clients and wished to ensure their client was cared for appropriately by the financial planner.

This points to a need for planners to educate potential COIs by explaining or demonstrating their value proposition, including the services they provide and specialities they deliver. This enables relationships to develop over time and trust between planner and referral partners to deepen, which can result in more formal arrangements such as joint ventures, business partnerships, mergers or multi-disciplinary practices which may facilitate the growth in referrals.

Above and beyond the above factors though, it was apparent that the planners most successful in attracting referrals were the ones who planned to do so through the development of comprehensive referral marketing and/or referral networking plans.

The referral marketing plan

The referral marketing plan involves the development of strategies, procedures and incentives for the referrer to make referrals. This can be done through a number of strategies, most commonly by forming reciprocal referral arrangements. The core of a good referral marketing plan is the ability to clearly communicate the value of the offering.

The referral networking plan

Equally important is the referral networking plan – the development of strategies and procedures to identify potential referral partners and select the most appropriate ones to develop long-term strategic alliances that are mutually beneficial.

Holding regular meetings or events such as business breakfasts or sporting matches with new potential partners can assist in the identification of new partners.

An essential element of a successful strategy over the longer run is the implementation of long-term procedures to monitor the performance of the network relationships. Resources should be devoted to the relationships which are the most beneficial. Just as importantly, the continuation of relationships which yield little or nothing in the way of referrals should be questioned.

A Referral Marketing Plan and a Referral Networking Plan will provide planners with the tools to ensure that the partners they have actually do provide referrals.

The key to success

Those planners who were most successful in attracting referrals noted that they:

- Met initially with many potential referrers

- Built larger referral networks

- Spent a lot of time explaining their processes, preparing and presenting case studies and providing demonstrations to their referral partners

- Met more frequently with their referral partners to discuss progress and results.

As with many aspects of professional life, the key to success is in the planning.

Dr Michael Topper is director of AstuteWheel. Adam Steen is Adjunct Professor, University of Adelaide