Resources from boom to near bust

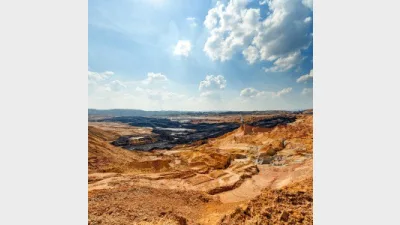

Long the jewel of the Australian economy, a lack of predictability when it comes to commodity prices is leading to questions about the viability for resources stocks.

While several fund managers have heralded the recent strong performances of Australian equities, AMP Capital's Pietersz, described the resources sector as the "market's Achilles heel".

"Iron ore and oil prices have fallen significantly during the past year and have severely hit the sector," he said.

"Together, these two commodities represent about 16 per cent of the resource sector's earnings and, until recently, iron ore was the country's single biggest export."

Slowdown not stop

However, Pietersz said there is still plenty of life in the resources sector, although he warned investors should steer clear of single commodity equities.

"The resources sector is sufficiently broad to offer opportunities beyond the woes of iron ore and oil," he said.

"The dominant players are reasonably diversified with separate business lines in coal, copper, aluminium and other metals to counter declines in iron ore prices. We see the benefit of being exposed to low-cost producers that have good cash-flow.

"That said, we are towards the end of the mining super-cycle and China's growth is clearly moderating. We have therefore stayed clear of smaller, single commodity miners that carry much higher risks."

Market Vectors Australia's Chesler backed Piertersz's warning against single commodity mining stocks, but stressed the resources sector slowdown was set to continue.

"The mining sector will continue to experience relative weakness with ongoing pressure on commodity prices based on global demand constraints," Chesler said.

"When investing in resource stocks it is our view that investors should not just focus on a single commodity, but take a diversified view.

"Resources stocks have been hit hard over the last few years and the continuing decline in iron ore prices are having a negative impact on resource stocks and Australia's terms of trade.

Sooner or later, if you overlook the environment for long enough you'll blow-up your business. And if your governance is poor you'll blow-up your business... sooner or later all those things come back to bite you.

"The big question is, how low can commodity prices go? Our view is that iron ore prices will continue to be volatile but [we] do not predict it will go as low as US$35.

"We are confident that the big companies flooding the market with iron ore will trim back production and reduce supply as the price falls."

Miners not down and out

Although fund managers are forecasting gloomy times for the resources sector, investors should not assume there are no opportunities for investment.

Alphinity's lead portfolio manager, Johan Carlberg, said "financially stronger resources companies such as BHP Billiton and Rio Tinto have so-called progressive dividend policies, which mean they target a steady increase in dividends each year, even when profits are falling".

"The dividend yield on these stocks may lend some support to the share prices," he said.

"However, it should be noted both companies have to borrow to fund some of the dividends paid, so in the end profits will have to rebound to make this model sustainable."

Rise and rise of ESG investing

With miners' stocks slipping, Hyperion's Samway said there has been an increase in demand for environmental and social governance (ESG) focused investments.

"We have a fairly large institutional business, so more than 50 per cent of our funds under management comes from super funds, and they're particularly interested in ESG and sustainable investing," he said.

"Businesses that aren't looking at E, S and G tend not to be long-term sustainable investments.

"That is sooner or later, if you overlook the environment for long enough you'll blow-up your business. And if your governance is poor you'll blow-up your business... sooner or later all those things come back to bite you."

Role of ESG in resources

Backing up Samway's suggestion that businesses that fail to seriously consider the environment and/or their governance structures were liable to "blow-up", AMP's Pietersz stressed the importance of considering ESG factors before investing in the resources sector.

"ESG factors are considerably important when investing in resources stock," he said.

"AMP Capital has an extensive history in researching this area. In 2014 we formalised the AMP Capital Responsible Investment Leaders (RIL) funds' policy on exposure to fossil fuels to ensure that the RIL funds don't invest in companies with material exposure to the most intensive fossil fuels.

"Our ESG investment research team regularly engages with resource companies to both advocate better practice and ensure risks are appropriately managed."

Mining slowdown not linked to ESG boom

While there has been an increase in focus on ESG investment, Alphinity's Carlberg played down the correlation between the slowdown in the resources sector and an increased interest in ESG.

"We haven't seen a wholesale shift in relation to ESG issues, but there have been some interesting developments in both directions," he said.

"We have seen some environmental interest groups intensify their efforts to stop or slow developments, arguing that in addition to negative environmental impact, low commodity prices have further reduced economic justification of these projects.

"On the other hand, we may also see political interest; as governments are faced with falling tax revenues and job losses, they may consider how they can support some projects that drive jobs and industry."

Read part one of Nicholas O'Donoghue's report: Aussie equities' stock rising

Read part three of Nicholas O'Donoghue's report: Falling dollar a bright spot for Aussie equities

Recommended for you

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.

Schroders has appointed a fund manager to its $6.9 billion fixed income team who joins from Macquarie Asset Management.

Evidentia’s chief investment strategist Nathan Lim has announced his retirement after a 30-year career.