A global market sell-off in August and concerns around the Fed’s approach to rate cuts have prompted investors to consider reassessing their portfolio allocations.

Market volatility has returned after its brief hiatus and almost every wave of volatility quickly becomes a whirlwind of misleading noise, as Wall Street strategists, economists and online pundits rush to offer explanations and craft predictions about what’s next. Our advice would be rather than to predict, it’s better to prepare, by having an arsenal of defensively orientated tools in your portfolio to navigate potential volatile periods.

Key Takeaways

-

August experienced one of the most volatile periods in recent years, with the volatility index (VIX) recording one of its highest intraday spikes, reaching levels not seen since the COVID-19 pandemic and the 2008/09 Global Financial Crisis.1

-

Volatility is a natural part of investing. Staying diversified is one of the most effective way to safeguard portfolios against market sentiment swings and psychological reactions.

-

To manage volatility prudently, investors might consider incorporating defensive assets such as gold and US treasuries, as well as exploring strategies such as covered calls and low volatility equities.

Did Volatility Go Missing?

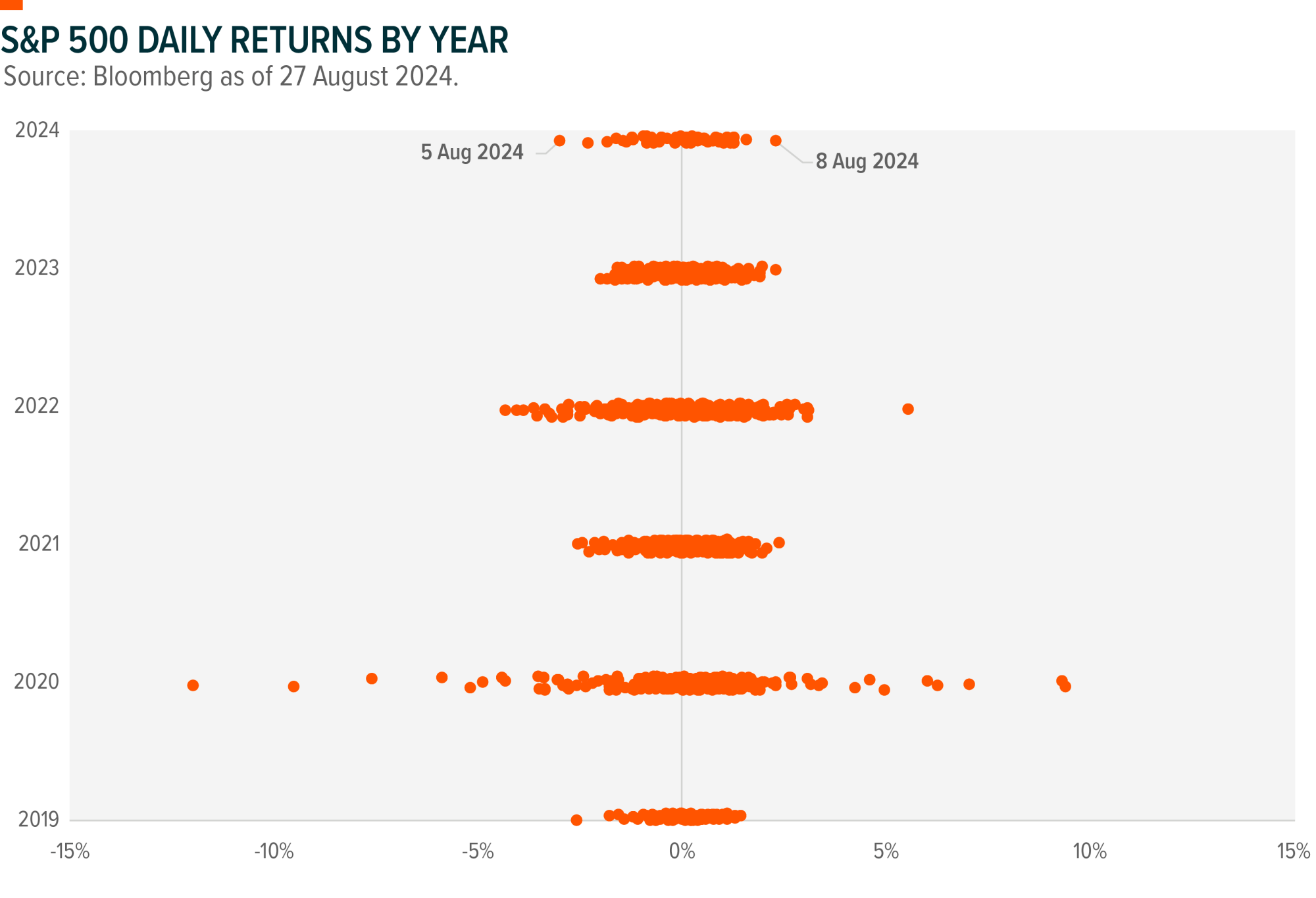

Over the last couple of years, share markets have seen relatively muted volatility. The chart below illustrates the daily movements in the US share market across the last five years, showing that both 2023 and 2024 have been relatively calm compared to the turbulence of 2020 during the COVID-19 pandemic. The early August 2024 points stand out as the most significant outliers so far this year.

The calm in the markets over the past 18 months enticed hedge funds and major traders to take on increasingly higher levels of risk. However, like a rubber band being stretched to its limit, there’s a point where it can snap, and when that does happen, there can be pain.

So what caused the volatility last month? It’s always hard to know the exact reason why, but many believe it’s attributable to a few reasons:

-

Japan announced its biggest increase in interest rates in over 17 years which wreaked havoc with investors who engaged in the “dollar-yen carry trade” given the unwinding of highly leveraged positions.

-

The US announced some mixed economic news around PMIs declining and rising jobless claims.

-

Warren Buffett’s Berkshire Hathaway selling down a large portion of it’s holding in Apple.

While this might feel like a triple whammy, it’s crucial to understand that market sentiment can swing rapidly, like a pendulum, and investors’ moods can drive price fluctuations. This shift doesn’t always indicate a sudden deterioration in fundamentals as it’s often about how investors perceive the situation.

