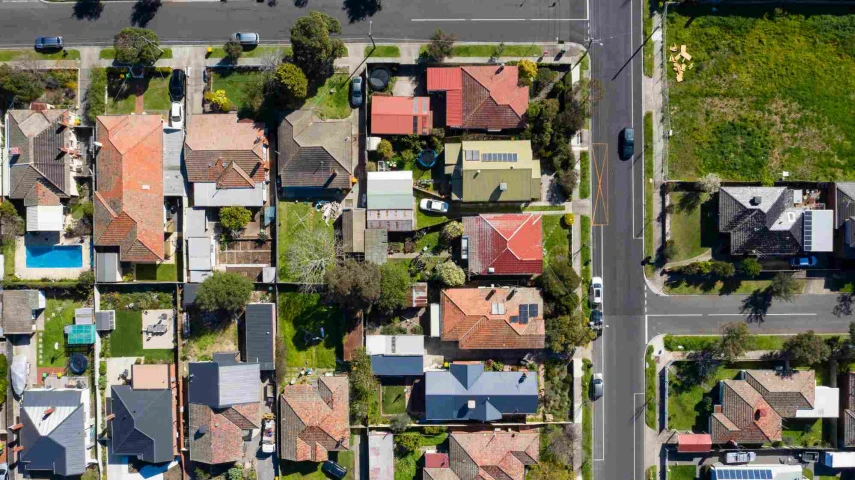

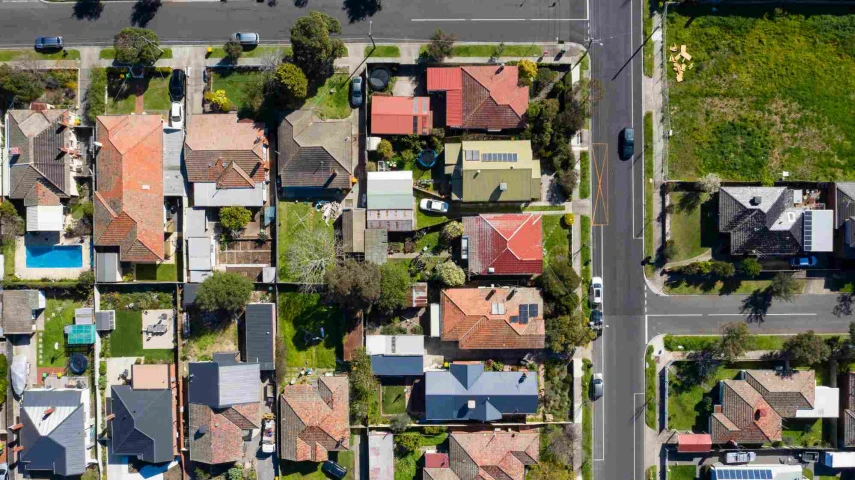

Australian property investors set their sights offshore

Domestic underperformance in the office sector means Australian property investors are turning their gaze towards global alternative real estate opportunities, portfolio managers say.

Data from the Australian Bureau of Statistics (ABS) on 30 August revealed CPI inflation had eased to 4.9 per cent in July. This was down from 5.4 per cent in June compared to the peak of 8.4 per cent in December 2022.

The Australian commercial property market was noticeably impacted by the rising rates cycle. It recorded the slowest quarter in Q1 2023 in over a decade with transactions at just $5.3 billion, a year-on-year decline of 73 per cent.

Australian names such as Cromwell Property Group and Dexus announced significant statutory net losses in FY23, at $443.8 million and $752.7 million respectively. For both companies, this was primarily driven by unrealised fair valuation losses on investment properties.

Justin Blaess, principal and portfolio manager at Quay Global Investors and winner of this year’s Global Property Securities Fund of the Year at the Money Management Fund Manager of the Year Awards, noted how the rising rates cycle has affected the property market domestically and internationally.

“Historically, rising rates hasn’t necessarily been an impediment to poor returns, but this time around it has. Real estate has struggled as a result of the magnitude and short time frame in which we've had big increases in interest rates,” he told Money Management.

As rising rates come to an end, Blaess said, operating environments have become relatively robust.

Damon Mumford, a Dexus Core Property Fund manager, observed the growing investor demand for global alternative real estate, which includes a range of non-traditional sectors such as retirement housing, self-storage and student accommodation, as people move away from offices and retail.

Traditional property sectors, particularly Australian office and retail, have been plagued by cyclical headwinds alongside the structural impacts of hybrid work environments.

Research from Dimensional showed that real estate investment trusts (REITs) focused on office properties have dropped nearly 25 per cent from the onset of 2022 to 30 June 2023.

