It could make sense for Australian wholesale investors to include corporate bonds in portfolios, with the traditional role of bonds re-emerging in 2023.

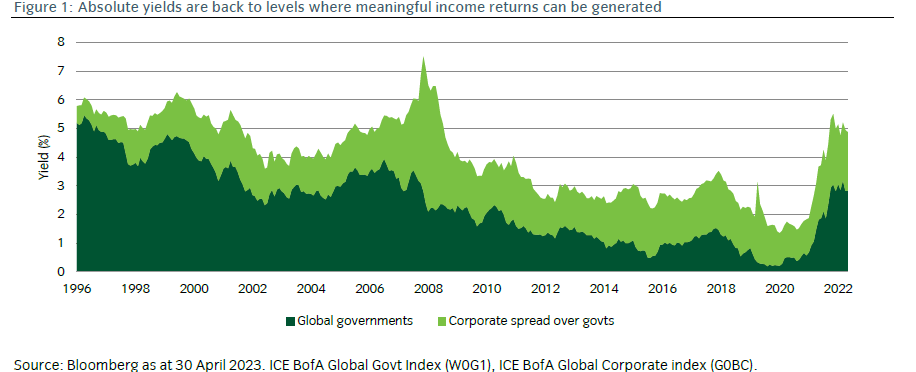

Credit yields and spreads too have risen to attractive levels, so much so that there exists the potential for investors to generate meaningful income from this asset class for the first time in a decade or more.

After a dire year for bonds in 2022, when their prices fell along with equities, the traditional role of fixed income and credit came into serious question. A 60:40 split between equities and bonds led to one of the worst losses ever in nominal terms for a 60:40 portfolio.

However, we believe the traditional role of fixed income as a diversifying asset has returned this year and bond prices have gained modestly, even in the face of high inflation. The prospects for bonds, and credit in particular, to provide protection to portfolios has arguably returned.

Fixed income, and particularly credit, offer the potential for diversification and positive returns should riskier asset classes such as equities languish if economic growth weakens, or the world falls into recession. We expect positive returns from bonds and credit to continue, especially if central banks end their tightening cycles or lower interest rates to overcome any economic slowdown or recession, which remains a possibility on the horizon.

Another important point is that credit markets now widely offer yields well above previous levels, as the chart below shows. Credit spreads for investment grade bonds have risen sharply in the past 18 months. When one considers the path of global credit spreads over the last 25 years or more, there have been few occasions when the spreads have exceeded current levels.

At the end of 2017, barely more than 10% of the global investment grade (IG) corporate market was yielding more than 4%. In contrast, by the end of April 2023, more than 80% of that market was yielding more than 4%, while half of the market had a yield greater than 5%. The global high yield (HY) market has experienced a similar shift higher in the yields. At the end of April 2023, more than 80% of the HY index, the ICE BofA Global Corporate Index (G0BC), carried a yield of 6% or more, whereas at the end of 2017, less than a quarter had a 6% yield.

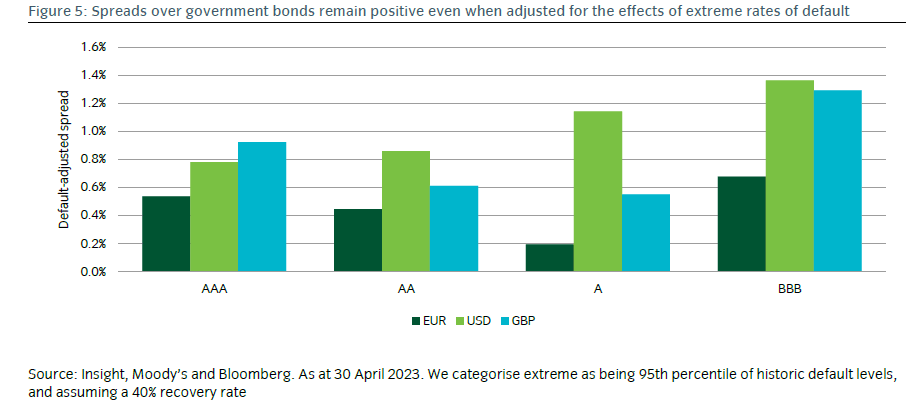

In addition, compared to just over five years ago, not only are yield levels higher, but there is also greater dispersion of spreads across the credit spectrum, particularly in BBB rated bond brackets. We believe that dispersion of credit spreads within each credit bracket may offer additional potential capacity for investors to achieve excess returns from relative value positions.

Importantly, for the risk-averse investor, current credit spread levels should more than compensate for default. Investors may have previously considered that credit was too risky to hold given the uncertain economic outlook. Yet credit spreads remain sufficiently wide across the three main credit markets, the US, Europe and Great Britain, to provide investors with a yield greater than the risk-free alternative, even when they are adjusted to reflect the effects on total spreads should extreme levels of default arise, as the chart below shows.

It is important for investors to ask what an approaching peak in the interest rate cycle means for credit. Although it may be too early to expect a material tightening in credit spreads, there are reasons to be more optimistic in the medium term. Inflation appears to be past its peak although we do not expect central banks to begin easing their tightening pressure yet. The European Central Bank is likely to continue raising rates in the near term. The potential for public and political pressure may mean they are likely to begin focussing more on the growth outlook before long if they can be comfortable that inflation is declining.

More generally, if credit markets forecast that interest rate decreases may be on the horizon, and that the economic growth profile could soon improve, the corporate sector outlook could be supported and that could encourage credit spreads to tighten, providing wholesale investors with the potential for capital gains over time.

Bruce Murphy is director of Australia and New Zealand at Insight Investment.