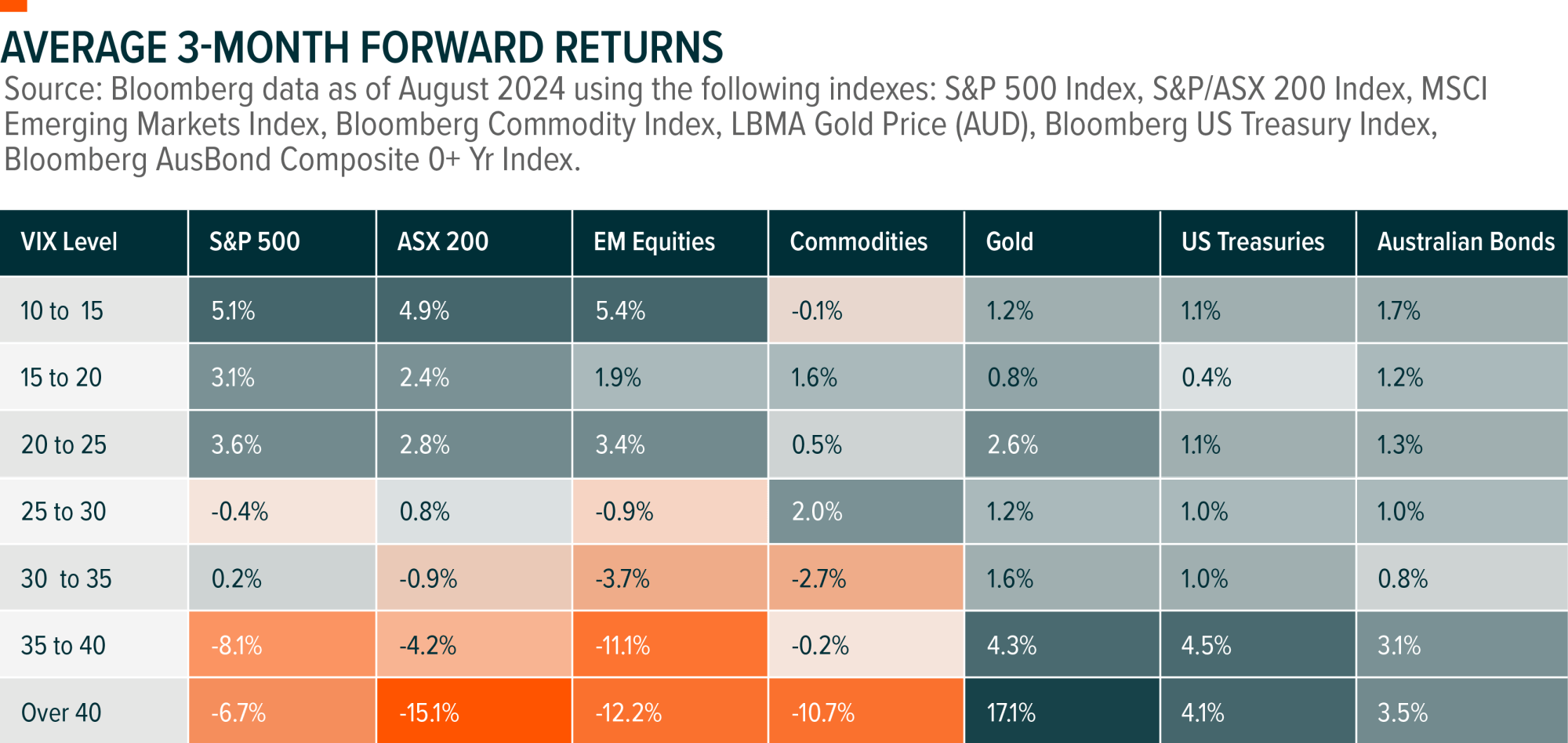

The VIX, often referred to as the “fear gauge,” measures market expectations of near-term volatility. It reflects investor sentiment, with higher VIX levels indicating increased uncertainty and potential market turbulence. The table below illustrates how various asset classes perform across different VIX environments over a 90 day period (given its associated with nearer term volatility). Typically, during periods when the VIX is low, equities tend to perform well, while in high VIX scenarios, more defensive assets like bonds and gold often outperform as investors seek safety amid heightened volatility.

One of the most effective ways that investors can safeguard their portfolios against these psychological and market-sentiment swings is by staying diversified and having defensive tools in their portfolios to manage ongoing market volatility. Let’s dive into these potential tools for investors to consider.