Instead, exposure to alternative property allows for greater portfolio diversification and attractive growth fundamentals, Mumford explained.

According to Macquarie Group, Australia lags behind in alternative REITs compared to the US market. In 2022, the sector comprised only 7.5 per cent of our domestic market. For the US market, 54 per cent was made up by alternatives.

The Dexus fund manager observed that the sector is still at its infancy in Australia, meaning opportunities for investors are limited.

“There is a much larger opportunity set in other markets such as the US, where investors can gain exposure to quality operators in sectors that have a history of market acceptance and performance,” he added.

According to Justin Pica, lead portfolio manager of the UBS CBRE Global Property Securities Fund, Australia makes up less than 3 per cent of the total addressable global property market worth over US$3 trillion.

Mumford reflected on the need for both domestic and overseas property to create an attractive balance.

“The Australian real estate market provides high-quality investment opportunities in a transparent market with attractive growth fundamentals driven by relatively high population growth.”

Meanwhile, overseas properties provide investors exposure to markets that perform at a different pace and offer opportunities that are difficult to obtain in Australia.

“Our view is the diversification that overseas exposure provides should contribute to more stable returns across a real estate investment portfolio,” he said.

Global opportunities for Australian investors

Given these factors, Blaess encouraged domestic property investors to cast their sights overseas, away from the poorer office returns which dominate the Australian property market.

“The global universe has far bigger opportunities and different sectors which have quite exciting outlooks,” he explained.

“It’s worth considering greater diversification, whether it be by sector, by region or by asset type, and the performance dispersion potential offered by overseas and non-cyclical opportunities,” Pica remarked.

Non-cyclical sectors, which are not disrupted by economic cycles, present different operating environments to cyclical sectors, therefore an opportunity for diversification.

Pica continued: “We think both cyclical and non-cyclical real estate options are important when investing.”

Global self-storage is a sector which has seen heightened demand due to its resilient growth, with an estimated market size of US$58.26 billion in 2023.

“We view this sector as more resilient and it was a growth sector during COVID,” the CBRE portfolio manager described.

He also identified hotels as an inviting industry to look out for in global property as valuations become more attractive. Hotels have seen a boom in demand following the pandemic lockdown as travel recommences and tourists flock to certain regions.

“We are observing more attractive hotel conditions in Japan, which clearly benefited from Japanese borders steadily reopening post-COVID and the increased demand for inbound tourism,” the CBRE portfolio manager continued.

Retirement housing is also seeing high levels of demand as the Baby Boomer generation transitions into senior assisted living spaces.

Finally, industrial logistics is experiencing strong trends and benefitting from structural tailwinds due to the rise in e-commerce.

The good news ahead

Following a period of poorer returns in certain property sectors, all three portfolio managers have a positive outlook ahead with higher earnings on the horizon.

“Underperformance of listed global real estate doesn’t generally last. If you have a bad year, you’re more than likely going to be followed by a good year, and we’ve had a really bad year,” Blaess said.

The Quay Global Real Estate Fund (AUD Hedged) saw negative returns of -8.1 per cent over the last 12 months to 31 July 2023, versus returns of -9.9 per cent by the FTSE EPRA/NAREIT Developed Hedged Index NET TR AUD.

In the same period, the Dexus Core Property Fund (Class A), which is benchmark unaware, reported a negative performance of -11.9 per cent.

The UBS CBRE Global Property Securities Fund returned -10.5 per cent in the period compared to returns of -13.2 per cent by the FTSE EPRA/NAREIT Developed Rental Net Return Index (AUD Hedged).

“Given the constructive earnings outlook and the value on offer, we think it’s positioning global real estate for a good back half of 2023 and 2024,” he forecasted.

Pica emphasised that global REITs are trading at historically attractive valuations and offer relatively stable fundamentals amidst slowing economic conditions.

Investors can expect positive low to mid-single digit earnings across global REITs markets, which will grow further in the coming 12 months.

Mumford is also optimistic about global real estate as inflationary pressures slowly reduce and investor appetite grows.

“This confidence, combined with better information about the cost of capital and the economic cycle, will see investors return to the real estate market, generating transaction activity that in turn will provide confidence about valuation levels,” he said.

Recommended for you

The rise of private credit funds is giving research houses cause for concern about their viability for retail and wholesale investors and necessitating changes to their research process.

The rebranding of the AMP advice division to Akumin brings to an end a 176-year history for the firm and provides a fresh start for advisers under Entireti.

With alternative funds being described as “impossible” for fund managers to target towards advisers without the support of BDMs for education, Money Management explores the evolving nature of the distribution role.

Commentators say the lack of transparency in private markets is making it difficult for fund managers and advisers to assess them from an ESG perspective.