Gold: The Safe Haven Precious Metal

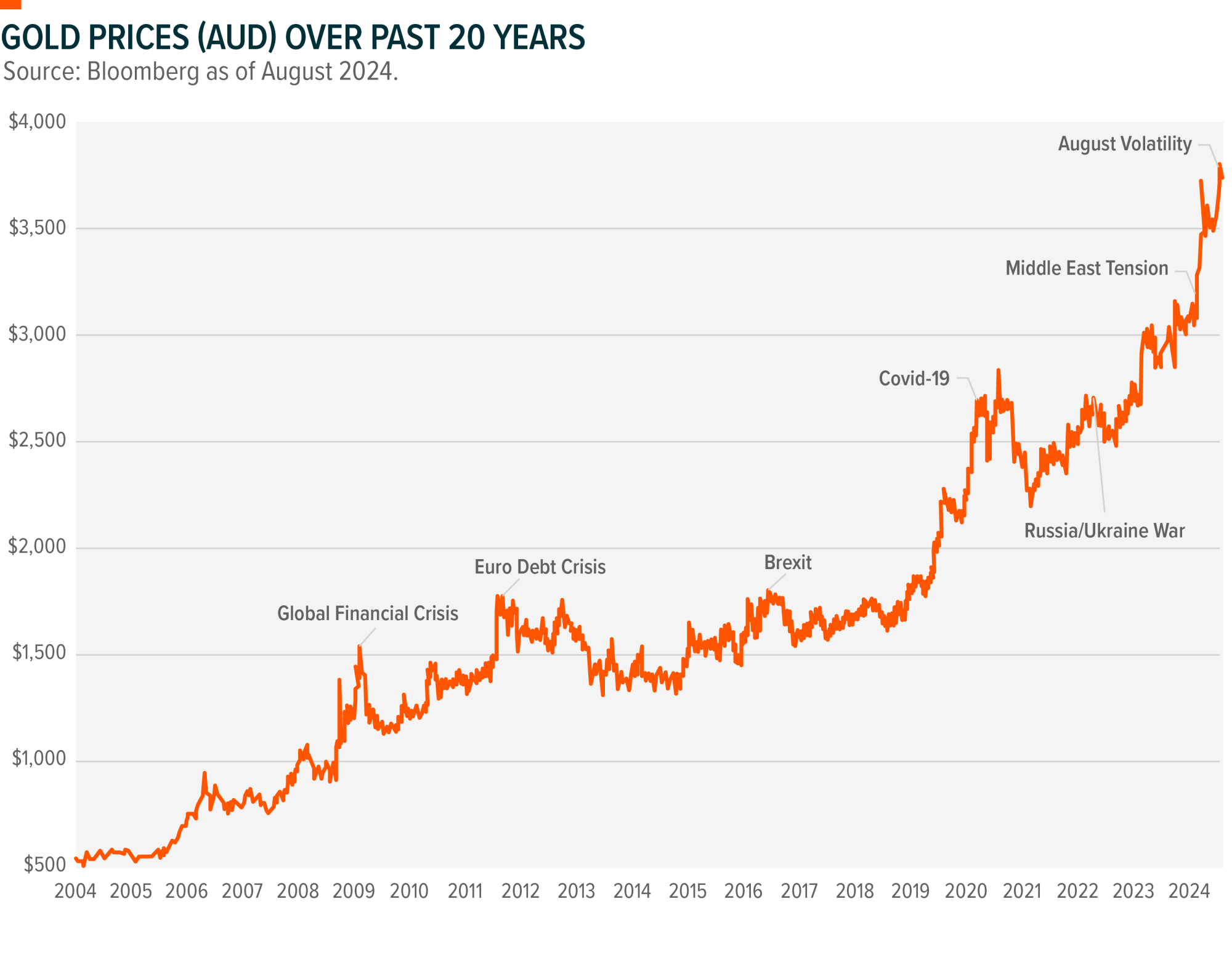

As seen in the table above, gold had the best relative performance compared to other asset classes when volatility increased. Gold is generally uncorrelated to equities providing enhanced diversification benefits to portfolio implementation.2 It’s the ultimate insurance policy when it comes to investing. As strange as it may seem, gold is the one asset that investors might not mind if it performs poorly in their portfolio because it means that it’s likely everything else is doing well. Thankfully for gold investors, the precious yellow metal has had a great last decade of performance, withstanding the various economic and geopolitical scenarios inducing volatility.

For investors who may have concerns about rising share market volatility, whether it’s caused by inflation shocks, geopolitical tensions, or just general concerns around the share market, gold can be an interesting alternative defensive asset to consider.

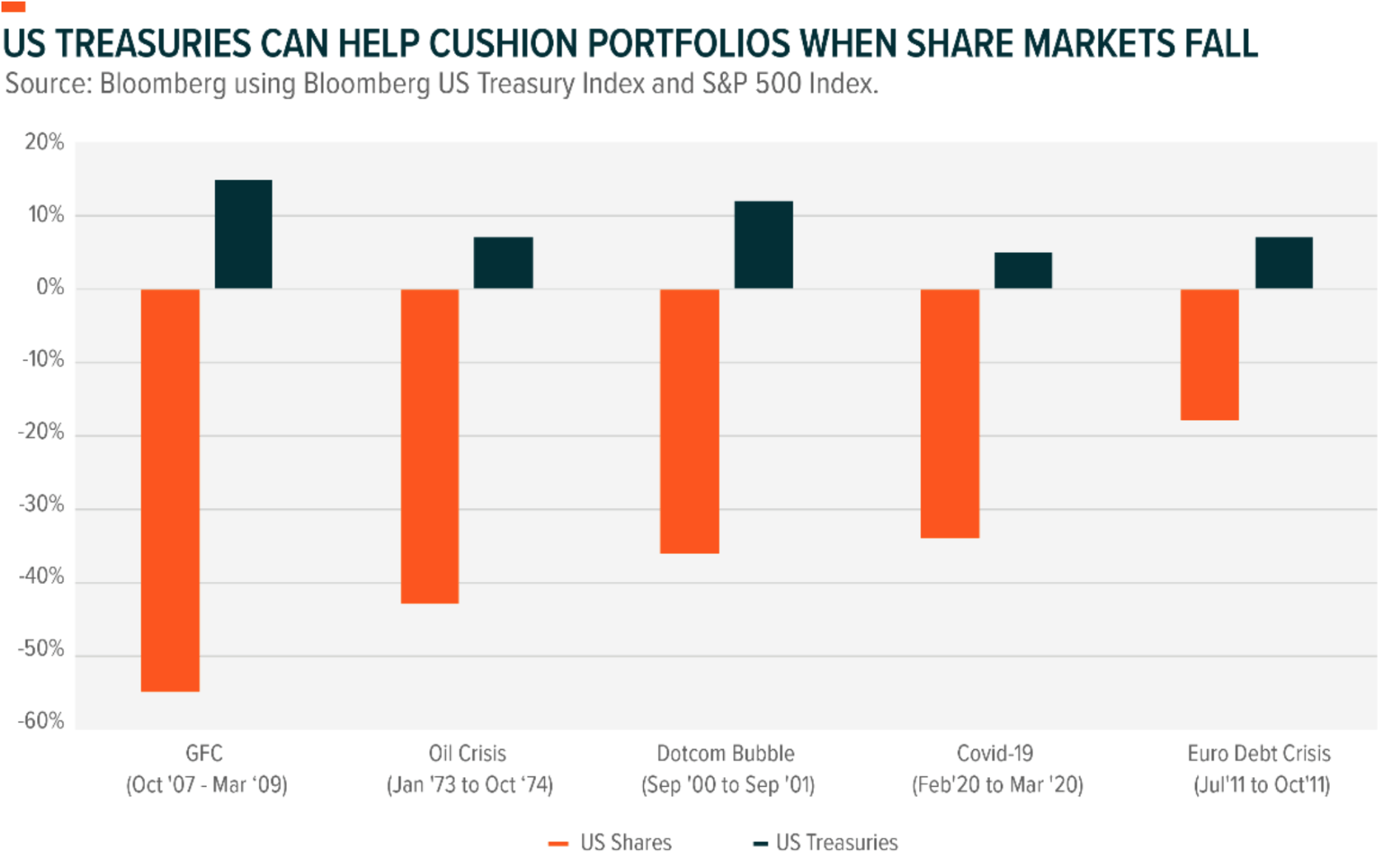

Treasuries: A Potential Source of Treasure

US Treasuries are another example of a safe-haven asset that is highly sought during market volatility due to their status as one of the most reliable assets, backed by the full faith and credit of the US government. In times of uncertainty, investors tend to flock to Treasuries for capital preservation and stability, which helps to offset losses in riskier assets like equities. Adding US Treasuries to a portfolio can provide a valuable hedge against market downturns, reduce overall portfolio risk, and enhance diversification, especially when market conditions are turbulent. US Treasury bonds have a quarter of the risk as US shares3 and can act as a defensive ballast during share market drawdowns.

If broader share market activity is negatively impacted, it could lead central banks to consider cutting interest rates to stabilise the economy. Such rate cuts generally increase the attractiveness of Treasury bonds, as lower interest rates make existing bonds with higher yields more valuable, leading to potential capital appreciation. This dynamic creates a favourable environment for Treasury bonds, making them a key component in portfolios, particularly during periods of economic uncertainty.

Equities: Covered Calls and Low Volatility Factor

For those seeking to retain equity exposure while lessening downside risk, investors may wish to consider covered call strategies and stocks that have low volatility profiles.

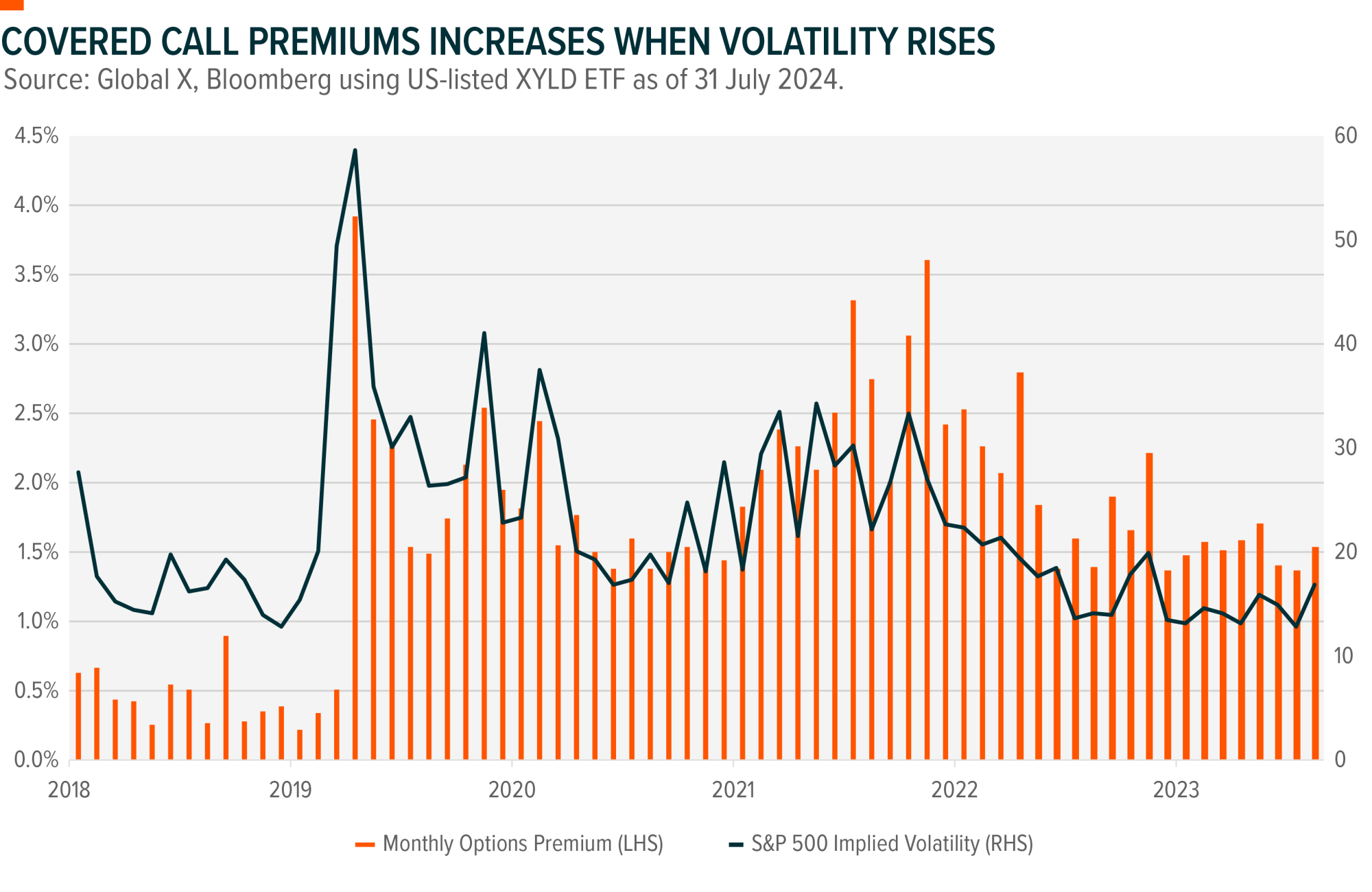

Covered calls provide an opportunity for investors to potentially monetise market volatility. Generally, when volatility rises, the premiums on offer for writing call options increase, which can provide an income avenue for investors. During recent periods of market volatility such as COVID-19 and the inflation shock in 2022, higher implied volatility translated into a pick-up in options premium income for investors.

The income generated from covered calls can provide an inherent protective buffer for client portfolios, as these strategies typically perform well when markets are flat or declining. During severe market downturns like the GFC and COVID-19, covered call strategies had less impactful drawdowns than the broader share market.4 For investors seeking modest downside protection while also aiming to capitalise on expected volatility, covered calls can be an attractive option.

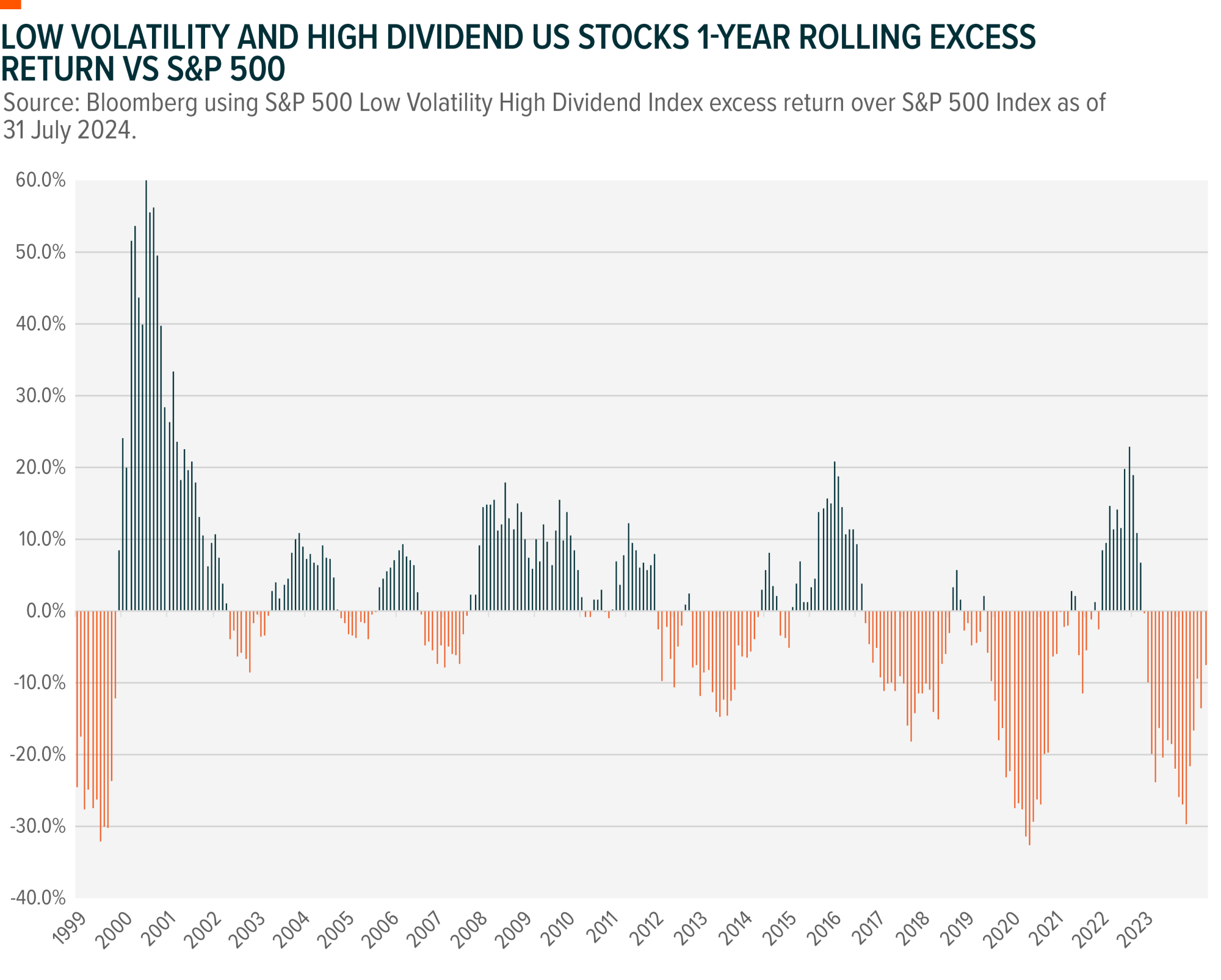

Investors might also consider focusing on income-oriented companies with low volatility characteristics. A multi-factor approach to equities that focuses on both yield and volatility factors can provide exposure to more defensive sectors like utilities, consumer staples, energy, and healthcare. Historically, this strategy has delivered strong performance during volatile periods, including the 2000/01 Dot Com boom, the 2008/09 Global Financial Crisis, 2016 Brexit and US elections, and the 2022 pandemic-induced inflation shock.

Helping Investors Stay Disciplined and Invested

Volatility is a normal part of the investing process. It’s the price of admission that investors pay to potentially seek enhanced returns above cash. While long-term investing has proven to be a powerful wealth-building strategy, emotions and psychology can sometimes disrupt even the best-laid plans. To stay the course, investors should consider incorporating a variety of volatility protection tools into their portfolios. Exchange traded funds (ETFs) have made these strategies more accessible and affordable, offering a practical way to manage risk.

As Benjamin Graham noted, “The essence of investment management is the management of risks, not the management of returns.” Rather than avoiding risk, investors can focus on managing it wisely by potentially adding layers of protection, such as gold, US treasuries, covered calls, and low volatility equities. By doing so, they can navigate market turbulence and trust their portfolios are resilient enough to weather both storms and sunny days.

Explore potential ETF opportunities across these strategies below:

GOLD: The Global X Physical Gold (ASX: GOLD) invests in physical gold via the stock exchange, offering higher liquidity and removing the need for investors to personally store bullion.

USTB: The Global X US Treasury Bond ETF (Currency Hedged) (ASX: USTB) invests in US Treasuries across the yield curve while providing currency hedging.

QYLD: The Global X Nasdaq 100 Covered Call ETF (ASX: QYLD) writes call options on the Nasdaq 100 Index, saving investors the time and potential expense of doing so individually.

UYLD: The Global X S&P 500 Covered Call ETF (ASX: UYLD) writes call options on the S&P 500 Index, saving investors the time and potential expense of doing so individually.

ZYUS: The S&P Global X 500 High Yield Low Volatility ETF (ASX: ZYUS) invests in 50 of the least volatile highest dividend-yielding equity securities from the S&P 500 Index.

Footnotes

1. Bloomberg. (August 2024)

2. Bloomberg. (August 2024) based on ten-year correlations.

3. Bloomberg. (August 2024) based on ten-year volatility.

4. Bloomberg.

Disclaimer:

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.